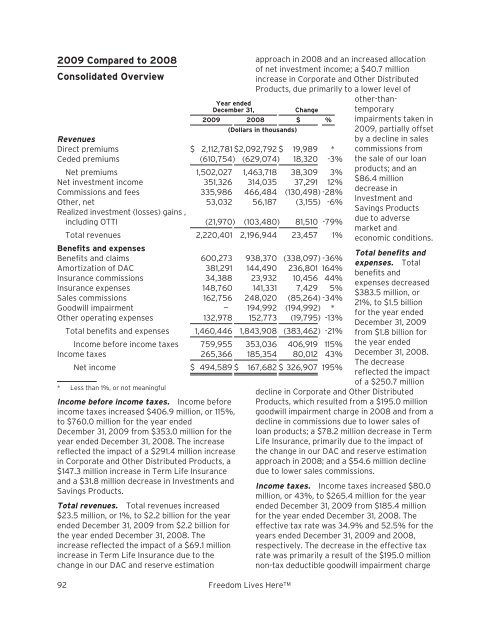

2009 Compared to 2008Consolidated OverviewYear endedDecember 31,Change2009 2008 $ %(Dollars in thousands)Revenues<strong>Direct</strong> premiums $ 2,112,781 $2,092,792 $ 19,989 *Ceded premiums (610,754) (629,074) 18,320 -3%Net premiums 1,502,027 1,463,718 38,309 3%Net investment income 351,326 314,035 37,291 12%Commissions and fees 335,986 466,484 (130,498) -28%Other, net 53,032 56,187 (3,155) -6%Realized investment (losses) gains ,including OTTI (21,970) (103,480) 81,510 -79%Total revenues 2,220,401 2,196,944 23,457 1%Benefits and expensesBenefits and claims 600,273 938,370 (338,097) -36%Amortization of DAC 381,291 144,490 236,801 164%Insurance commissions 34,388 23,932 10,456 44%Insurance expenses 148,760 141,331 7,429 5%Sales commissions 162,756 248,020 (85,264) -34%Goodwill impairment — 194,992 (194,992) *Other operating expenses 132,978 152,773 (19,795) -13%Total benefits and expenses 1,460,446 1,843,908 (383,462) -21%Income before income taxes 759,955 353,036 406,919 115%Income taxes 265,366 185,354 80,012 43%Net income $ 494,589 $ 167,682 $ 326,907 195%* Less than 1%, or not meaningfulIncome before income taxes. Income beforeincome taxes increased $406.9 million, or 115%,to $760.0 million for the year endedDecember 31, 2009 from $353.0 million for theyear ended December 31, 2008. The increasereflected the impact of a $291.4 million increasein Corporate and Other Distributed Products, a$147.3 million increase in Term Life Insuranceand a $31.8 million decrease in Investments andSavings Products.Total revenues. Total revenues increased$23.5 million, or 1%, to $2.2 billion for the yearended December 31, 2009 from $2.2 billion forthe year ended December 31, 2008. Theincrease reflected the impact of a $69.1 millionincrease in Term Life Insurance due to thechange in our DAC and reserve estimation92 Freedom Lives Here TMapproach in 2008 and an increased allocationof net investment income; a $40.7 millionincrease in Corporate and Other DistributedProducts, due primarily to a lower level ofother-thantemporaryimpairments taken in2009, partially offsetby a decline in salescommissions fromthe sale of our loanproducts; and an$86.4 milliondecrease inInvestment andSavings Productsdue to adversemarket andeconomic conditions.Total benefits andexpenses. Totalbenefits andexpenses decreased$383.5 million, or21%, to $1.5 billionfor the year endedDecember 31, 2009from $1.8 billion forthe year endedDecember 31, 2008.The decreasereflected the impactof a $250.7 milliondecline in Corporate and Other DistributedProducts, which resulted from a $195.0 milliongoodwill impairment charge in 2008 and from adecline in commissions due to lower sales ofloan products; a $78.2 million decrease in TermLife Insurance, primarily due to the impact ofthe change in our DAC and reserve estimationapproach in 2008; and a $54.6 million declinedue to lower sales commissions.Income taxes. Income taxes increased $80.0million, or 43%, to $265.4 million for the yearended December 31, 2009 from $185.4 millionfor the year ended December 31, 2008. Theeffective tax rate was 34.9% and 52.5% for theyears ended December 31, 2009 and 2008,respectively. The decrease in the effective taxrate was primarily a result of the $195.0 millionnon-tax deductible goodwill impairment charge

