- Page 1:

Molina Medicaid SolutionsResponse t

- Page 7 and 8:

Bridging the Rivers ofChange Togeth

- Page 9 and 10:

Bridging the Rivers ofChange Togeth

- Page 11 and 12:

Bridging the Rivers ofChange Togeth

- Page 13 and 14:

Bridging the Rivers ofChange Togeth

- Page 15 and 16:

Bridging the Rivers ofChange Togeth

- Page 17 and 18:

Bridging the Rivers ofChange Togeth

- Page 19 and 20:

Bridging the Rivers ofChange Togeth

- Page 21 and 22:

Bridging the Rivers ofChange Togeth

- Page 23 and 24:

Bridging the Rivers ofChange Togeth

- Page 25 and 26:

Bridging the Rivers ofChange Togeth

- Page 27 and 28:

Bridging the Rivers ofChange Togeth

- Page 29 and 30:

Bridging the Rivers ofChange Togeth

- Page 31 and 32:

Bridging the Rivers ofChange Togeth

- Page 33 and 34:

Bridging the Rivers ofChange Togeth

- Page 35 and 36:

Bridging the Rivers ofChange Togeth

- Page 37 and 38:

Bridging the Rivers ofChange Togeth

- Page 39 and 40:

Bridging the Rivers ofChange Togeth

- Page 41 and 42:

Bridging the Rivers ofChange Togeth

- Page 43 and 44:

Bridging the Rivers ofChange Togeth

- Page 45 and 46:

Bridging the Rivers ofChange Togeth

- Page 47 and 48:

Bridging the Rivers ofChange Togeth

- Page 49 and 50:

Bridging the Rivers ofChange Togeth

- Page 51 and 52:

Bridging the Rivers ofChange Togeth

- Page 53 and 54:

Bridging the Rivers ofChange Togeth

- Page 55 and 56:

Bridging the Rivers ofChange Togeth

- Page 57 and 58:

Bridging the Rivers ofChange Togeth

- Page 59 and 60:

Bridging the Rivers ofChange Togeth

- Page 61 and 62:

Bridging the Rivers ofChange Togeth

- Page 63 and 64:

Bridging the Rivers ofChange Togeth

- Page 65 and 66:

Bridging the Rivers ofChange Togeth

- Page 67 and 68:

Bridging the Rivers ofChange Togeth

- Page 69 and 70:

Bridging the Rivers ofChange Togeth

- Page 71 and 72:

Bridging the Rivers ofChange Togeth

- Page 73 and 74:

Bridging the Rivers ofChange Togeth

- Page 75 and 76:

Bridging the Rivers ofChange Togeth

- Page 77 and 78:

Bridging the Rivers ofChange Togeth

- Page 79 and 80:

Bridging the Rivers ofChange Togeth

- Page 81 and 82:

Bridging the Rivers ofChange Togeth

- Page 83 and 84:

Bridging the Rivers ofChange Togeth

- Page 85 and 86:

Bridging the Rivers ofChange Togeth

- Page 87 and 88:

Bridging the Rivers ofChange Togeth

- Page 89 and 90:

Bridging the Rivers ofChange Togeth

- Page 91 and 92:

Bridging the Rivers ofChange Togeth

- Page 93 and 94:

Bridging the Rivers ofChange Togeth

- Page 95 and 96:

Bridging the Rivers ofChange Togeth

- Page 97 and 98:

Bridging the Rivers ofChange Togeth

- Page 99 and 100:

Bridging the Rivers ofChange Togeth

- Page 101 and 102:

Bridging the Rivers ofChange Togeth

- Page 103 and 104:

Bridging the Rivers ofChange Togeth

- Page 105 and 106:

Bridging the Rivers ofChange Togeth

- Page 107 and 108:

Bridging the Rivers ofChange Togeth

- Page 109 and 110:

Bridging the Rivers ofChange Togeth

- Page 111 and 112:

Bridging the Rivers ofChange Togeth

- Page 113 and 114:

Bridging the Rivers ofChange Togeth

- Page 115 and 116:

Bridging the Rivers ofChange Togeth

- Page 117 and 118:

Bridging the Rivers ofChange Togeth

- Page 119 and 120:

Bridging the Rivers ofChange Togeth

- Page 121 and 122:

Bridging the Rivers ofChange Togeth

- Page 123 and 124:

