- Page 1 and 2:

LIPPO-MAPLETREEINDONESIA RETAIL TRU

- Page 3 and 4:

Metropolis Town SquareMall WTC Mata

- Page 5 and 6:

KeyInvestmentHighlightsStrong acqui

- Page 7 and 8:

Locked-in master leases with rental

- Page 9 and 10:

1. Mall WTC Matahari UnitsRetail Sp

- Page 11 and 12:

Notice to investorsNo person is aut

- Page 13 and 14:

Forward-looking statementsCertain s

- Page 15 and 16:

Market and industry informationThis

- Page 17 and 18:

SummaryThe following summary is qua

- Page 19 and 20:

a right of first refusal (the “RO

- Page 21 and 22:

• The management of all the Retai

- Page 23 and 24:

information was extracted are based

- Page 25 and 26:

2006. It is estimated that the urba

- Page 27 and 28:

Further, the Retail Malls are manag

- Page 29 and 30:

Key Information on the PropertiesA

- Page 31 and 32:

Location of the Properties in Indon

- Page 33 and 34:

INFORMATION ON THE PROPERTIESThe Re

- Page 35 and 36:

Pictures of Gajah Mada Plaza19

- Page 37 and 38:

Percentage of contribution to LMIRT

- Page 39 and 40:

Number of tenants as at 30 June2007

- Page 41 and 42:

Car parking lots . . . . . . . . .

- Page 43 and 44:

Occupancy rate as at 30 June 2007.

- Page 45 and 46:

Year of building completion . . . .

- Page 47 and 48:

NLA as at 30 June 2007 . . . . . .

- Page 49 and 50:

Year of building completion . . . .

- Page 51 and 52:

Appraised value by Knight Frank as

- Page 53 and 54:

NPI for Forecast Period 2007,Projec

- Page 55 and 56:

Note:(1) Based on Strata Titles Own

- Page 57 and 58:

Note:(1) Based on Kiosks Sale and P

- Page 59 and 60:

Appraised value by Colliers as at30

- Page 61 and 62:

Percentage of contribution to LMIRT

- Page 63 and 64: Notes:(1) These 14 Singapore SPCs (

- Page 65 and 66: (See “Strategy—Capital and Risk

- Page 67 and 68: Operating Companies: PT Multi Nusan

- Page 69 and 70: Payable by LMIR Trust(c) Any other

- Page 71 and 72: The offeringLMIR Trust . . . . . .

- Page 73 and 74: Lock-ups . . . . . . . . . . . . .

- Page 75 and 76: Listing and Trading . . . . . . . .

- Page 77 and 78: Singapore are made in accordance wi

- Page 79 and 80: Forecast Period2007Projection Year2

- Page 81 and 82: Risk factorsProspective investors s

- Page 83 and 84: Risk factorssimilar tenancy terms.

