Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

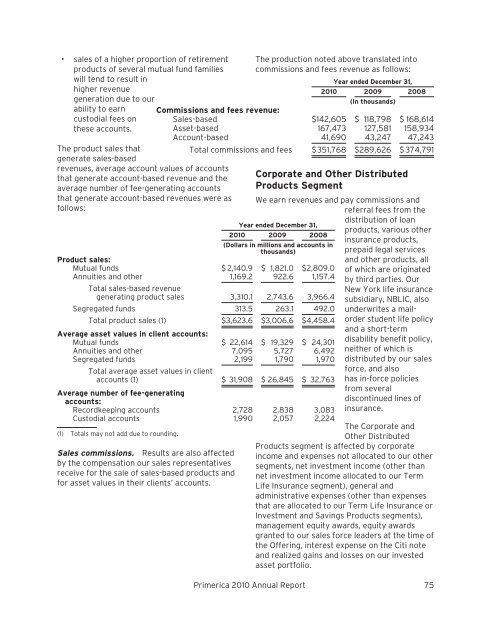

• sales of a higher proportion of retirementproducts of several mutual fund familieswill tend to result inhigher revenuegeneration due to ourability to earncustodial fees onthese accounts.The product sales thatgenerate sales-basedrevenues, average account values of accountsthat generate account-based revenue and theaverage number of fee-generating accountsthat generate account-based revenues were asfollows:Year ended December 31,<strong>2010</strong> 2009 2008(Dollars in millions and accounts inthousands)Product sales:Mutual funds $ 2,140.9 $ 1,821.0 $2,809.0Annuities and other 1,169.2 922.6 1,157.4Total sales-based revenuegenerating product sales 3,310.1 2,743.6 3,966.4Segregated funds 313.5 263.1 492.0Total product sales (1) $3,623.6 $3,006.6 $4,458.4Average asset values in client accounts:Mutual funds $ 22,614 $ 19,329 $ 24,301Annuities and other 7,095 5,727 6,492Segregated funds 2,199 1,790 1,970Total average asset values in clientaccounts (1) $ 31,908 $ 26,845 $ 32,763Average number of fee-generatingaccounts:Recordkeeping accounts 2,728 2,838 3,083Custodial accounts 1,990 2,057 2,224(1) Totals may not add due to rounding.Sales commissions. Results are also affectedby the compensation our sales representativesreceive for the sale of sales-based products andfor asset values in their clients’ accounts.The production noted above translated intocommissions and fees revenue as follows:Year ended December 31,<strong>2010</strong> 2009 2008(In thousands)Commissions and fees revenue:Sales-based $142,605 $ 118,798 $ 168,614Asset-based 167,473 127,581 158,934Account-based 41,690 43,247 47,243Total commissions and fees $351,768 $289,626 $ 374,791Corporate and Other DistributedProducts SegmentWe earn revenues and pay commissions andreferral fees from thedistribution of loanproducts, various otherinsurance products,prepaid legal servicesand other products, allof which are originatedby third parties. OurNew York life insurancesubsidiary, NBLIC, alsounderwrites a mailorderstudent life policyand a short-termdisability benefit policy,neither of which isdistributed by our salesforce, and alsohas in-force policiesfrom severaldiscontinued lines ofinsurance.The Corporate andOther DistributedProducts segment is affected by corporateincome and expenses not allocated to our othersegments, net investment income (other thannet investment income allocated to our TermLife Insurance segment), general andadministrative expenses (other than expensesthat are allocated to our Term Life Insurance orInvestment and Savings Products segments),management equity awards, equity awardsgranted to our sales force leaders at the time ofthe Offering, interest expense on the Citi noteand realized gains and losses on our investedasset portfolio.<strong>Primerica</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong> 75