We use the specific-identification method todetermine the realized gains or losses fromsecurities transactions. The components of netrealized investment gains (losses) as well asdetails on gross realized investment gains andlosses and proceeds from sales or otherredemptions were as follows:Year ended December 31,<strong>2010</strong> 2009 2008(In thousands)Gross realized investment gains (losses):Gains from sales $ 47,925 $ 42,983 $ 12,933Losses from sales (2,257) (3,518) (2,546)Other-than-temporary impairments (12,158) (61,394) (114,022)Gains (losses) from derivatives 635 (41) 155Net realized investment gains (losses) $ 34,145 $ (21,970) $ (103,480)Gross realized investment gains (losses) reclassified fromaccumulated other comprehensive income $ 33,510 $ (21,929) $ (103,635)Proceeds from sales or other redemptions $1,543,976 $1,592,687 $1,453,956Other-Than-Temporary ImpairmentWe conduct a review each quarter to identifyand evaluate impaired investments that haveindications of possible other-than-temporaryimpairment (OTTI). An investment in a debt orequity security is impaired if its fair value fallsbelow its cost. Factors considered indetermining whether an unrealized loss istemporary include the length of time andextent to which fair value has been below cost,the financial condition and near-term prospectsfor the issuer, and our evaluation of our intentto sell the security prior to recovery of itsamortized cost, which may be maturity.Our review for other-than-temporaryimpairment generally entails:• Analysis of individual investments thathave fair values less than a pre-definedpercentage of amortized cost, includingconsideration of the length of time theinvestment has been in an unrealized lossposition;• Analysis of corporate bonds by reviewingthe issuer’s most recent performance todate, including analyst reviews, analystoutlooks and rating agency information;• Analysis of commercial mortgage-backedbonds based on the risk assessment ofeach security including performance todate, credit enhancement, risk analyticsand outlook, underlying collateral, lossprojections, rating agency information andavailable third-party reviews and analytics;• Analysis of residential mortgage-backedbonds based on loss projections providedby models compared to current creditenhancement levels;• Analysis of our other investments, asrequired based on the type of investment;and• Analysis of downward credit migrationsthat occurred during the quarter.130 Freedom Lives Here

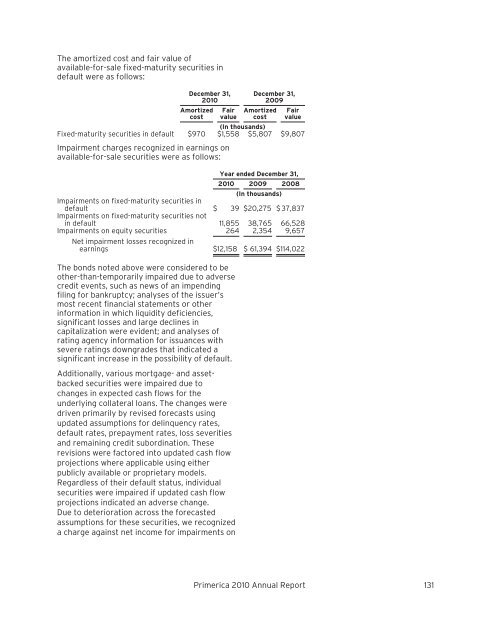

The amortized cost and fair value ofavailable-for-sale fixed-maturity securities indefault were as follows:December 31,<strong>2010</strong>AmortizedcostFairvalueDecember 31,2009AmortizedcostFairvalue(In thousands)Fixed-maturity securities in default $970 $1,558 $5,807 $9,807Impairment charges recognized in earnings onavailable-for-sale securities were as follows:Year ended December 31,<strong>2010</strong> 2009 2008(In thousands)Impairments on fixed-maturity securities indefault $ 39 $20,275 $ 37,837Impairments on fixed-maturity securities notin default 11,855 38,765 66,528Impairments on equity securities 264 2,354 9,657Net impairment losses recognized inearnings $12,158 $ 61,394 $114,022The bonds noted above were considered to beother-than-temporarily impaired due to adversecredit events, such as news of an impendingfiling for bankruptcy; analyses of the issuer’smost recent financial statements or otherinformation in which liquidity deficiencies,significant losses and large declines incapitalization were evident; and analyses ofrating agency information for issuances withsevere ratings downgrades that indicated asignificant increase in the possibility of default.Additionally, various mortgage- and assetbackedsecurities were impaired due tochanges in expected cash flows for theunderlying collateral loans. The changes weredriven primarily by revised forecasts usingupdated assumptions for delinquency rates,default rates, prepayment rates, loss severitiesand remaining credit subordination. Theserevisions were factored into updated cash flowprojections where applicable using eitherpublicly available or proprietary models.Regardless of their default status, individualsecurities were impaired if updated cash flowprojections indicated an adverse change.Due to deterioration across the forecastedassumptions for these securities, we recognizeda charge against net income for impairments on<strong>Primerica</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong> 131

- Page 1 and 2:

Freedom Lives Here 2010 Annual Repo

- Page 3 and 4:

A Main Street Company for Main Stre

- Page 5 and 6:

North America’s vastmiddle-income

- Page 7 and 8:

More than 50 percent of U.S. househ

- Page 9 and 10:

We are PrimericaPrimerica is a Main

- Page 11 and 12:

Primerica helps familiescreate a fi

- Page 13 and 14:

René Turner wasalways told growing

- Page 15 and 16:

We teach people how money works.We

- Page 19 and 20:

UNITED STATESSECURITIES AND EXCHANG

- Page 21 and 22:

CAUTIONARY STATEMENT CONCERNING FOR

- Page 23 and 24:

PART IITEM 1.BUSINESSOverviewPrimer

- Page 25 and 26:

them reduce and ultimately pay off

- Page 27 and 28:

With the support of our home office

- Page 29 and 30:

ecognized with the sales representa

- Page 31 and 32:

force. We also profile successful s

- Page 33 and 34:

• bonuses and other compensation,

- Page 35 and 36:

originators (and in some states as

- Page 37 and 38:

We organize and manage our business

- Page 39 and 40:

premiums that are less per person p

- Page 41 and 42:

insurance policies that we underwri

- Page 43 and 44:

assistance, has developed a series

- Page 45 and 46:

SEC, FINRA and with respect to 529

- Page 47 and 48:

they sell insurance policies. Our C

- Page 49 and 50:

preceding 12 months, exceed this st

- Page 51 and 52:

interest rate risk and business ris

- Page 53 and 54:

operational support to its subsidia

- Page 55 and 56:

Privacy of Consumer Information. U.

- Page 57 and 58:

media. This negative commentary can

- Page 59 and 60:

with such laws and regulations, inc

- Page 61 and 62:

and disrupt the economy. Although w

- Page 63 and 64:

Our financial strength and credit r

- Page 65 and 66:

There are certain risks and uncerta

- Page 67 and 68:

26). The update revises the definit

- Page 69 and 70:

conduct standards prescribed by FIN

- Page 71 and 72:

licensing requirements have caused,

- Page 73 and 74:

Terrorist Financing Act and its acc

- Page 75 and 76:

educing dividends or other amounts

- Page 77 and 78:

housed at our Duluth and Roswell, G

- Page 79 and 80:

• for dates as of or periods endi

- Page 81 and 82:

to and subject to the limitations o

- Page 83 and 84:

Field Audit Department from 1993 to

- Page 85 and 86:

Securities Authorized for Issuanceu

- Page 87 and 88:

ITEM 6.SELECTED FINANCIAL DATA.The

- Page 89 and 90:

pursuant to which we issued to a wh

- Page 91 and 92:

ecruiting boost we experienced in t

- Page 93 and 94:

• Mortality. We use historical ex

- Page 95 and 96:

• sales of a higher proportion of

- Page 97 and 98:

on quality rating, average life and

- Page 99 and 100: Deferred Policy Acquisition Costs(D

- Page 101 and 102: life insurance processing responsib

- Page 103 and 104: einsurance agreements impacted the

- Page 105 and 106: Notes to the Pro Forma Statement of

- Page 107 and 108: Term Life Insurance Segment ProForm

- Page 109 and 110: Investments and Savings ProductsSeg

- Page 111 and 112: We believe that the pro forma resul

- Page 113 and 114: ecognized in 2008. Excluding the ef

- Page 115 and 116: amortize the higher DAC balance res

- Page 117 and 118: Corporate and Other DistributedProd

- Page 119 and 120: The composition of our invested ass

- Page 121 and 122: LIQUIDITY AND CAPITALRESOURCESDivid

- Page 123 and 124: surplus notes, hybrid securities or

- Page 125 and 126: ITEM 7A. QUANTITATIVE ANDQUALITATIV

- Page 127 and 128: AssetsPRIMERICA, INC. AND SUBSIDIAR

- Page 129 and 130: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 131 and 132: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 133 and 134: which we are able to reinvest at ou

- Page 135 and 136: with reinsured policies. Ceded poli

- Page 137 and 138: indemnify and hold the Company harm

- Page 139 and 140: New Accounting PrinciplesScope Exce

- Page 141 and 142: immediately contributed back to us

- Page 143 and 144: The Investment and Savings Products

- Page 145 and 146: (4) InvestmentsOn March 31, 2010, w

- Page 147 and 148: The following tables summarize, for

- Page 149: The net effect on stockholders’ e

- Page 153 and 154: The roll-forward of credit-related

- Page 155 and 156: having similar tenors (e.g., sector

- Page 157 and 158: (5) Financial InstrumentsThe carryi

- Page 159 and 160: Due from reinsurers includes ceded

- Page 161 and 162: (8) Intangible Assets and GoodwillT

- Page 163 and 164: (11) Note PayableIn April 2010, we

- Page 165 and 166: Income tax expense (benefit) attrib

- Page 167 and 168: above, plus an additional 7,098 com

- Page 169 and 170: Non-Employee Share-BasedTransaction

- Page 171 and 172: We had arrangements with Citi in re

- Page 173 and 174: Contingent LiabilitiesThe Company i

- Page 175 and 176: ITEM 9. CHANGES IN ANDDISAGREEMENTS

- Page 177 and 178: Members of Our Board of DirectorsTh

- Page 179 and 180: finance, and risk and asset managem

- Page 181 and 182: PART IVITEM 15. EXHIBITS AND FINANC

- Page 183 and 184: 10.4 Long-Term Services Agreement d

- Page 185 and 186: 10.29 Employment Agreement, dated a

- Page 187 and 188: Schedule ISummary of Investments

- Page 189 and 190: Schedule IICondensed Financial Info

- Page 191 and 192: Schedule IICondensed Financial Info

- Page 193 and 194: 101% of the outstanding principal a

- Page 195 and 196: GrossamountSchedule IVReinsurancePR

- Page 197 and 198: Annual MeetingThe annual meeting of