Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Molina Medicaid Solutions - DHHR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

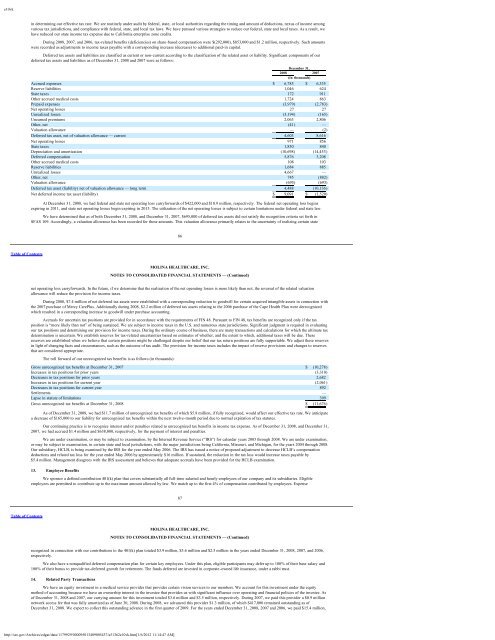

e10vkin determining our effective tax rate. We are routinely under audit by federal, state, or local authorities regarding the timing and amount of deductions, nexus of income amongvarious tax jurisdictions, and compliance with federal, state, and local tax laws. We have pursued various strategies to reduce our federal, state and local taxes. As a result, wehave reduced our state income tax expense due to California enterprise zone credits.During 2008, 2007, and 2006, tax-related benefits (deficiencies) on share-based compensation were $(292,000), $853,000 and $1.2 million, respectively. Such amountswere recorded as adjustments to income taxes payable with a corresponding increase (decrease) to additional paid-in capital.Deferred tax assets and liabilities are classified as current or non-current according to the classification of the related asset or liability. Significant components of ourdeferred tax assets and liabilities as of December 31, 2008 and 2007 were as follows:December 31,2008 2007(In thousands)Accrued expenses $ 6,785 $ 6,335Reserve liabilities 1,046 624State taxes 172 911Other accrued medical costs 1,724 863Prepaid expenses (3,979) (2,783)Net operating losses 27 27Unrealized losses (3,194) (165)Unearned premiums 2,063 2,806Other, net (41) —Valuation allowance — (2)Deferred tax asset, net of valuation allowance — current 4,603 8,616Net operating losses 971 856State taxes 1,830 840Depreciation and amortization (10,698) (14,453)Deferred compensation 5,876 3,208Other accrued medical costs 108 103Reserve liabilities 1,684 885Unrealized losses 4,667 —Other, net 745 (882)Valuation allowance (695) (693)Deferred tax asset (liability) net of valuation allowance — long term 4,488 (10,136)Net deferred income tax asset (liability) $ 9,091 $ (1,520)At December 31, 2008, we had federal and state net operating loss carryforwards of $422,000 and $10.9 million, respectively. The federal net operating loss beginsexpiring in 2011, and state net operating losses begin expiring in 2013. The utilization of the net operating losses is subject to certain limitations under federal and state law.We have determined that as of both December 31, 2008, and December 31, 2007, $695,000 of deferred tax assets did not satisfy the recognition criteria set forth inSFAS 109. Accordingly, a valuation allowance has been recorded for these amounts. This valuation allowance primarily relates to the uncertainty of realizing certain state86Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)net operating loss carryforwards. In the future, if we determine that the realization of the net operating losses is more likely than not, the reversal of the related valuationallowance will reduce the provision for income taxes.During 2008, $7.4 million of net deferred tax assets were established with a corresponding reduction to goodwill for certain acquired intangible assets in connection withthe 2007 purchase of Mercy CarePlus. Additionally during 2008, $2.2 million of deferred tax assets relating to the 2006 purchase of the Cape Health Plan were derecognizedwhich resulted in a corresponding increase to goodwill under purchase accounting.Accruals for uncertain tax positions are provided for in accordance with the requirements of FIN 48. Pursuant to FIN 48, tax benefits are recognized only if the taxposition is “more likely than not” of being sustained. We are subject to income taxes in the U.S. and numerous state jurisdictions. Significant judgment is required in evaluatingour tax positions and determining our provision for income taxes. During the ordinary course of business, there are many transactions and calculations for which the ultimate taxdetermination is uncertain. We establish reserves for tax-related uncertainties based on estimates of whether, and the extent to which, additional taxes will be due. Thesereserves are established when we believe that certain