ecognized in 2008. Excluding the effect of thegoodwill impairment charge, the effective taxrate would have been 33.2% for the year endedDecember 31, 2008.Term Life Insurance SegmentYear endedDecember 31,Change2009 2008 $ %(Dollars in thousands)Revenues<strong>Direct</strong> premiums $2,030,988 $2,007,339 $ 23,649 1%Ceded premiums (596,791) (613,386) 16,595 -3%Net premiums 1,434,197 1,393,953 40,244 3%Allocated net investmentincome 274,212 244,736 29,476 12%Other, net 33,656 34,333 (677) -2%Total revenues 1,742,065 1,673,022 69,043 4%Benefits and expensesBenefits and claims 559,038 894,910 (335,872) -38%Amortization of DAC 371,663 131,286 240,377 183%Acquisition and operatingexpenses, net of deferrals 152,352 135,007 17,345 13%Total benefits andexpenses 1,083,053 1,161,203 (78,150) -7%Segment income beforeincome taxes $ 659,012 $ 511,819 $ 147,193 29%Our Term Life Insurance results set forth abovefor the year ended December 31, 2009 are notdirectly comparable to results for the yearended December 31, 2008 due to a change inour DAC and reserve estimation approachimplemented in the fourth quarter of 2008. Theimpact of this change on our Term LifeInsurance results for the year endedDecember 31, 2009 is illustrated in the tablebelow:Actualyear-to-year changeAdjustment forchange in DACand reserveestimationapproachYear-to-year change(Before change in DACand reserve estimationapproach)$ % $ $ %(Dollars in thousands)<strong>Direct</strong> premiums $ 23,649 1% $ (6,870) $ 30,519 2%Ceded premiums $ 16,595 -3% $ 57,810 $ (41,215) -7%Benefits and claims $(335,872) -38% $(328,258) $ (7,614) *Amortization of DAC $ 240,377 183% $ 179,391 $ 60,986 46%Acquisition and operating expenses, net ofdeferrals $ 17,345 13% $ 8,088 $ 9,257 7%Segment income before income taxes $ 147,193 29% $ 191,718 $(44,525) -9%* Less than 1%<strong>Primerica</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong> 93

- Page 1 and 2:

Freedom Lives Here 2010 Annual Repo

- Page 3 and 4:

A Main Street Company for Main Stre

- Page 5 and 6:

North America’s vastmiddle-income

- Page 7 and 8:

More than 50 percent of U.S. househ

- Page 9 and 10:

We are PrimericaPrimerica is a Main

- Page 11 and 12:

Primerica helps familiescreate a fi

- Page 13 and 14:

René Turner wasalways told growing

- Page 15 and 16:

We teach people how money works.We

- Page 19 and 20:

UNITED STATESSECURITIES AND EXCHANG

- Page 21 and 22:

CAUTIONARY STATEMENT CONCERNING FOR

- Page 23 and 24:

PART IITEM 1.BUSINESSOverviewPrimer

- Page 25 and 26:

them reduce and ultimately pay off

- Page 27 and 28:

With the support of our home office

- Page 29 and 30:

ecognized with the sales representa

- Page 31 and 32:

force. We also profile successful s

- Page 33 and 34:

• bonuses and other compensation,

- Page 35 and 36:

originators (and in some states as

- Page 37 and 38:

We organize and manage our business

- Page 39 and 40:

premiums that are less per person p

- Page 41 and 42:

insurance policies that we underwri

- Page 43 and 44:

assistance, has developed a series

- Page 45 and 46:

SEC, FINRA and with respect to 529

- Page 47 and 48:

they sell insurance policies. Our C

- Page 49 and 50:

preceding 12 months, exceed this st

- Page 51 and 52:

interest rate risk and business ris

- Page 53 and 54:

operational support to its subsidia

- Page 55 and 56:

Privacy of Consumer Information. U.

