The eligibility and enrollment rules for the U

The eligibility and enrollment rules for the U

The eligibility and enrollment rules for the U

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

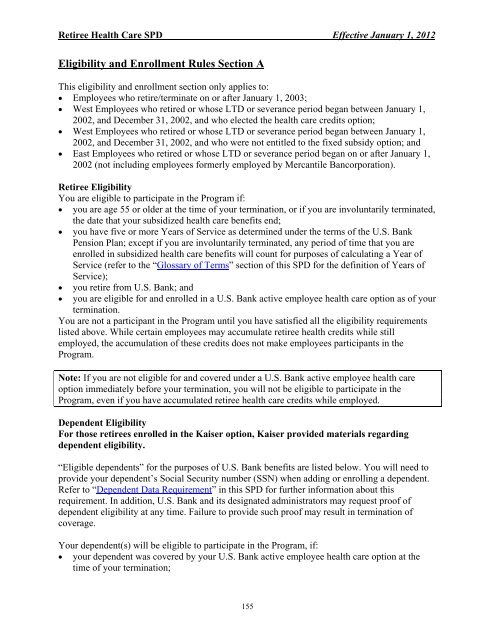

Retiree Health Care SPD Effective January 1, 2012<br />

Eligibility <strong>and</strong> Enrollment Rules Section A<br />

This <strong>eligibility</strong> <strong>and</strong> <strong>enrollment</strong> section only applies to:<br />

• Employees who retire/terminate on or after January 1, 2003;<br />

• West Employees who retired or whose LTD or severance period began between January 1,<br />

2002, <strong>and</strong> December 31, 2002, <strong>and</strong> who elected <strong>the</strong> health care credits option;<br />

• West Employees who retired or whose LTD or severance period began between January 1,<br />

2002, <strong>and</strong> December 31, 2002, <strong>and</strong> who were not entitled to <strong>the</strong> fixed subsidy option; <strong>and</strong><br />

• East Employees who retired or whose LTD or severance period began on or after January 1,<br />

2002 (not including employees <strong>for</strong>merly employed by Mercantile Bancorporation).<br />

Retiree Eligibility<br />

You are eligible to participate in <strong>the</strong> Program if:<br />

• you are age 55 or older at <strong>the</strong> time of your termination, or if you are involuntarily terminated,<br />

<strong>the</strong> date that your subsidized health care benefits end;<br />

• you have five or more Years of Service as determined under <strong>the</strong> terms of <strong>the</strong> U.S. Bank<br />

Pension Plan; except if you are involuntarily terminated, any period of time that you are<br />

enrolled in subsidized health care benefits will count <strong>for</strong> purposes of calculating a Year of<br />

Service (refer to <strong>the</strong> “Glossary of Terms” section of this SPD <strong>for</strong> <strong>the</strong> definition of Years of<br />

Service);<br />

• you retire from U.S. Bank; <strong>and</strong><br />

• you are eligible <strong>for</strong> <strong>and</strong> enrolled in a U.S. Bank active employee health care option as of your<br />

termination.<br />

You are not a participant in <strong>the</strong> Program until you have satisfied all <strong>the</strong> <strong>eligibility</strong> requirements<br />

listed above. While certain employees may accumulate retiree health credits while still<br />

employed, <strong>the</strong> accumulation of <strong>the</strong>se credits does not make employees participants in <strong>the</strong><br />

Program.<br />

Note: If you are not eligible <strong>for</strong> <strong>and</strong> covered under a U.S. Bank active employee health care<br />

option immediately be<strong>for</strong>e your termination, you will not be eligible to participate in <strong>the</strong><br />

Program, even if you have accumulated retiree health care credits while employed.<br />

Dependent Eligibility<br />

For those retirees enrolled in <strong>the</strong> Kaiser option, Kaiser provided materials regarding<br />

dependent <strong>eligibility</strong>.<br />

“Eligible dependents” <strong>for</strong> <strong>the</strong> purposes of U.S. Bank benefits are listed below. You will need to<br />

provide your dependent’s Social Security number (SSN) when adding or enrolling a dependent.<br />

Refer to “Dependent Data Requirement” in this SPD <strong>for</strong> fur<strong>the</strong>r in<strong>for</strong>mation about this<br />

requirement. In addition, U.S. Bank <strong>and</strong> its designated administrators may request proof of<br />

dependent <strong>eligibility</strong> at any time. Failure to provide such proof may result in termination of<br />

coverage.<br />

Your dependent(s) will be eligible to participate in <strong>the</strong> Program, if:<br />

• your dependent was covered by your U.S. Bank active employee health care option at <strong>the</strong><br />

time of your termination;<br />

155