Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

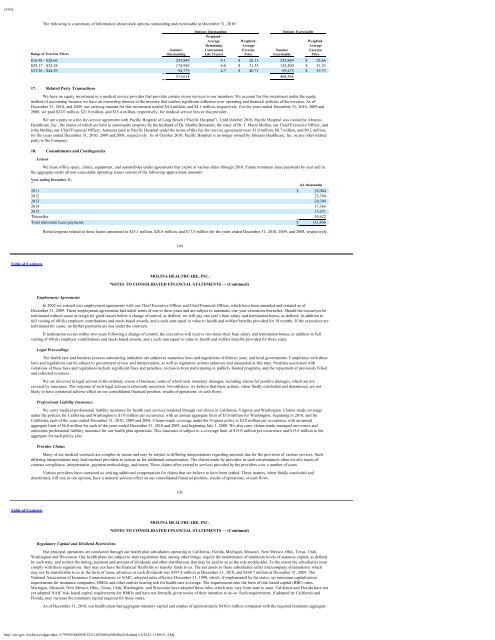

e10vkThe following is a summary of information about stock options outstanding and exercisable at December 31, 2010:Options Outstanding Options ExercisableWeighted-Average Weighted- Weighted-Remaining Average AverageNumber Contractual Exercise Number ExerciseRange of Exercise Prices Outstanding Life (Years) Price Exercisable Price$16.98 - $28.66 243,889 4.1 $ 26.13 243,889 $ 28.66$29.17 - $32.58 174,950 6.0 $ 31.33 135,200 $ 31.23$33.56 - $44.29 94,775 4.7 $ 40.71 89,475 $ 39.73513,614 468,56417. Related Party TransactionsWe have an equity investment in a medical service provider that provides certain vision services to our members. We account for this investment under the equitymethod of accounting because we have an ownership interest in the investee that confers significant influence over operating and financial policies of the investee. As ofDecember 31, 2010, and 2009, our carrying amount for this investment totaled $4.4 million, and $4.1 million, respectively. For the years ended December 31, 2010, 2009 and2008, we paid $22.0 million, $21.8 million, and $15.4 million, respectively, for medical service fees to this provider.We are a party to a fee-for-service agreement with Pacific Hospital of Long Beach (“Pacific Hospital”). Until October 2010, Pacific Hospital was owned by AbrazosHealthcare, Inc., the shares of which are held as community property by the husband of Dr. Martha Bernadett, the sister of Dr. J. Mario <strong>Molina</strong>, our Chief Executive Officer, andJohn <strong>Molina</strong>, our Chief Financial Officer. Amounts paid to Pacific Hospital under the terms of this fee-for-service agreement were $1.0 million, $0.7 million, and $0.2 million,for the years ended December 31, 2010, 2009 and 2008, respectively. As of October 2010, Pacific Hospital is no longer owned by Abrazos Healthcare, Inc. or any other relatedparty to the Company.18. Commitments and ContingenciesLeasesWe lease office space, clinics, equipment, and automobiles under agreements that expire at various dates through 2018. Future minimum lease payments by year and inthe aggregate under all non-cancelable operating leases consist of the following approximate amounts:Year ending December 31,(In thousands)2011 $ 28,0042012 23,7942013 20,3492014 17,3662015 13,671Thereafter 30,622Total minimum lease payments $ 133,806Rental expense related to these leases amounted to $25.1 million, $20.8 million, and $17.5 million for the years ended December 31, 2010, 2009, and 2008, respectively.104Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)Employment AgreementsIn 2002 we entered into employment agreements with our Chief Executive Officer and Chief Financial Officer, which have been amended and restated as ofDecember 31, 2009. These employment agreements had initial terms of one to three years and are subject to automatic one-year extensions thereafter. Should the executives beterminated without cause or resign for good reason before a change of control, as defined, we will pay one year’s base salary and termination bonus, as defined, in addition tofull vesting of 401(k) employer contributions and stock-based awards, and a cash sum equal in value to health and welfare benefits provided for 18 months. If the executives areterminated for cause, no further payments are due under the contracts.If termination occurs within two years following a change of control, the executives will receive two times their base salary and termination bonus, in addition to fullvesting of 401(k) employer contributions and stock-based awards, and a cash sum equal in value to health and welfare benefits provided for three years.Legal ProceedingsThe health care and business process outsourcing industries are subject to numerous laws and regulations of federal, state, and local governments. Compliance with theselaws and regulations can be subject to government review and interpretation, as well as regulatory actions unknown and unasserted at this time. Penalties associated withviolations of these laws and regulations include significant fines and penalties, exclusion from participating