- Page 85 and 86: Risk factors• losses arising from

- Page 87 and 88: Risk factorsacquisitions is limited

- Page 89 and 90: Risk factorsafter the proposed plan

- Page 91 and 92: Risk factorsIf the tenure of the un

- Page 93 and 94: Risk factorsThe Properties may be s

- Page 95 and 96: Risk factorsRenovation work or phys

- Page 97 and 98: Risk factorsSuch compulsory acquisi

- Page 99 and 100: Risk factorsthereby materially and

- Page 101 and 102: Risk factorsinterpretation by the I

- Page 103 and 104: Risk factors• broad market fluctu

- Page 105 and 106: Ownership of UnitsPRINCIPAL UNITHOL

- Page 107 and 108: DistributionsThe distributable inco

- Page 109 and 110: Exchange rates and exchange control

- Page 111 and 112: CapitalisationThe following table s

- Page 113: Unaudited pro forma consolidated ba

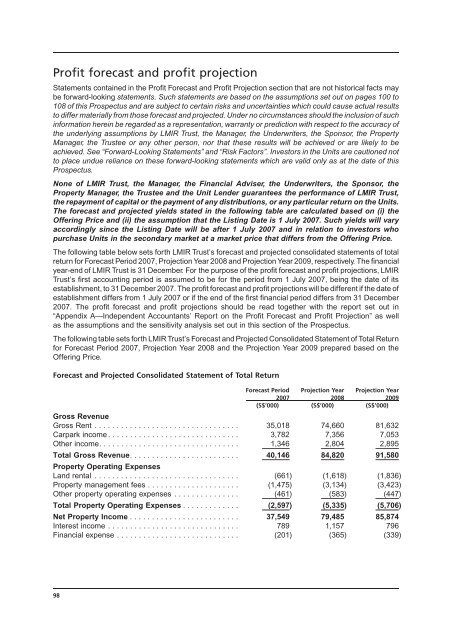

- Page 117 and 118: Profit forecast and profit projecti

- Page 119 and 120: Profit forecast and profit projecti

- Page 121 and 122: Profit forecast and profit projecti

- Page 123 and 124: Profit forecast and profit projecti

- Page 125 and 126: Profit forecast and profit projecti

- Page 127 and 128: Profit forecast and profit projecti

- Page 129 and 130: StrategyDate, to the extent that LM

- Page 131 and 132: StrategyGiven that there is limited

- Page 133 and 134: Strategyterm funding in a more cost

- Page 135 and 136: Business and propertiesIn addition,

- Page 137 and 138: Business and propertiestheir daily

- Page 139 and 140: Business and propertiesValuationEac

- Page 141 and 142: Business and propertiesThe followin

- Page 143 and 144: Business and propertiesINFORMATION

- Page 145 and 146: Business and propertiesother strata

- Page 147 and 148: Business and propertiesBecause of t

- Page 149 and 150: Business and propertieswell-known c

- Page 151 and 152: Business and propertiesThe largest

- Page 153 and 154: Business and properties“Overview

- Page 155 and 156: Business and properties200 sq m and

- Page 157 and 158: Business and properties• Mal Cima

- Page 159 and 160: Business and propertiesTHE PLAZA SE

- Page 161 and 162: Business and propertiesThe table be

- Page 163 and 164: Business and properties• Epicentr

- Page 165 and 166:

Business and propertiesMAL LIPPO CI

- Page 167 and 168:

Business and propertiesThe table be

- Page 169 and 170:

Business and propertiesPercentage o

- Page 171 and 172:

Business and propertiesfloor. The o

- Page 173 and 174:

Business and properties• Pangrang

- Page 175 and 176:

Business and propertiesBANDUNG INDA

- Page 177 and 178:

Business and propertiesThe table be

- Page 179 and 180:

Business and propertiesAmendment to

- Page 181 and 182:

Business and propertiesISTANA PLAZA

- Page 183 and 184:

Business and propertiesThe table be

- Page 185 and 186:

Business and propertiesThe Istana P

- Page 187 and 188:

Business and propertiesRelevant inf

- Page 189 and 190:

Business and propertiesRelevant inf

- Page 191 and 192:

Business and propertiesRelevant inf

- Page 193 and 194:

Business and propertiesAppraised va

- Page 195 and 196:

Business and propertiesRelevant inf

- Page 197 and 198:

Business and propertiesRelevant inf

- Page 199 and 200:

Business and propertiesRelevant inf

- Page 201 and 202:

Business and propertiesDescriptionP

- Page 203 and 204:

Business and propertiesSun PlazaMed

- Page 205 and 206:

The Manager and corporate governanc

- Page 207 and 208:

The Manager and corporate governanc

- Page 209 and 210:

The Manager and corporate governanc

- Page 211 and 212:

The Manager and corporate governanc

- Page 213 and 214:

The Manager and corporate governanc

- Page 215 and 216:

The Manager and corporate governanc

- Page 217 and 218:

The Manager and corporate governanc

- Page 219 and 220:

The Manager and corporate governanc

- Page 221 and 222:

The Manager and corporate governanc

- Page 223 and 224:

The Manager and corporate governanc

- Page 225 and 226:

The SponsorThe business structure o

- Page 227 and 228:

The Sponsorshopping, entertainment

- Page 229 and 230:

The SponsorKEY SHAREHOLDERS OF THE

- Page 231 and 232:

The formation and structure of LMIR

- Page 233 and 234:

The formation and structure of LMIR

- Page 235 and 236:

The formation and structure of LMIR

- Page 237 and 238:

The formation and structure of LMIR

- Page 239 and 240:

Certain agreements relating to LMIR

- Page 241 and 242:

Certain agreements relating to LMIR

- Page 243 and 244:

Certain agreements relating to LMIR

- Page 245 and 246:

Certain agreements relating to LMIR

- Page 247 and 248:

Certain agreements relating to LMIR

- Page 249 and 250:

Certain agreements relating to LMIR

- Page 251 and 252:

Certain agreements relating to LMIR

- Page 253 and 254:

Certain agreements relating to LMIR

- Page 255 and 256:

Certain agreements relating to LMIR

- Page 257 and 258:

Overview of relevant laws and regul

- Page 259 and 260:

Overview of relevant laws and regul

- Page 261 and 262:

Overview of relevant laws and regul

- Page 263 and 264:

Overview of relevant laws and regul

- Page 265 and 266:

TaxationSINGAPORE TAX IMPLICATIONST

- Page 267 and 268:

Taxationbe applied to reduce the co

- Page 269 and 270:

TaxationOn the rental payments to t

- Page 271 and 272:

Plan of distributionThe Manager is

- Page 273 and 274:

Plan of distributionThe restriction

- Page 275 and 276:

Plan of distributionNote:(1) Includ

- Page 277 and 278:

Plan of distributionArticle 31, sec

- Page 279 and 280:

Plan of distributionUnited States o

- Page 281 and 282:

Clearance and settlementINTRODUCTIO

- Page 283 and 284:

General information(1) The profit f

- Page 285 and 286:

General information(f)(g)(h)Rule 74

- Page 287 and 288:

Glossary% Per centum or percentageA

- Page 289 and 290:

GlossaryColliersColliers Internatio

- Page 291 and 292:

GlossaryIndonesian SPCsInterested P

- Page 293 and 294:

GlossaryNPIOCBC BankNet property in

- Page 295 and 296:

GlossaryRetail Space Singapore SPCs

- Page 297 and 298:

GlossaryUnit Lending AgreementUnit

- Page 299 and 300:

Appendix AINDEPENDENT ACCOUNTANTS

- Page 301 and 302:

Appendix BINDEPENDENT ACCOUNTANTS

- Page 303 and 304:

Appendix BLIPPO-MAPLETREE INDONESIA

- Page 305 and 306:

Appendix BPro Forma Consolidated Ba

- Page 307 and 308:

Appendix B(D)Pro Forma Consolidated

- Page 309 and 310:

Appendix B(x)(xi)(xii)(xiii)(xiv)S$

- Page 311 and 312:

Appendix BCash and cash equivalents

- Page 313 and 314:

Appendix BLeased assets—Leases in

- Page 315 and 316:

Appendix Btemporary difference; and

- Page 317 and 318:

Appendix B• The Trustee, the Mana

- Page 319 and 320:

Appendix BDeferred income represent

- Page 321 and 322:

Appendix Bfinancial year exceeds th

- Page 323 and 324:

Appendix Bprice is to be negotiated

- Page 325 and 326:

Appendix B4. Bandung Indah PlazaPT

- Page 327 and 328:

Appendix CINDEPENDENT SINGAPORE TAX

- Page 329 and 330:

Appendix CGains on disposal of shar

- Page 331 and 332:

Appendix CDisposal of UnitsSingapor

- Page 333 and 334:

Appendix DINDEPENDENT INDONESIAN TA

- Page 335 and 336:

Appendix DD-3

- Page 337 and 338:

Appendix DD-5

- Page 339 and 340:

Appendix DD-7

- Page 341 and 342:

Appendix EINDEPENDENT PROPERTY VALU

- Page 343 and 344:

Appendix EReport No.017/WPA-Report/

- Page 345 and 346:

Appendix EReport No.017/WPA-Report/

- Page 347 and 348:

Appendix EReport No.017/WPA-Report/

- Page 349 and 350:

Appendix EReport No.017/WPA-Report/

- Page 351 and 352:

Appendix EReport No.017/WPA-Report/

- Page 353 and 354:

Appendix EReport No.017/WPA-Report/

- Page 355 and 356:

Appendix EReport No.017/WPA-Report/

- Page 357 and 358:

Appendix EReport No.017/WPA-Report/

- Page 359 and 360:

Appendix EReport No.017/WPA-Report/

- Page 361 and 362:

Appendix EReport No.017/WPA-Report/

- Page 363 and 364:

Appendix EReport No.017/WPA-Report/

- Page 365 and 366:

Appendix EReport No.017/WPA-Report/

- Page 367 and 368:

Appendix EReport No.017/WPA-Report/

- Page 369 and 370:

Appendix EReport No.017/WPA-Report/

- Page 371 and 372:

Appendix EReport No.017/WPA-Report/

- Page 373 and 374:

Appendix EReport No.017/WPA-Report/

- Page 375 and 376:

Appendix EReport No.017/WPA-Report/

- Page 377 and 378:

Appendix ERef. No: V/2006/PKG/3819

- Page 379 and 380:

Appendix EVALUATION CERTIFICATEProp

- Page 381 and 382:

Appendix EVALUATION CERTIFICATEProp

- Page 383 and 384:

Appendix EVALUATION CERTIFICATEProp

- Page 385 and 386:

Appendix EVALUATION CERTIFICATEProp

- Page 387 and 388:

Appendix EVALUATION CERTIFICATEProp

- Page 389 and 390:

Appendix EVALUATION CERTIFICATEProp

- Page 391 and 392:

Appendix EVALUATION CERTIFICATEProp

- Page 393 and 394:

Appendix EVALUATION CERTIFICATEProp

- Page 395 and 396:

Appendix EVALUATION CERTIFICATEProp

- Page 397 and 398:

Appendix EVALUATION CERTIFICATEProp

- Page 399 and 400:

Appendix EPropertiesLandarea (m 2 )

- Page 401 and 402:

Appendix EADDENDUM—STATEMENT OF A

- Page 403 and 404:

Appendix FINDEPENDENT REPORT ON THE

- Page 405 and 406:

TABLE OF CONTENTSREPORT INSTRUCTION

- Page 407 and 408:

Report instructionsAbout Jones Lang

- Page 409 and 410:

Executive summaryIMPLICATIONS FOR R

- Page 411 and 412:

Overview of Indonesia and its Econo

- Page 413 and 414:

Overview of Indonesia and its Econo

- Page 415 and 416:

Overview of Indonesia and its Econo

- Page 417 and 418:

Overview of Indonesia and its Econo

- Page 419 and 420:

Overview of Indonesia and its Econo

- Page 421 and 422:

Overview of Indonesia and its Econo

- Page 423 and 424:

Overview of Indonesia and its Econo

- Page 425 and 426:

Retail Market OverviewTable 2.1.1 I

- Page 427 and 428:

Retail Market Overview2.3 Changing

- Page 429 and 430:

Retail Market Overviewretailers hav

- Page 431 and 432:

Retail Market OverviewCompletionyea

- Page 433 and 434:

Retail Market Overview2.7.5 Carrefo

- Page 435 and 436:

Retail Market OverviewIn view of th

- Page 437 and 438:

Overview of PortfolioAs the adminis

- Page 439 and 440:

Overview of PortfolioFigure 3.1.4:

- Page 441 and 442:

Overview of PortfolioFigure 3.2.2 B

- Page 443 and 444:

Overview of PortfolioFigure 3.2.4 S

- Page 445 and 446:

Overview of PortfolioFigure 3.2.6 M

- Page 447 and 448:

Overview of PortfolioFigure 3.3.1 L

- Page 449 and 450:

Overview of PortfolioMall WTC Matah

- Page 451 and 452:

Leased MallsFigure 4.1.1 Cibubur Ju

- Page 453 and 454:

Leased MallsTable 4.1.3 Major tenan

- Page 455 and 456:

Leased MallsTable 4.1.4 Cibubur Jun

- Page 457 and 458:

Leased Malls4.1.7 SWOT analysisTabl

- Page 459 and 460:

Leased Malls4.2 Plaza Semanggi4.2.1

- Page 461 and 462:

Leased Mallsnumber of international

- Page 463 and 464:

Leased MallsTaking the survey and t

- Page 465 and 466:

Leased Malls• There are two major

- Page 467 and 468:

Leased Malls4.2.7 SWOT analysisTabl

- Page 469 and 470:

Leased Mallsterms of its very promi

- Page 471 and 472:

Leased MallsFigure 4.3.2 Bandung In

- Page 473 and 474:

Leased Malls• In terms of reasons

- Page 475 and 476:

Leased Mallsand approximately 38,00

- Page 477 and 478:

Leased MallsWhile BIP is likely to

- Page 479 and 480:

Leased MallsFigure 4.4.2 Istana Pla

- Page 481 and 482:

Leased Malls• The main reason sta

- Page 483 and 484:

Leased Malls• Cihampelas Walk is

- Page 485 and 486:

Leased MallsFigure 4.4.4: Istana Pl

- Page 487 and 488:

Leased MallsOn the completion of th

- Page 489 and 490:

Leased MallsThe target market for M

- Page 491 and 492:

Leased MallsThe current Hypermart e

- Page 493 and 494:

Leased MallsFigure 4.6.2 Gajah Mada

- Page 495 and 496:

Leased Malls• Of all the malls in

- Page 497 and 498:

Leased Mallshypermart. The centre a

- Page 499 and 500:

Leased Malls4.6.7 SWOT analysisTabl

- Page 501 and 502:

Leased MallsTable 4.6.7: Rental pos

- Page 503 and 504:

Leased Malls4.7.3 Tenant mixThe cur

- Page 505 and 506:

Leased Mallsprimarily the city of B

- Page 507 and 508:

Leased MallsTable 4.7.5: Main compe

- Page 509 and 510:

Retail Spaces Malls5. RETAIL SPACES

- Page 511 and 512:

Retail Spaces MallsIn addition, loc

- Page 513 and 514:

Retail Spaces MallsThe store target

- Page 515 and 516:

Retail Spaces MallsTable 5.3.1: Cen

- Page 517 and 518:

Retail Spaces MallsFigure 5.3.3: Gr

- Page 519 and 520:

Retail Spaces MallsThis relatively

- Page 521 and 522:

Retail Spaces MallsStrata title sho

- Page 523 and 524:

Retail Spaces MallsMadiun are locat

- Page 525 and 526:

Retail Spaces MallsFigure 5.6.3 Pla

- Page 527 and 528:

Retail Spaces MallsThe centre has t

- Page 529 and 530:

Appendix GTERMS, CONDITIONS AND PRO

- Page 531 and 532:

Appendix G(15) The Manager reserves

- Page 533 and 534:

Appendix GAdditional Terms and Cond

- Page 535 and 536:

Appendix G(10) By completing and de

- Page 537 and 538:

Appendix GAdditional Terms and Cond

- Page 539 and 540:

Appendix GWhere your Electronic App

- Page 541 and 542:

Appendix GApplication to the Manage

- Page 543 and 544:

Appendix GTerms and Conditions for

- Page 545 and 546:

Appendix HLIST OF PRESENT AND PAST

- Page 547 and 548:

Appendix H(6) Mr Tan Boon LeongCurr

- Page 549 and 550:

Appendix HCurrent DirectorshipsMapl

- Page 551 and 552:

Appendix HCurrent DirectorshipsMapl

- Page 553 and 554:

(This page intentionally left blank

- Page 555 and 556:

LIPPO-MAPLETREE INDONESIA RETAIL TR