Bridging the Rivers ofChange Togeth

- Page 125 and 126:

Bridging the Rivers ofChange Togeth

- Page 127 and 128:

Bridging the Rivers ofChange Togeth

- Page 129 and 130:

Bridging the Rivers ofChange Togeth

- Page 131 and 132:

Bridging the Rivers ofChange Togeth

- Page 133 and 134:

Bridging the Rivers ofChange Togeth

- Page 135 and 136:

Bridging the Rivers ofChange Togeth

- Page 137 and 138:

Bridging the Rivers ofChange Togeth

- Page 139 and 140:

Bridging the Rivers ofChange Togeth

- Page 141 and 142:

Bridging the Rivers ofChange Togeth

- Page 143 and 144:

Bridging the Rivers ofChange Togeth

- Page 145 and 146:

Bridging the Rivers ofChange Togeth

- Page 147 and 148:

Bridging the Rivers ofChange Togeth

- Page 149 and 150:

Bridging the Rivers ofChange Togeth

- Page 151 and 152:

Bridging the Rivers ofChange Togeth

- Page 153 and 154:

Bridging the Rivers ofChange Togeth

- Page 155 and 156:

Bridging the Rivers ofChange Togeth

- Page 157 and 158:

Bridging the Rivers ofChange Togeth

- Page 159 and 160:

Bridging the Rivers ofChange Togeth

- Page 161 and 162:

Bridging the Rivers ofChange Togeth

- Page 163 and 164:

Bridging the Rivers ofChange Togeth

- Page 165 and 166:

Bridging the Rivers ofChange Togeth

- Page 167 and 168:

Bridging the Rivers ofChange Togeth

- Page 169 and 170:

Bridging the Rivers ofChange Togeth

- Page 171 and 172:

Bridging the Rivers ofChange Togeth

- Page 173 and 174:

Bridging the Rivers ofChange Togeth

- Page 175 and 176:

Bridging the Rivers ofChange Togeth

- Page 177 and 178:

Bridging the Rivers ofChange Togeth

- Page 179 and 180:

Bridging the Rivers ofChange Togeth

- Page 181 and 182:

Bridging the Rivers ofChange Togeth

- Page 183 and 184:

Bridging the Rivers ofChange Togeth

- Page 185 and 186:

Bridging the Rivers ofChange Togeth

- Page 187 and 188:

Bridging the Rivers ofChange Togeth

- Page 189 and 190:

Bridging the Rivers ofChange Togeth

- Page 191 and 192:

Bridging the Rivers ofChange Togeth

- Page 193 and 194:

Bridging the Rivers ofChange Togeth

- Page 195 and 196:

Bridging the Rivers ofChange Togeth

- Page 197 and 198:

Bridging the Rivers ofChange Togeth

- Page 199 and 200:

Bridging the Rivers ofChange Togeth

- Page 201 and 202:

Bridging the Rivers ofChange Togeth

- Page 203 and 204:

Bridging the Rivers ofChange Togeth

- Page 205 and 206:

Bridging the Rivers ofChange Togeth

- Page 207 and 208:

Bridging the Rivers ofChange Togeth

- Page 209 and 210:

Bridging the Rivers ofChange Togeth

- Page 211 and 212:

Bridging the Rivers ofChange Togeth

- Page 213 and 214:

Bridging the Rivers ofChange Togeth

- Page 215 and 216:

Bridging the Rivers ofChange Togeth

- Page 217 and 218:

Bridging the Rivers ofChange Togeth

- Page 219 and 220:

Bridging the Rivers ofChange Togeth

- Page 221 and 222:

Bridging the Rivers ofChange Togeth

- Page 223 and 224:

Bridging the Rivers ofChange Togeth

- Page 225 and 226:

Bridging the Rivers ofChange Togeth

- Page 227 and 228:

Bridging the Rivers ofChange Togeth

- Page 229 and 230:

Bridging the Rivers ofChange Togeth

- Page 231 and 232:

Bridging the Rivers ofChange Togeth

- Page 233 and 234:

Bridging the Rivers ofChange Togeth

- Page 235 and 236:

Bridging the Rivers ofChange Togeth

- Page 237 and 238:

Bridging the Rivers ofChange Togeth

- Page 239 and 240:

Bridging the Rivers ofChange Togeth

- Page 241 and 242:

