Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

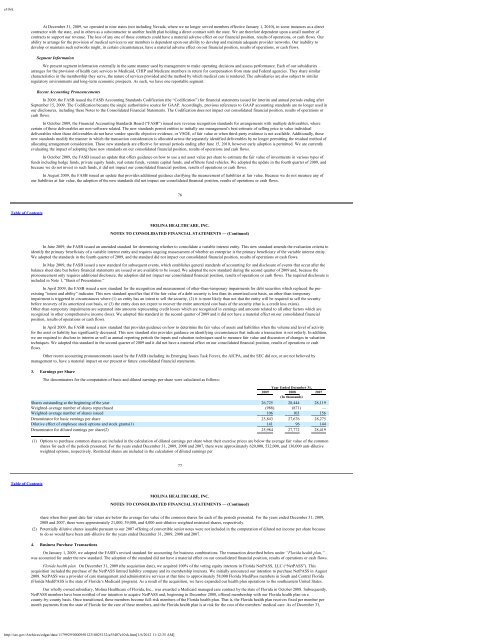

e10vkAt December 31, 2009, we operated in nine states (not including Nevada, where we no longer served members effective January 1, 2010), in some instances as a directcontractor with the state, and in others as a subcontractor to another health plan holding a direct contract with the state. We are therefore dependent upon a small number ofcontracts to support our revenue. The loss of any one of those contracts could have a material adverse effect on our financial position, results of operations, or cash flows. Ourability to arrange for the provision of medical services to our members is dependent upon our ability to develop and maintain adequate provider networks. Our inability todevelop or maintain such networks might, in certain circumstances, have a material adverse effect on our financial position, results of operations, or cash flows.Segment InformationWe present segment information externally in the same manner used by management to make operating decisions and assess performance. Each of our subsidiariesarranges for the provision of health care services to <strong>Medicaid</strong>, CHIP and Medicare members in return for compensation from state and Federal agencies. They share similarcharacteristics in the membership they serve, the nature of services provided and the method by which medical care is rendered. The subsidiaries are also subject to similarregulatory environments and long-term economic prospects. As such, we have one reportable segment.Recent Accounting PronouncementsIn 2009, the FASB issued the FASB Accounting Standards Codification (the “Codification”) for financial statements issued for interim and annual periods ending afterSeptember 15, 2009. The Codification became the single authoritative source for GAAP. Accordingly, previous references to GAAP accounting standards are no longer used inour disclosures, including these Notes to the Consolidated Financial Statements. The Codification does not impact our consolidated financial position, results of operations orcash flows.In October 2009, the Financial Accounting Standards Board (“FASB”) issued new revenue recognition standards for arrangements with multiple deliverables, wherecertain of those deliverables are non-software related. The new standards permit entities to initially use management’s best estimate of selling price to value individualdeliverables when those deliverables do not have vendor specific objective evidence, or VSOE, of fair value or when third-party evidence is not available. Additionally, thesenew standards modify the manner in which the transaction consideration is allocated across the separately identified deliverables by no longer permitting the residual method ofallocating arrangement consideration. These new standards are effective for annual periods ending after June 15, 2010, however early adoption is permitted. We are currentlyevaluating the impact of adopting these new standards on our consolidated financial position, results of operations and cash flows.In October 2009, the FASB issued an update that offers guidance on how to use a net asset value per share to estimate the fair value of investments in various types offunds including hedge funds, private equity funds, real estate funds, venture capital funds, and offshore fund vehicles. We adopted the update in the fourth quarter of 2009, andbecause we do not invest in such funds, it did not impact our consolidated financial position, results of operations or cash flows.In August 2009, the FASB issued an update that provides additional guidance clarifying the measurement of liabilities at fair value. Because we do not measure any ofour liabilities at fair value, the adoption of the new standards did not impact our consolidated financial position, results of operations or cash flows.76Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)In June 2009, the FASB issued an amended standard for determining whether to consolidate a variable interest entity. This new standard amends the evaluation criteria toidentify the primary beneficiary of a variable interest entity and requires ongoing reassessment of whether an enterprise is the primary beneficiary of the variable interest entity.We adopted the standards in the fourth quarter of 2009, and the standard did not impact our consolidated financial position, results of operations or cash flows.In May 2009, the FASB issued a new standard for subsequent events, which establishes general standards of accounting for and disclosure of events that occur after thebalance sheet date but before financial statements are issued or are available to be issued. We adopted the new standard during the second quarter of 2009 and, because thepronouncement only requires additional disclosure, the adoption did not impact our consolidated financial position, results of operations or cash flows. The required disclosure isincluded in Note 1, “Basis of Presentation.”In April 2009, the FASB issued a new standard for the recognition and measurement of other-than-temporary impairments for debt securities which replaced the preexisting“intent and ability” indicator. This