Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

Primerica 2010 Annual Report - Direct Selling News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

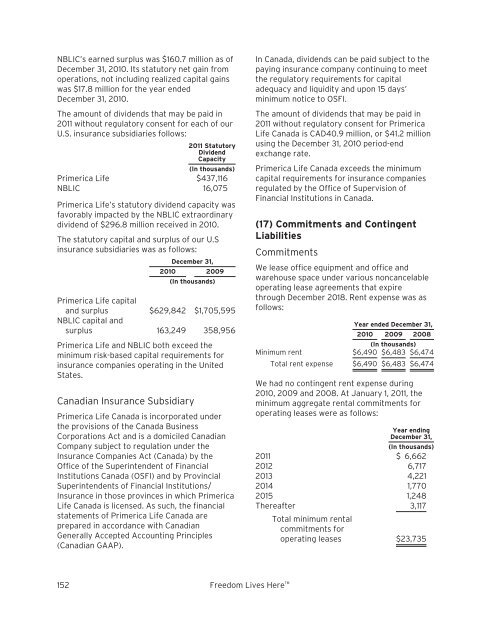

NBLIC’s earned surplus was $160.7 million as ofDecember 31, <strong>2010</strong>. Its statutory net gain fromoperations, not including realized capital gainswas $17.8 million for the year endedDecember 31, <strong>2010</strong>.The amount of dividends that may be paid in2011 without regulatory consent for each of ourU.S. insurance subsidiaries follows:2011 StatutoryDividendCapacity(In thousands)<strong>Primerica</strong> Life $437,116NBLIC 16,075<strong>Primerica</strong> Life’s statutory dividend capacity wasfavorably impacted by the NBLIC extraordinarydividend of $296.8 million received in <strong>2010</strong>.The statutory capital and surplus of our U.Sinsurance subsidiaries was as follows:December 31,<strong>2010</strong> 2009(In thousands)<strong>Primerica</strong> Life capitaland surplus $629,842 $1,705,595NBLIC capital andsurplus 163,249 358,956<strong>Primerica</strong> Life and NBLIC both exceed theminimum risk-based capital requirements forinsurance companies operating in the UnitedStates.Canadian Insurance Subsidiary<strong>Primerica</strong> Life Canada is incorporated underthe provisions of the Canada BusinessCorporations Act and is a domiciled CanadianCompany subject to regulation under theInsurance Companies Act (Canada) by theOffice of the Superintendent of FinancialInstitutions Canada (OSFI) and by ProvincialSuperintendents of Financial Institutions/Insurance in those provinces in which <strong>Primerica</strong>Life Canada is licensed. As such, the financialstatements of <strong>Primerica</strong> Life Canada areprepared in accordance with CanadianGenerally Accepted Accounting Principles(Canadian GAAP).In Canada, dividends can be paid subject to thepaying insurance company continuing to meetthe regulatory requirements for capitaladequacy and liquidity and upon 15 days’minimum notice to OSFI.The amount of dividends that may be paid in2011 without regulatory consent for <strong>Primerica</strong>Life Canada is CAD40.9 million, or $41.2 millionusing the December 31, <strong>2010</strong> period-endexchange rate.<strong>Primerica</strong> Life Canada exceeds the minimumcapital requirements for insurance companiesregulated by the Office of Supervision ofFinancial Institutions in Canada.(17) Commitments and ContingentLiabilitiesCommitmentsWe lease office equipment and office andwarehouse space under various noncancelableoperating lease agreements that expirethrough December 2018. Rent expense was asfollows:Year ended December 31,<strong>2010</strong> 2009 2008(In thousands)Minimum rent $6,490 $6,483 $6,474Total rent expense $6,490 $6,483 $6,474We had no contingent rent expense during<strong>2010</strong>, 2009 and 2008. At January 1, 2011, theminimum aggregate rental commitments foroperating leases were as follows:Year endingDecember 31,(In thousands)2011 $ 6,6622012 6,7172013 4,2212014 1,7702015 1,248Thereafter 3,117Total minimum rentalcommitments foroperating leases $23,735152 Freedom Lives Here