Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

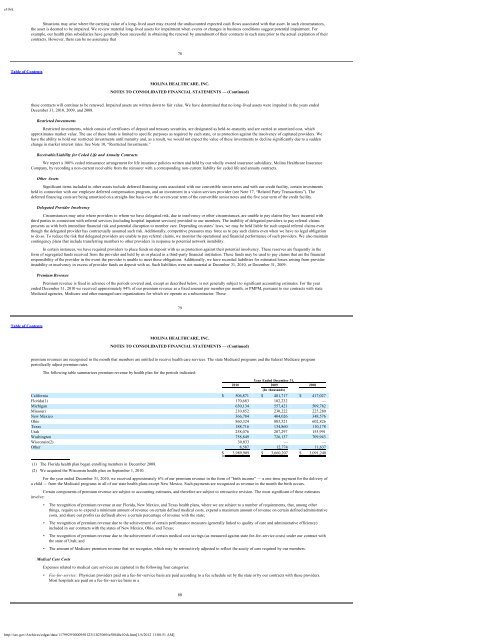

e10vkSituations may arise where the carrying value of a long-lived asset may exceed the undiscounted expected cash flows associated with that asset. In such circumstances,the asset is deemed to be impaired. We review material long-lived assets for impairment when events or changes in business conditions suggest potential impairment. Forexample, our health plan subsidiaries have generally been successful in obtaining the renewal by amendment of their contracts in each state prior to the actual expiration of theircontracts. However, there can be no assurance that78Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)these contracts will continue to be renewed. Impaired assets are written down to fair value. We have determined that no long-lived assets were impaired in the years endedDecember 31, 2010, 2009, and 2008.Restricted InvestmentsRestricted investments, which consist of certificates of deposit and treasury securities, are designated as held-to-maturity and are carried at amortized cost, whichapproximates market value. The use of these funds is limited to specific purposes as required by each state, or as protection against the insolvency of capitated providers. Wehave the ability to hold our restricted investments until maturity and, as a result, we would not expect the value of these investments to decline significantly due to a suddenchange in market interest rates. See Note 10, “Restricted Investments.”Receivable/Liability for Ceded Life and Annuity ContractsWe report a 100% ceded reinsurance arrangement for life insurance policies written and held by our wholly owned insurance subsidiary, <strong>Molina</strong> Healthcare InsuranceCompany, by recording a non-current receivable from the reinsurer with a corresponding non-current liability for ceded life and annuity contracts.Other AssetsSignificant items included in other assets include deferred financing costs associated with our convertible senior notes and with our credit facility, certain investmentsheld in connection with our employee deferred compensation program, and an investment in a vision services provider (see Note 17, “Related Party Transactions”). Thedeferred financing costs are being amortized on a straight-line basis over the seven-year term of the convertible senior notes and the five year term of the credit facility.Delegated Provider InsolvencyCircumstances may arise where providers to whom we have delegated risk, due to insolvency or other circumstances, are unable to pay claims they have incurred withthird parties in connection with referral services (including hospital inpatient services) provided to our members. The inability of delegated providers to pay referral claimspresents us with both immediate financial risk and potential disruption to member care. Depending on states’ laws, we may be held liable for such unpaid referral claims eventhough the delegated provider has contractually assumed such risk. Additionally, competitive pressures may force us to pay such claims even when we have no legal obligationto do so. To reduce the risk that delegated providers are unable to pay referral claims, we monitor the operational and financial performance of such providers. We also maintaincontingency plans that include transferring members to other providers in response to potential network instability.In certain instances, we have required providers to place funds on deposit with us as protection against their potential insolvency. These reserves are frequently in theform of segregated funds received from the provider and held by us or placed in a third-party financial institution. These funds may be used to pay claims that are the financialresponsibility of the provider in the event the provider is unable to meet these obligations. Additionally, we have recorded liabilities for estimated losses arising from providerinstability or insolvency in excess of provider funds on deposit with us. Such liabilities were not material at December 31, 2010, or December 31, 2009.Premium RevenuePremium revenue is fixed in advance of the periods covered and, except as described below, is not generally subject to significant accounting estimates. For the yearended December 31, 2010 we received approximately 94% of our premium revenue as a fixed amount per member per month, or PMPM, pursuant to our contracts with state<strong>Medicaid</strong> agencies, Medicare and other managed care organizations for which we operate as a subcontractor. These79Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)premium revenues are recognized in the month that members are entitled to receive health care services. The state <strong>Medicaid</strong> programs and the federal Medicare programperiodically adjust premium rates.The following table summarizes premium revenue by health plan for the periods indicated:Year Ended December 31,2010 2009 2008(In thousands)California $ 506,871 $ 481,717 $ 417,027Florida(1) 170,683 102,232 —Michigan 630,134 557,421 509,782Missouri 210,852 230,222 225,280New Mexico 366,784 404,026 348,576Ohio 860,324 803,521 602,826Texas 188,716 134,860 110,178Utah 258,076 207,297 155,991Washington 758,849 726,137 709,943Wisconsin(2) 30,033 — —Other 8,587 12,774 11,637$ 3,989,909 $ 3,660,207 $ 3,091,240(1) The Florida health plan began enrolling members in December 2008.(2) We acquired the Wisconsin health plan on September 1, 2010.For the year ended December 31, 2010, we received approximately 6% of our premium revenue in the form of “birth income” — a one-time payment for the delivery ofa child — from the <strong>Medicaid</strong> programs in all of our state health plans except New Mexico. Such payments are recognized as revenue in the month the birth occurs.Certain components of premium revenue are subject to accounting estimates, and therefore are subject to retroactive revision. The most significant of these estimatesinvolve:• The recognition of premium revenue at our Florida, New Mexico, and Texas health plans, where we are subject to a number of requirements, that, among otherthings, require us to expend a minimum amount of revenue on certain defined medical costs, expend a maximum amount of revenue on certain defined administrativecosts, and share our profits (as defined) above a certain percentage of revenue with the state;• The recognition of premium revenue due to the achievement of certain performance measures (generally linked to quality of care and administrative efficiency)included in our contracts with the states of New Mexico, Ohio, and Texas;• The recognition of premium revenue due to the achievement of certain medical cost savings (as measured against state fee-for-service costs) under our contract withthe state of Utah; and• The amount of Medicare premium revenue that we recognize, which may be retroactively adjusted to reflect the acuity of care required by our members.Medical Care CostsExpenses related to medical care services are captured in the following four categories:• Fee-for-service: Physician providers paid on a fee-for-service basis are paid according to a fee schedule set by the state or by our contracts with these providers.Most hospitals are paid on a fee-for-service basis in a80http://sec.gov/Archives/edgar/data/1179929/000095012311023069/a58840e10vk.htm[1/6/2012 11:08:51 AM]