Download Complete PDF - apctt

Download Complete PDF - apctt

Download Complete PDF - apctt

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

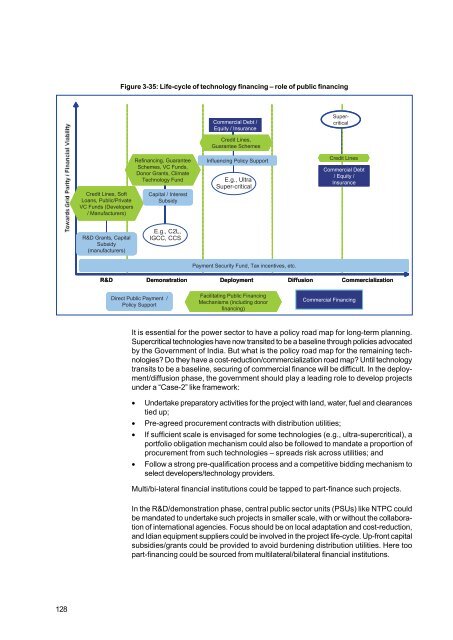

Figure 3-35: Life-cycle of technology financing – role of public financingCommercial Debt /Equity / InsuranceSupercriticalRefinancing, GuaranteeSchemes, VC Funds,Donor Grants, ClimateTechnology FundCredit Lines, SoftCapital / InterestLoans, Public/PrivateSubsidyVC Funds (Developers/ Manufacturers)Credit Lines,Guarantee SchemesInfluencing Policy SupportE.g., UltraSuper-criticalCredit LinesCommercial Debt/ Equity /InsuranceR&D Grants, CapitalSubsidy(manufacturers)E.g., C2L,IGCC, CCSPayment Security Fund, Tax incentives, etc.R&D Demonstration Deployment Diffusion CommercializationDirect Public Payment /Policy SupportFacilitating Public FinancingMechanisms (including donorfinancing)Commercial FinancingIt is essential for the power sector to have a policy road map for long-term planning.Supercritical technologies have now transited to be a baseline through policies advocatedby the Government of India. But what is the policy road map for the remaining technologies?Do they have a cost-reduction/commercialization road map? Until technologytransits to be a baseline, securing of commercial finance will be difficult. In the deployment/diffusionphase, the government should play a leading role to develop projectsunder a “Case-2” like framework:• Undertake preparatory activities for the project with land, water, fuel and clearancestied up;• Pre-agreed procurement contracts with distribution utilities;• If sufficient scale is envisaged for some technologies (e.g., ultra-supercritical), aportfolio obligation mechanism could also be followed to mandate a proportion ofprocurement from such technologies – spreads risk across utilities; and• Follow a strong pre-qualification process and a competitive bidding mechanism toselect developers/technology providers.Multi/bi-lateral financial institutions could be tapped to part-finance such projects.In the R&D/demonstration phase, central public sector units (PSUs) like NTPC couldbe mandated to undertake such projects in smaller scale, with or without the collaborationof international agencies. Focus should be on local adaptation and cost-reduction,and Idian equipment suppliers could be involved in the project life-cycle. Up-front capitalsubsidies/grants could be provided to avoid burdening distribution utilities. Here toopart-financing could be sourced from multilateral/bilateral financial institutions.128