- Page 57 and 58:

media. This negative commentary can

- Page 59 and 60:

with such laws and regulations, inc

- Page 61 and 62: and disrupt the economy. Although w

- Page 63 and 64: Our financial strength and credit r

- Page 65 and 66: There are certain risks and uncerta

- Page 67 and 68: 26). The update revises the definit

- Page 69 and 70: conduct standards prescribed by FIN

- Page 71 and 72: licensing requirements have caused,

- Page 73 and 74: Terrorist Financing Act and its acc

- Page 75 and 76: educing dividends or other amounts

- Page 77 and 78: housed at our Duluth and Roswell, G

- Page 79 and 80: • for dates as of or periods endi

- Page 81 and 82: to and subject to the limitations o

- Page 83 and 84: Field Audit Department from 1993 to

- Page 85 and 86: Securities Authorized for Issuanceu

- Page 87 and 88: ITEM 6.SELECTED FINANCIAL DATA.The

- Page 89 and 90: pursuant to which we issued to a wh

- Page 91 and 92: ecruiting boost we experienced in t

- Page 93 and 94: • Mortality. We use historical ex

- Page 95 and 96: • sales of a higher proportion of

- Page 97 and 98: on quality rating, average life and

- Page 99 and 100: Deferred Policy Acquisition Costs(D

- Page 101 and 102: life insurance processing responsib

- Page 103 and 104: einsurance agreements impacted the

- Page 105 and 106: Notes to the Pro Forma Statement of

- Page 107 and 108: Term Life Insurance Segment ProForm

- Page 109 and 110: Investments and Savings ProductsSeg

- Page 111: We believe that the pro forma resul

- Page 115 and 116: amortize the higher DAC balance res

- Page 117 and 118: Corporate and Other DistributedProd

- Page 119 and 120: The composition of our invested ass

- Page 121 and 122: LIQUIDITY AND CAPITALRESOURCESDivid

- Page 123 and 124: surplus notes, hybrid securities or

- Page 125 and 126: ITEM 7A. QUANTITATIVE ANDQUALITATIV

- Page 127 and 128: AssetsPRIMERICA, INC. AND SUBSIDIAR

- Page 129 and 130: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 131 and 132: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 133 and 134: which we are able to reinvest at ou

- Page 135 and 136: with reinsured policies. Ceded poli

- Page 137 and 138: indemnify and hold the Company harm

- Page 139 and 140: New Accounting PrinciplesScope Exce

- Page 141 and 142: immediately contributed back to us

- Page 143 and 144: The Investment and Savings Products

- Page 145 and 146: (4) InvestmentsOn March 31, 2010, w

- Page 147 and 148: The following tables summarize, for

- Page 149 and 150: The net effect on stockholders’ e

- Page 151 and 152: The amortized cost and fair value o

- Page 153 and 154: The roll-forward of credit-related

- Page 155 and 156: having similar tenors (e.g., sector

- Page 157 and 158: (5) Financial InstrumentsThe carryi

- Page 159 and 160: Due from reinsurers includes ceded

- Page 161 and 162: (8) Intangible Assets and GoodwillT

- Page 163 and 164:

(11) Note PayableIn April 2010, we

- Page 165 and 166:

Income tax expense (benefit) attrib

- Page 167 and 168:

above, plus an additional 7,098 com

- Page 169 and 170:

Non-Employee Share-BasedTransaction

- Page 171 and 172:

We had arrangements with Citi in re

- Page 173 and 174:

Contingent LiabilitiesThe Company i

- Page 175 and 176:

ITEM 9. CHANGES IN ANDDISAGREEMENTS

- Page 177 and 178:

Members of Our Board of DirectorsTh

- Page 179 and 180:

finance, and risk and asset managem

- Page 181 and 182:

PART IVITEM 15. EXHIBITS AND FINANC

- Page 183 and 184:

10.4 Long-Term Services Agreement d

- Page 185 and 186:

10.29 Employment Agreement, dated a

- Page 187 and 188:

Schedule ISummary of Investments

- Page 189 and 190:

Schedule IICondensed Financial Info

- Page 191 and 192:

Schedule IICondensed Financial Info

- Page 193 and 194:

101% of the outstanding principal a

- Page 195 and 196:

GrossamountSchedule IVReinsurancePR

- Page 197 and 198:

Annual MeetingThe annual meeting of