The eligibility and enrollment rules for the U

The eligibility and enrollment rules for the U

The eligibility and enrollment rules for the U

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Retiree Health Care SPD Effective January 1, 2012<br />

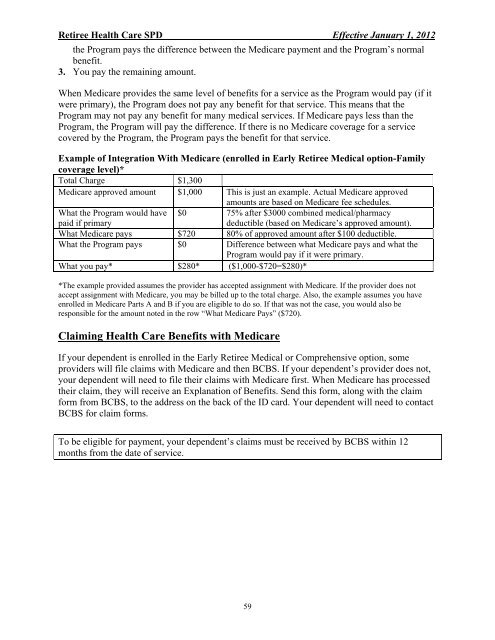

<strong>the</strong> Program pays <strong>the</strong> difference between <strong>the</strong> Medicare payment <strong>and</strong> <strong>the</strong> Program’s normal<br />

benefit.<br />

3. You pay <strong>the</strong> remaining amount.<br />

When Medicare provides <strong>the</strong> same level of benefits <strong>for</strong> a service as <strong>the</strong> Program would pay (if it<br />

were primary), <strong>the</strong> Program does not pay any benefit <strong>for</strong> that service. This means that <strong>the</strong><br />

Program may not pay any benefit <strong>for</strong> many medical services. If Medicare pays less than <strong>the</strong><br />

Program, <strong>the</strong> Program will pay <strong>the</strong> difference. If <strong>the</strong>re is no Medicare coverage <strong>for</strong> a service<br />

covered by <strong>the</strong> Program, <strong>the</strong> Program pays <strong>the</strong> benefit <strong>for</strong> that service.<br />

Example of Integration With Medicare (enrolled in Early Retiree Medical option-Family<br />

coverage level)*<br />

Total Charge $1,300<br />

Medicare approved amount $1,000 This is just an example. Actual Medicare approved<br />

amounts are based on Medicare fee schedules.<br />

What <strong>the</strong> Program would have $0 75% after $3000 combined medical/pharmacy<br />

paid if primary<br />

deductible (based on Medicare’s approved amount).<br />

What Medicare pays $720 80% of approved amount after $100 deductible.<br />

What <strong>the</strong> Program pays $0 Difference between what Medicare pays <strong>and</strong> what <strong>the</strong><br />

Program would pay if it were primary.<br />

What you pay* $280* ($1,000-$720=$280)*<br />

*<strong>The</strong> example provided assumes <strong>the</strong> provider has accepted assignment with Medicare. If <strong>the</strong> provider does not<br />

accept assignment with Medicare, you may be billed up to <strong>the</strong> total charge. Also, <strong>the</strong> example assumes you have<br />

enrolled in Medicare Parts A <strong>and</strong> B if you are eligible to do so. If that was not <strong>the</strong> case, you would also be<br />

responsible <strong>for</strong> <strong>the</strong> amount noted in <strong>the</strong> row “What Medicare Pays” ($720).<br />

Claiming Health Care Benefits with Medicare<br />

If your dependent is enrolled in <strong>the</strong> Early Retiree Medical or Comprehensive option, some<br />

providers will file claims with Medicare <strong>and</strong> <strong>the</strong>n BCBS. If your dependent’s provider does not,<br />

your dependent will need to file <strong>the</strong>ir claims with Medicare first. When Medicare has processed<br />

<strong>the</strong>ir claim, <strong>the</strong>y will receive an Explanation of Benefits. Send this <strong>for</strong>m, along with <strong>the</strong> claim<br />

<strong>for</strong>m from BCBS, to <strong>the</strong> address on <strong>the</strong> back of <strong>the</strong> ID card. Your dependent will need to contact<br />

BCBS <strong>for</strong> claim <strong>for</strong>ms.<br />

To be eligible <strong>for</strong> payment, your dependent’s claims must be received by BCBS within 12<br />

months from <strong>the</strong> date of service.<br />

59