Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

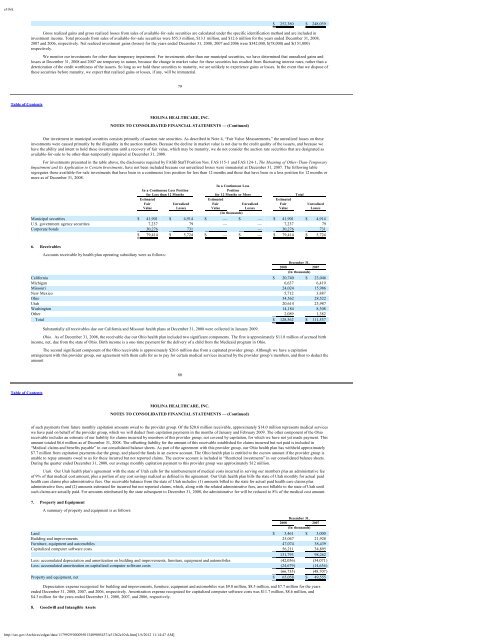

e10vk$ 252,380 $ 248,039Gross realized gains and gross realized losses from sales of available-for-sale securities are calculated under the specific identification method and are included ininvestment income. Total proceeds from sales of available-for-sale securities were $55.3 million, $13.1 million, and $12.6 million for the years ended December 31, 2008,2007 and 2006, respectively. Net realized investment gains (losses) for the years ended December 31, 2008, 2007 and 2006 were $342,000, $(78,000) and $(151,000)respectively.We monitor our investments for other-than-temporary impairment. For investments other than our municipal securities, we have determined that unrealized gains andlosses at December 31, 2008 and 2007 are temporary in nature, because the change in market value for these securities has resulted from fluctuating interest rates, rather than adeterioration of the credit worthiness of the issuers. So long as we hold these securities to maturity, we are unlikely to experience gains or losses. In the event that we dispose ofthese securities before maturity, we expect that realized gains or losses, if any, will be immaterial.79Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)Our investment in municipal securities consists primarily of auction rate securities. As described in Note 4, “Fair Value Measurements,” the unrealized losses on theseinvestments were caused primarily by the illiquidity in the auction markets. Because the decline in market value is not due to the credit quality of the issuers, and because wehave the ability and intent to hold these investments until a recovery of fair value, which may be maturity, we do not consider the auction rate securities that are designated asavailable-for-sale to be other-than-temporarily impaired at December 31, 2008.For investments presented in the table above, the disclosures required by FASB Staff Position Nos. FAS 115-1 and FAS 124-1, The Meaning of Other-Than-TemporaryImpairment and Its Application to Certain Investments, have not been included because our unrealized losses were immaterial at December 31, 2007. The following tablesegregates those available-for-sale investments that have been in a continuous loss position for less than 12 months and those that have been in a loss position for 12 months ormore as of December 31, 2008.In a Continuous LossIn a Continuous Loss Position Positionfor Less than 12 Months for 12 Months or More TotalEstimated Estimated EstimatedFair Unrealized Fair Unrealized Fair UnrealizedValue Losses Value Losses Value Losses(In thousands)Municipal securities $ 41,901 $ 4,914 $ — $ — $ 41,901 $ 4,914U.S. government agency securities 7,237 79 — — 7,237 79Corporate bonds 30,276 731 — 30,276 731$ 79,414 $ 5,724 $ — $ — $ 79,414 $ 5,7246. ReceivablesAccounts receivable by health plan operating subsidiary were as follows:December 31,2008 2007(In thousands)California $ 20,740 $ 23,046Michigan 6,637 6,419Missouri 24,024 15,986New Mexico 5,712 3,887Ohio 34,562 28,522Utah 20,614 23,987Washington 14,184 8,308Other 2,089 1,382Total $ 128,562 $ 111,537Substantially all receivables due our California and Missouri health plans at December 31, 2008 were collected in January 2009.Ohio. As of December 31, 2008, the receivable due our Ohio health plan included two significant components. The first is approximately $11.8 million of accrued birthincome, net, due from the state of Ohio. Birth income is a one-time payment for the delivery of a child from the <strong>Medicaid</strong> program in Ohio.The second significant component of the Ohio receivable is approximately $20.6 million due from a capitated provider group. Although we have a capitationarrangement with this provider group, our agreement with them calls for us to pay for certain medical services incurred by the provider group’s members, and then to deduct theamount80Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)of such payments from future monthly capitation amounts owed to the provider group. Of the $20.6 million receivable, approximately $14.0 million represents medical serviceswe have paid on behalf of the provider group, which we will deduct from capitation payments in the months of January and February 2009. The other component of the Ohioreceivable includes an estimate of our liability for claims incurred by members of this provider group, not covered by capitation, for which we have not yet made payment. Thisamount totaled $6.6 million as of December 31, 2008. The offsetting liability for the amount of this receivable established for claims incurred but not paid is included in“Medical claims and benefits payable” in our consolidated balance sheets. As part of the agreement with this provider group, our Ohio health plan has withheld approximately$7.7 million from capitation payments due the group, and placed the funds in an escrow account. The Ohio health plan is entitled to the escrow amount if the provider group isunable to repay amounts owed to us for these incurred but not reported claims. The escrow account is included in “Restricted investments” in our consolidated balance sheets.During the quarter ended December 31, 2008, our average monthly capitation payment to this provider group was approximately $12 million.Utah. Our Utah health plan’s agreement with the state of Utah calls for the reimbursement of medical costs incurred in serving our members plus an administrative feeof 9% of that medical cost amount, plus a portion of any cost savings realized as defined in the agreement. Our Utah health plan bills the state of Utah monthly for actual paidhealth care claims plus administrative fees. Our receivable balance from the state of Utah includes: (1) amounts billed to the state for actual paid health care claims plusadministrative fees; and (2) amounts estimated for incurred but not reported claims, which, along with the related administrative fees, are not billable to the state of Utah untilsuch claims are actually paid. For amounts reimbursed by the state subsequent to December 31, 2008, the administrative fee will be reduced to 8% of the medical cost amount.7. Property and EquipmentA summary of property and equipment is as follows:December 31,2008 2007(In thousands)Land $ 3,461 $ 3,000Building and improvements 25,047 21,928Furniture, equipment and automobiles 47,074 38,439Capitalized computer software costs 56,211 34,895131,793 98,262Less: accumulated depreciation and amortization on building and improvements, furniture, equipment and automobiles (42,056) (34,071)Less: accumulated amortization on capitalized computer software costs (24,679) (14,636)(66,735) (48,707)Property and equipment, net $ 65,058 $ 49,555Depreciation expense recognized for building and improvements, furniture, equipment and automobiles was $9.0 million, $8.5 million, and $7.7 million for the yearsended December 31, 2008, 2007, and 2006, respectively. Amortization expense recognized for capitalized computer software costs was $11.7 million, $8.6 million, and$4.3 million for the years ended December 31, 2008, 2007, and 2006, respectively.8. Goodwill and Intangible Assetshttp://sec.gov/Archives/edgar/data/1179929/000095013409005437/a51362e10vk.htm[1/6/2012 11:14:47 AM]