Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

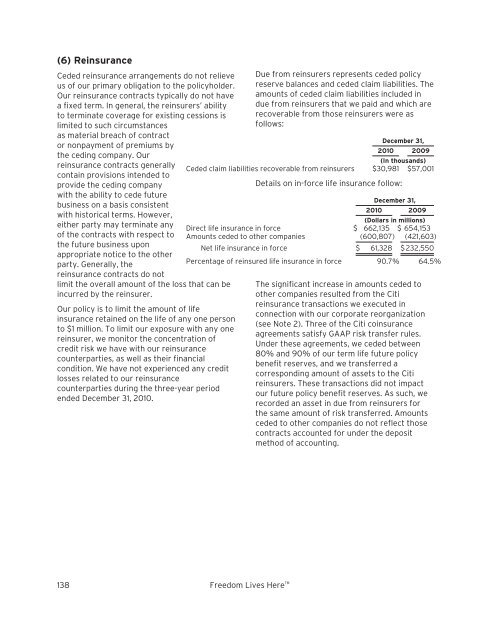

(6) ReinsuranceCeded reinsurance arrangements do not relieveus of our primary obligation to the policyholder.Our reinsurance contracts typically do not havea fixed term. In general, the reinsurers’ abilityto terminate coverage for existing cessions islimited to such circumstancesas material breach of contractor nonpayment of premiums bythe ceding company. Ourreinsurance contracts generallycontain provisions intended toprovide the ceding companywith the ability to cede futurebusiness on a basis consistentwith historical terms. However,either party may terminate anyof the contracts with respect tothe future business uponappropriate notice to the otherparty. Generally, thereinsurance contracts do notlimit the overall amount of the loss that can beincurred by the reinsurer.Our policy is to limit the amount of lifeinsurance retained on the life of any one personto $1 million. To limit our exposure with any onereinsurer, we monitor the concentration ofcredit risk we have with our reinsurancecounterparties, as well as their financialcondition. We have not experienced any creditlosses related to our reinsurancecounterparties during the three-year periodended December 31, <strong>2010</strong>.Due from reinsurers represents ceded policyreserve balances and ceded claim liabilities. Theamounts of ceded claim liabilities included indue from reinsurers that we paid and which arerecoverable from those reinsurers were asfollows:December 31,<strong>2010</strong> 2009(In thousands)Ceded claim liabilities recoverable from reinsurers $30,981 $57,001Details on in-force life insurance follow:December 31,<strong>2010</strong> 2009(Dollars in millions)<strong>Direct</strong> life insurance in force $ 662,135 $ 654,153Amounts ceded to other companies (600,807) (421,603)Net life insurance in force $ 61,328 $ 232,550Percentage of reinsured life insurance in force 90.7% 64.5%The significant increase in amounts ceded toother companies resulted from the Citireinsurance transactions we executed inconnection with our corporate reorganization(see Note 2). Three of the Citi coinsuranceagreements satisfy GAAP risk transfer rules.Under these agreements, we ceded between80% and 90% of our term life future policybenefit reserves, and we transferred acorresponding amount of assets to the Citireinsurers. These transactions did not impactour future policy benefit reserves. As such, werecorded an asset in due from reinsurers forthe same amount of risk transferred. Amountsceded to other companies do not reflect thosecontracts accounted for under the depositmethod of accounting.138 Freedom Lives Here