positions might be challenged despite our belief that our tax return positions are fully supportable. We adjust these reservesin light of changing facts and circumstances, such as the outcome of tax audit. The provision for income taxes includes the impact of reserve provisions and changes to reservesthat are considered appropriate.The roll forward of our unrecognized tax benefits is as follows (in thousands):Gross unrecognized tax benefits at December 31, 2007 $ (10,278)Increases in tax positions for prior years (3,310)Decreases in tax positions for prior years 2,682Increases in tax positions for current year (2,061)Decreases in tax positions for current year 892Settlements —Lapse in statute of limitations 399Gross unrecognized tax benefits at December 31, 2008 $ (11,676)As of December 31, 2008, we had $11.7 million of unrecognized tax benefits of which $5.8 million, if fully recognized, would affect our effective tax rate. We anticipatea decrease of $165,000 to our liability for unrecognized tax benefits within the next twelve-month period due to normal expiration of tax statutes.Our continuing practice is to recognize interest and/or penalties related to unrecognized tax benefits in income tax expense. As of December 31, 2008, and December 31,2007, we had accrued $1.4 million and $638,000, respectively, for the payment of interest and penalties.We are under examination, or may be subject to examination, by the Internal Revenue Service (“IRS”) for calendar years 2005 through 2008. We are under examination,or may be subject to examination, in certain state and local jurisdictions, with the major jurisdictions being California, Missouri, and Michigan, for the years 2004 through 2008.Our subsidiary, HCLB, is being examined by the IRS for the year ended May 2006. The IRS has issued a notice of proposed adjustment to decrease HCLB’s compensationdeductions and related tax loss for the year ended May 2006 by approximately $16 million. If sustained, the reduction in the tax loss would increase taxes payable by$5.4 million. Management disagrees with the IRS assessment and believes that adequate accruals have been provided for the HCLB examination.13. Employee BenefitsWe sponsor a defined contribution 401(k) plan that covers substantially all full-time salaried and hourly employees of our company and its subsidiaries. Eligibleemployees are permitted to contribute up to the maximum amount allowed by law. We match up to the first 4% of compensation contributed by employees. Expense87Table of ContentsMOLINA HEALTHCARE, INC.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)recognized in connection with our contributions to the 401(k) plan totaled $3.9 million, $3.6 million and $2.5 million in the years ended December 31, 2008, 2007, and 2006,respectively.We also have a nonqualified deferred compensation plan for certain key employees. Under this plan, eligible participants may defer up to 100% of their base salary and100% of their bonus to provide tax-deferred growth for retirement. The funds deferred are invested in corporate-owned life insurance, under a rabbi trust.14. Related Party TransactionsWe have an equity investment in a medical service provider that provides certain vision services to our members. We account for this investment under the equitymethod of accounting because we have an ownership interest in the investee that provides us with significant influence over operating and financial policies of the investee. Asof December 31, 2008 and 2007, our carrying amount for this investment totaled $3.6 million and $3.5 million, respectively. During 2007, we paid this provider a $0.9 millionnetwork access fee that was fully amortized as of June 30, 2008. During 2008, we advanced this provider $1.3 million, of which $417,000 remained outstanding as ofDecember 31, 2008. We expect to collect this outstanding advance in the first quarter of 2009. For the years ended December 31, 2008, 2007 and 2006, we paid $15.4 million,http://sec.gov/Archives/edgar/data/1179929/000095013409005437/a51362e10vk.htm[1/6/2012 11:14:47 AM]