in publicly funded programs, and the repayment of previously billedand collected revenues.We are involved in legal actions in the ordinary course of business, some of which seek monetary damages, including claims for punitive damages, which are notcovered by insurance. The outcome of such legal actions is inherently uncertain. Nevertheless, we believe that these actions, when finally concluded and determined, are notlikely to have a material adverse effect on our consolidated financial position, results of operations, or cash flows.Professional Liability InsuranceWe carry medical professional liability insurance for health care services rendered through our clinics in California, Virginia and Washington. Claims-made coverageunder the policies for California and Washington is $1.0 million per occurrence with an annual aggregate limit of $3.0 million for Washington, beginning in 2010, and forCalifornia, each of the years ended December 31, 2010, 2009 and 2008. Claims-made coverage under the Virginia policy is $2.0 million per occurrence with an annualaggregate limit of $6.0 million for each of the years ended December 31, 2010 and 2009, and beginning July 1, 2008. We also carry claims-made managed care errors andomissions professional liability insurance for our health plan operations. This insurance is subject to a coverage limit of $15.0 million per occurrence and $15.0 million in theaggregate for each policy year.Provider ClaimsMany of our medical contracts are complex in nature and may be subject to differing interpretations regarding amounts due for the provision of various services. Suchdiffering interpretations may lead medical providers to pursue us for additional compensation. The claims made by providers in such circumstances often involve issues ofcontract compliance, interpretation, payment methodology, and intent. These claims often extend to services provided by the providers over a number of years.Various providers have contacted us seeking additional compensation for claims that we believe to have been settled. These matters, when finally concluded anddetermined, will not, in our opinion, have a material adverse effect on our consolidated financial position, results of operations, or cash flows.105Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)Regulatory Capital and Dividend RestrictionsOur principal operations are conducted through our health plan subsidiaries operating in California, Florida, Michigan, Missouri, New Mexico, Ohio, Texas, Utah,Washington and Wisconsin. Our health plans are subject to state regulations that, among other things, require the maintenance of minimum levels of statutory capital, as definedby each state, and restrict the timing, payment and amount of dividends and other distributions that may be paid to us as the sole stockholder. To the extent the subsidiaries mustcomply with these regulations, they may not have the financial flexibility to transfer funds to us. The net assets in these subsidiaries (after intercompany eliminations) whichmay not be transferable to us in the form of loans, advances or cash dividends was $397.8 million at December 31, 2010, and $368.7 million at December 31, 2009. TheNational Association of Insurance Commissioners, or NAIC, adopted rules effective December 31, 1998, which, if implemented by the states, set minimum capitalizationrequirements for insurance companies, HMOs and other entities bearing risk for health care coverage. The requirements take the form of risk-based capital (RBC) rules.Michigan, Missouri, New Mexico, Ohio, Texas, Utah, Washington, and Wisconsin have adopted these rules, which may vary from state to state. California and Florida have notyet adopted NAIC risk-based capital requirements for HMOs and have not formally given notice of their intention to do so. Such requirements, if adopted by California andFlorida, may increase the minimum capital required for those states.As of December 31, 2010, our health plans had aggregate statutory capital and surplus of approximately $416.6 million compared with the required minimum aggregatehttp://sec.gov/Archives/edgar/data/1179929/000095012311023069/a58840e10vk.htm[1/6/2012 11:08:51 AM]