Bridging the Rivers ofChange Togeth

- Page 243 and 244:

Bridging the Rivers ofChange Togeth

- Page 245 and 246:

Bridging the Rivers ofChange Togeth

- Page 247 and 248:

Bridging the Rivers ofChange Togeth

- Page 249 and 250:

Bridging the Rivers ofChange Togeth

- Page 265:

Bridging the Rivers ofChange Togeth

- Page 272 and 273:

Bridging the Rivers ofChange Togeth

- Page 274 and 275:

Bridging the Rivers ofChange Togeth

- Page 276 and 277:

Bridging the Rivers ofChange Togeth

- Page 278 and 279:

Bridging the Rivers ofChange Togeth

- Page 280 and 281:

Bridging the Rivers ofChange Togeth

- Page 282 and 283:

Bridging the Rivers ofChange Togeth

- Page 284 and 285:

Bridging the Rivers ofChange Togeth

- Page 286 and 287:

Bridging the Rivers ofChange Togeth

- Page 288 and 289:

Bridging the Rivers ofChange Togeth

- Page 290 and 291:

Bridging the Rivers ofChange Togeth

- Page 292 and 293:

Bridging the Rivers ofChange Togeth

- Page 294 and 295:

Bridging the Rivers ofChange Togeth

- Page 296 and 297:

Bridging the Rivers ofChange Togeth

- Page 298 and 299:

Bridging the Rivers ofChange Togeth

- Page 300 and 301:

Bridging the Rivers ofChange Togeth

- Page 302 and 303:

Bridging the Rivers ofChange Togeth

- Page 304 and 305:

Bridging the Rivers ofChange Togeth

- Page 306 and 307:

Bridging the Rivers ofChange Togeth

- Page 308 and 309:

Bridging the Rivers ofChange Togeth

- Page 310 and 311:

Bridging the Rivers ofChange Togeth

- Page 312 and 313:

Bridging the Rivers ofChange Togeth

- Page 314 and 315:

Bridging the Rivers ofChange Togeth

- Page 316 and 317:

Bridging the Rivers ofChange Togeth

- Page 318 and 319:

Bridging the Rivers ofChange Togeth

- Page 320 and 321:

Bridging the Rivers ofChange Togeth

- Page 322 and 323:

Bridging the Rivers ofChange Togeth

- Page 324 and 325:

Bridging the Rivers ofChange Togeth

- Page 326 and 327:

Bridging the Rivers ofChange Togeth

- Page 328 and 329:

Bridging the Rivers ofChange Togeth

- Page 330 and 331:

Bridging the Rivers ofChange Togeth

- Page 332 and 333:

Bridging the Rivers ofChange Togeth

- Page 334 and 335:

Bridging the Rivers ofChange Togeth

- Page 336 and 337:

e10vkTable of ContentsItem 1:Overvi

- Page 338 and 339:

e10vkDepartment of Health Services

- Page 340 and 341:

e10vkservices, and reputation or na

- Page 342 and 343:

e10vkIf our government contracts ar

- Page 344 and 345:

e10vkIf our cost increases resultin

- Page 346 and 347:

e10vkour board of directors. Becaus

- Page 348 and 349:

e10vkFirst Quarter $ 44.94 $ 23.46S

- Page 350 and 351:

e10vkTable of ContentsCertain compo

- Page 352 and 353:

e10vkNevada 8,037 1,106.45 9,099 1,

- Page 354 and 355:

e10vkInvestment IncomeInvestment in

- Page 356 and 357:

e10vkand 2007, respectively. EBITDA

- Page 358 and 359:

e10vk$2.8 million, or $0.10 per dil

- Page 360 and 361:

e10vkREPORT OF INDEPENDENT REGISTER

- Page 362 and 363:

e10vk65Table of ContentsMOLINA HEAL

- Page 364 and 365:

e10vkDelegated Provider InsolvencyC

- Page 366 and 367:

e10vk2007 (see Note 11, “Long-Ter

- Page 368 and 369:

