Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

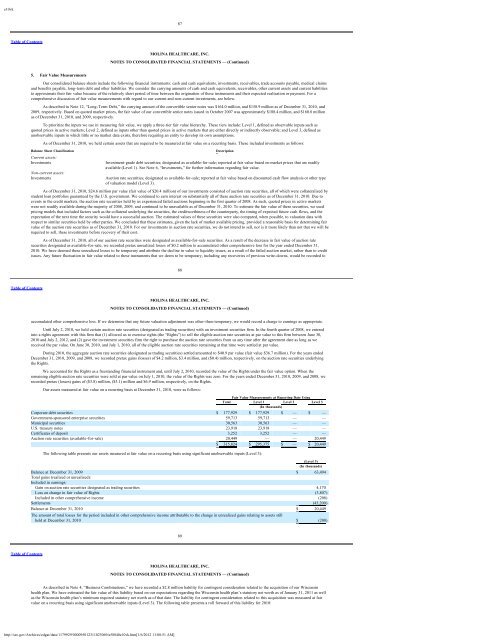

e10vk87Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)5. Fair Value MeasurementsOur consolidated balance sheets include the following financial instruments: cash and cash equivalents, investments, receivables, trade accounts payable, medical claimsand benefits payable, long-term debt and other liabilities. We consider the carrying amounts of cash and cash equivalents, receivables, other current assets and current liabilitiesto approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization or payment. For acomprehensive discussion of fair value measurements with regard to our current and non-current investments, see below.As described in Note 12, “Long-Term Debt,” the carrying amount of the convertible senior notes was $164.0 million, and $158.9 million as of December 31, 2010, and2009, respectively. Based on quoted market prices, the fair value of our convertible senior notes issued in October 2007 was approximately $188.4 million, and $160.8 millionas of December 31, 2010, and 2009, respectively.To prioritize the inputs we use in measuring fair value, we apply a three-tier fair value hierarchy. These tiers include: Level 1, defined as observable inputs such asquoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined asunobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.As of December 31, 2010, we held certain assets that are required to be measured at fair value on a recurring basis. These included investments as follows:Balance Sheet Classification DescriptionCurrent assets:InvestmentsNon-current assets:InvestmentsInvestment-grade debt securities; designated as available-for-sale; reported at fair value based on market prices that are readilyavailable (Level 1). See Note 6, “Investments,” for further information regarding fair value.Auction rate securities; designated as available-for-sale; reported at fair value based on discounted cash flow analysis or other typeof valuation model (Level 3).As of December 31, 2010, $24.6 million par value (fair value of $20.4 million) of our investments consisted of auction rate securities, all of which were collateralized bystudent loan portfolios guaranteed by the U.S. government. We continued to earn interest on substantially all of these auction rate securities as of December 31, 2010. Due toevents in the credit markets, the auction rate securities held by us experienced failed auctions beginning in the first quarter of 2008. As such, quoted prices in active marketswere not readily available during the majority of 2008, 2009, and continued to be unavailable as of December 31, 2010. To estimate the fair value of these securities, we usedpricing models that included factors such as the collateral underlying the securities, the creditworthiness of the counterparty, the timing of expected future cash flows, and theexpectation of the next time the security would have a successful auction. The estimated values of these securities were also compared, when possible, to valuation data withrespect to similar securities held by other parties. We concluded that these estimates, given the lack of market available pricing, provided a reasonable basis for determining fairvalue of the auction rate securities as of December 31, 2010. For our investments in auction rate securities, we do not intend to sell, nor is it more likely than not that we will berequired to sell, these investments before recovery of their cost.As of December 31, 2010, all of our auction rate securities were designated as available-for-sale securities. As a result of the decrease in fair value of auction ratesecurities designated as available-for-sale, we recorded pretax unrealized losses of $0.2 million to accumulated other comprehensive loss for the year ended December 31,2010. We have deemed these unrealized losses to be temporary and attribute the decline in value to liquidity issues, as a result of the failed auction market, rather than to creditissues. Any future fluctuation in fair value related to these instruments that we deem to be temporary, including any recoveries of previous write-downs, would be recorded to88Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)accumulated other comprehensive loss. If we determine that any future valuation adjustment was other-than-temporary, we would record a charge to earnings as appropriate.Until July 2, 2010, we held certain auction rate securities (designated as trading securities) with an investment securities firm. In the fourth quarter of 2008, we enteredinto a rights agreement with this firm that (1) allowed us to exercise rights (the “Rights”) to sell the eligible auction rate securities at par value to this firm between June 30,2010 and July 2, 2012, and (2) gave the investment securities firm the right to purchase the auction rate securities from us any time after the agreement date as long as wereceived the par value. On June 30, 2010, and July 1, 2010, all of the eligible auction rate securities remaining at that time were settled at par value.During 2010, the aggregate auction rate securities (designated as trading securities) settled amounted to $40.9 par value (fair value $36.7 million). For the years endedDecember 31, 2010, 2009, and 2008, we recorded pretax gains (losses) of $4.2 million, $3.4 million, and ($0.4) million, respectively, on the auction rate securities underlyingthe Rights.We accounted for the Rights as a freestanding financial instrument and, until July 2, 2010, recorded the value of the Rights under the fair value option. When theremaining eligible auction rate securities were sold at par value on July 1, 2010, the value of the Rights was zero. For the years ended December 31, 2010, 2009, and 2008, werecorded pretax (losses) gains of ($3.8) million, ($3.1) million and $6.9 million, respectively, on the Rights.Our assets measured at fair value on a recurring basis at December 31, 2010, were as follows:Fair Value Measurements at Reporting Date UsingTotal Level 1 Level 2 Level 3(In thousands)Corporate debt securities $ 177,929 $ 177,929 $ — $ —Government-sponsored enterprise securities 59,713 59,713 — —Municipal securities 30,563 30,563 — —U.S. treasury notes 23,918 23,918 — —Certificates of deposit 3,252 3,252 — —Auction rate securities (available-for-sale) 20,449 — — 20,449$ 315,824 $ 295,375 $ — $ 20,449The following table presents our assets measured at fair value on a recurring basis using significant unobservable inputs (Level 3):(Level 3)(In thousands)Balance at December 31, 2009 $ 63,494Total gains (realized or unrealized):Included in earnings:Gain on auction rate securities designated as trading securities 4,170Loss on change in fair value of Rights (3,807)Included in other comprehensive income (208)Settlements (43,200)Balance at December 31, 2010 $ 20,449The amount of total losses for the period included in other comprehensive income attributable to the change in unrealized gains relating to assets stillheld at December 31, 2010 $ (208)89Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)As described in Note 4, “Business Combinations,” we have recorded a $2.8 million liability for contingent consideration related to the acquisition of our Wisconsinhealth plan. We have estimated the fair value of this liability based on our expectations regarding the Wisconsin health plan’s statutory net worth as of January 31, 2011 as wellas the Wisconsin health plan’s minimum required statutory net worth as of that date. The liability for contingent consideration related to this acquisition was measured at fairvalue on a recurring basis using significant unobservable inputs (Level 3). The following table presents a roll forward of this liability for 2010:http://sec.gov/Archives/edgar/data/1179929/000095012311023069/a58840e10vk.htm[1/6/2012 11:08:51 AM]