new standard specifies that if the fair value of a debt security is less than its amortized cost basis, an other-than-temporaryimpairment is triggered in circumstances where (1) an entity has an intent to sell the security, (2) it is more likely than not that the entity will be required to sell the securitybefore recovery of its amortized cost basis, or (3) the entity does not expect to recover the entire amortized cost basis of the security (that is, a credit loss exists).Other-than-temporary impairments are separated into amounts representing credit losses which are recognized in earnings and amounts related to all other factors which arerecognized in other comprehensive income (loss). We adopted this standard in the second quarter of 2009 and it did not have a material effect on our consolidated financialposition, results of operations or cash flows.In April 2009, the FASB issued a new standard that provides guidance on how to determine the fair value of assets and liabilities when the volume and level of activityfor the asset or liability has significantly decreased. This new standard also provides guidance on identifying circumstances that indicate a transaction is not orderly. In addition,we are required to disclose in interim as well as annual reporting periods the inputs and valuation techniques used to measure fair value and discussion of changes in valuationtechniques. We adopted this standard in the second quarter of 2009 and it did not have a material effect on our consolidated financial position, results of operations or cashflows.Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the AICPA, and the SEC did not, or are not believed bymanagement to, have a material impact on our present or future consolidated financial statements.3. Earnings per ShareThe denominators for the computation of basic and diluted earnings per share were calculated as follows:Year Ended December 31,2009 2008 2007(In thousands)Shares outstanding at the beginning of the year 26,725 28,444 28,119Weighted-average number of shares repurchased (988) (871) —Weighted-average number of shares issued 106 103 156Denominator for basic earnings per share 25,843 27,676 28,275Dilutive effect of employee stock options and stock grants(1) 141 96 144Denominator for diluted earnings per share(2) 25,984 27,772 28,419(1) Options to purchase common shares are included in the calculation of diluted earnings per share when their exercise prices are below the average fair value of the commonshares for each of the periods presented. For the years ended December 31, 2009, 2008 and 2007, there were approximately 620,000, 532,000, and 136,000 anti-dilutiveweighted options, respectively. Restricted shares are included in the calculation of diluted earnings per77Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)share when their grant date fair values are below the average fair value of the common shares for each of the periods presented. For the years ended December 31, 2009,2008 and 2007, there were approximately 21,000, 39,000, and 4,000 anti-dilutive weighted restricted shares, respectively.(2) Potentially dilutive shares issuable pursuant to our 2007 offering of convertible senior notes were not included in the computation of diluted net income per share becauseto do so would have been anti-dilutive for the years ended December 31, 2009, 2008 and 2007.4. Business Purchase TransactionsOn January 1, 2009, we adopted the FASB’s revised standard for accounting for business combinations. The transaction described below under “Florida health plan,”was accounted for under the new standard. The adoption of the standard did not have a material effect on our consolidated financial position, results of operations or cash flows.Florida health plan. On December 31, 2009 (the acquisition date), we acquired 100% of the voting equity interests in Florida NetPASS, LLC (“NetPASS”). Thisacquisition included the purchase of the NetPASS limited liability company and its membership interests. We initially announced our intention to purchase NetPASS in August2008. NetPASS was a provider of care management and administrative services at that time to approximately 58,000 Florida MediPass members in South and Central Florida(Florida MediPASS is the state of Florida’s <strong>Medicaid</strong> program). As a result of the acquisition, we have expanded our health plan operations to the southeastern United States.Our wholly owned subsidiary, <strong>Molina</strong> Healthcare of Florida, Inc., was awarded a <strong>Medicaid</strong> managed care contract by the state of Florida in October 2008. Subsequently,NetPASS members have been notified of our intention to acquire NetPASS and, beginning in December 2008, offered membership with our Florida health plan on acounty-by-county basis. Once transitioned, these members become full-risk members of the Florida health plan. That is, the Florida health plan receives fixed per member permonth payments from the state of Florida for the care of these members, and the Florida health plan is at risk for the cost of the members’ medical care. As of December 31,http://sec.gov/Archives/edgar/data/1179929/000095012310025132/a55407e10vk.htm[1/6/2012 11:12:35 AM]