e10vk$ 252,380 $ 248,039Gross reali

- Page 370 and 371: e10vkTable of ContentsMOLINA HEALTH

- Page 372 and 373: e10vk$10.9 million, and $7.9 millio

- Page 374 and 375: e10vkIn July 2008, our board of dir

- Page 376 and 377: e10vkThe Registrant has an equity i

- Page 378 and 379: e10vkSIGNATURESPursuant to the requ

- Page 380 and 381: exv12w1EX-12.1 2 a51362exv12w1.htm

- Page 382 and 383: exv23w1EX-23.1 4 a51362exv23w1.htm

- Page 384 and 385: exv31w2EX-31.2 6 a51362exv31w2.htm

- Page 386 and 387: exv32w2EX-32.2 8 a51362exv32w2.htm

- Page 388 and 389: e10vkEX-31.1EX-31.2EX-32.1EX-32.2Ta

- Page 390 and 391: e10vkLeverage operational efficienc

- Page 392 and 393: e10vkhealth plans. Among such facto

- Page 394 and 395: e10vkMissouri and Ohio health plans

- Page 396 and 397: e10vkWe are subject to various rout

- Page 398 and 399: e10vkIt may be difficult for a thir

- Page 400 and 401: e10vkItem 5:PART IIMarket for Regis

- Page 402 and 403: e10vkstates to exclude certain bene

- Page 404 and 405: e10vkMedical care ratio 86.8% 84.8%

- Page 406 and 407: e10vkTable of ContentsMedical care

- Page 408 and 409: e10vkare required to pay a fee for

- Page 410 and 411: e10vkknown. While we believe our cu

- Page 412 and 413: e10vkTable of ContentsMOLINA HEALTH

- Page 414 and 415: e10vkYear Ended December 31,2009 20

- Page 416 and 417: e10vkCalifornia $ 481,717 $ 417,027

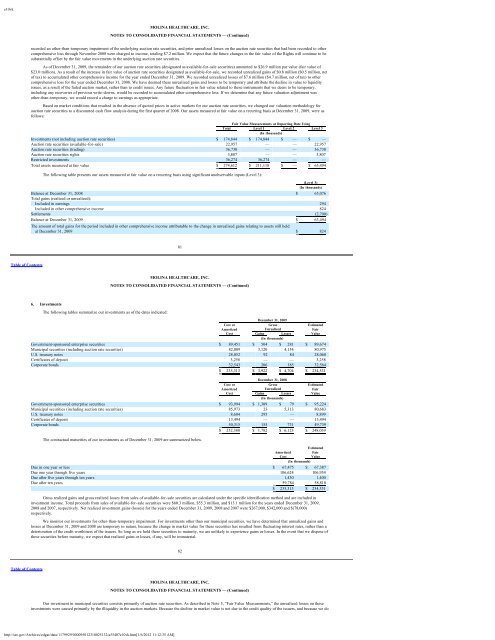

- Page 418 and 419: e10vkMOLINA HEALTHCARE, INC.NOTES T

- Page 422 and 423: e10vknot intend to sell, nor is it

- Page 424 and 425: e10vk87Table of ContentsMOLINA HEAL

- Page 426 and 427: e10vkDuring 2009, 2008, and 2007, t

- Page 428 and 429: e10vk$29.17 - $30.05 9,350 5.9 $ 29

- Page 430 and 431: e10vk(1) The Registrant’s condens

- Page 432 and 433: e10vkChanges in Internal Controls:

- Page 434 and 435: e10vkSignature Title Date/s/ Joseph

- Page 436 and 437: exv10w22Commitments exceed the sum

- Page 438 and 439: exv10w22Loan Document. The amendmen

- Page 440 and 441: exv10w22Name:Title:Fifth Amendment

- Page 442 and 443: exv10w22Fifth Amendment to Credit A

- Page 444 and 445: exv10w24EX-10.24 3 a55407exv10w24.h

- Page 446 and 447: exv10w24Molina ECMS ref# 729 Provid

- Page 448 and 449: exv10w24Molina ECMS ref# 729 Provid

- Page 450 and 451: exv10w24HSA — Hospital Services A

- Page 452 and 453: exv10w243.2 Member Eligibility Dete

- Page 454 and 455: exv10w245.6 Amendment. Health Plan

- Page 456 and 457: exv10w24HSA — Hospital Services A

- Page 458 and 459: exv10w24License No. StreetNPI (or U

- Page 460 and 461: exv10w24Page 23 of 40ATTACHMENT CPr

- Page 462 and 463: exv10w24• This reimbursement meth

- Page 464 and 465: exv10w24Molina ECMS ref# 729 Provid

- Page 466 and 467: exv10w24(Rule 53250(e)(4))8. Provid

- Page 468 and 469: exv10w241. Right to Audit. Provider

- Page 470 and 471:

exv10w24Treasurer G. William Hammer

- Page 472 and 473:

exv10w25unless the situation is one

- Page 474 and 475:

exv10w25Plan in identifying, proces

- Page 476 and 477:

exv10w25Page 9that the offset and r

- Page 478 and 479:

exv10w25under this Agreement.h. Hea

- Page 480 and 481:

exv10w25Page 16Date 6/1/06ATTACHMEN

- Page 482 and 483:

exv10w25that Provider is de-delegat

- Page 484 and 485:

exv10w25the subscriber or Member by

- Page 486 and 487:

exv10w25discretion, that Provider h

- Page 488 and 489:

exv10w252.5 Annual Disclosure of Ca

- Page 490 and 491:

exv10w25Initials of authorizedrepre

- Page 492 and 493:

exv10w25the report is true and corr

- Page 494 and 495:

exv21w1EX-21.1 6 a55407exv21w1.htm

- Page 496 and 497:

exv31w1EX-31.1 8 a55407exv31w1.htm

- Page 498 and 499:

exv32w1EX-32.1 10 a55407exv32w1.htm

- Page 500 and 501:

e10vk10-K 1 a58840e10vk.htm FORM 10

- Page 502 and 503:

e10vkOur StrengthsWe focus on servi

- Page 504 and 505:

e10vkevent.CompetitionWe operate in

- Page 506 and 507:

e10vkat the funding for these healt

- Page 508 and 509:

e10vk18Table of ContentsAlso, many

- Page 510 and 511:

e10vkTable of Contentsalleged non-c

- Page 512 and 513:

e10vk(fair value of $20.4 million).

- Page 514 and 515:

e10vkTable of ContentsSTOCK PERFORM

- Page 516 and 517:

e10vkAs of December 31, 2010, our h

- Page 519 and 520:

e10vkYear Ended December 31,2010 20

- Page 521 and 522:

e10vkAcquisitionsWisconsin Health P

- Page 523 and 524:

e10vkspecific performance measures

- Page 525 and 526:

e10vkoverestimations were tied to o

- Page 527 and 528:

e10vkIntangible assets, net 105,500

- Page 529 and 530:

e10vkOur Health Plans segment compr

- Page 531 and 532:

e10vkSituations may arise where the

- Page 533 and 534:

e10vkinvestment fund. As of Decembe

- Page 535 and 536:

e10vk87Table of ContentsMOLINA HEAL

- Page 537 and 538:

e10vk7. ReceivablesHealth Plans seg

- Page 539 and 540:

e10vkTable of ContentsMOLINA HEALTH

- Page 541 and 542:

e10vkindebtedness under the Credit

- Page 543 and 544:

e10vkstatutory capital and surplus

- Page 545 and 546:

e10vkCash paid in business purchase

- Page 547 and 548:

e10vkItem 12.Security Ownership of

- Page 549 and 550:

exv10w27EX-10.27 2 a58840exv10w27.h

- Page 551 and 552:

exv10w27(f) all transferable or ass

- Page 553 and 554:

exv10w27and other charges have been

- Page 555 and 556:

exv10w27under or affecting the Prop

- Page 557 and 558:

exv10w27BY A GENERAL RELEASE, WHICH

- Page 559 and 560:

exv10w27(f) Seller’s share of the

- Page 561 and 562:

exv10w2710.6 Items Not to be Prorat

- Page 563 and 564:

exv10w27- 21 -(i) Delinquency Repor

- Page 565 and 566:

exv10w27executed, and delivered by

- Page 567 and 568:

exv10w27MATERIALS THAT PERTAIN TO T

- Page 569 and 570:

exv10w27Attn: General CounselTeleph

- Page 571 and 572:

exv10w2718.16 Authority. The indivi

- Page 573 and 574:

exv12w1EX-12.1 3 a58840exv12w1.htm

- Page 575 and 576:

exv23w1EX-23.1 5 a58840exv23w1.htm

- Page 577 and 578:

exv31w2EX-31.2 7 a58840exv31w2.htm

- Page 579:

exv32w2EX-32.2 9 a58840exv32w2.htm