during <strong>2010</strong> was primarily a result of ourcorporate reorganization.See Note 14 for additional information.(14) Share-Based TransactionsAs of December 31, <strong>2010</strong>, the Company hadoutstanding equity awards under its OmnibusIncentive Plan (OIP). We adopted the OIP onMarch 31, <strong>2010</strong>. Prior to April 1, <strong>2010</strong>, we had nooutstanding share-based awards. The OIPprovides for the issuance of equity awards,including stock options, stock appreciationrights, restricted stock, deferred stock, RSUs,unrestricted stock as well as cash-basedawards. In addition to time-based vestingrequirements, awards granted under the OIPmay also be subject to specified performancecriteria. As of December 31, <strong>2010</strong>, we had3.4 million shares available for future grantsunder this plan. All outstanding managementawards have time-based vesting requirements,vesting over three years. Certain quarterlyincentive contests among our sales forceleaders have performance-based vestingrequirements. As the restrictions onoutstanding RSUs expire, we will issue commonshares. Because the RSUs are eligible fordividend equivalents and are included in ourcalculation of EPS under the two-class method,the related issuance of common shares will notimpact basic or diluted EPS.In connection with the Offering and the privatesale, certain existing Citi equity awardsimmediately vested, resulting in approximately$2.2 million of compensation expense and areclassification of approximately $2.4 millionfrom due to affiliates to paid-in capital.For the year ended December 31, <strong>2010</strong>, we alsorecognized approximately $9.7 million ofexpense in connection with new employee andnon-employee director equity award grants.These expenses were partially offset by a taxbenefit of approximately $3.2 million. The valueof restricted stock and RSUs granted toemployees was based on the fair market valueof our common stock at the date of grant. Wegranted shares of restricted stock to U.S.employees and non-employee directors andRSUs to Canadian employees. These awardsvest over three years and are not subject toany sales restrictions or deferred deliveryfollowing vesting.As of December 31, <strong>2010</strong>, total compensationcost not yet recognized in our financialstatements related to employee equity awardswas $29.2 million, all of which was related toequity awards with time-based vestingconditions yet to be reached. We expect torecognize these amounts over a weightedaverageperiod of approximately 2.3 years.Employee Share-Based TransactionsThe following table summarizes employeerestricted stock activity during <strong>2010</strong>.Weighted-averagemeasurement-date fairShares value per share(Shares in thousands)Unvested employee restricted stock andRSUs, December 31, 2009 — —Granted in <strong>2010</strong> 2,569 $15.02Forfeited in <strong>2010</strong> (3) $15.00Conversions from awards in Citi shares 11 $15.00Vested in <strong>2010</strong> (11) $15.00Unvested employee restricted stock andRSUs, December 31, <strong>2010</strong> 2,566 $15.02148 Freedom Lives Here

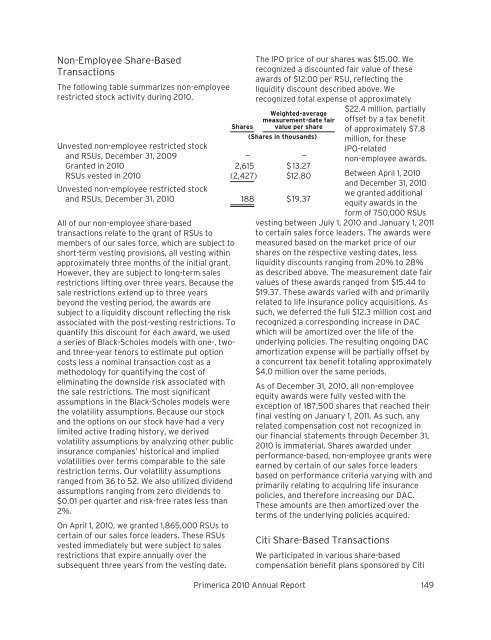

Non-Employee Share-BasedTransactionsThe following table summarizes non-employeerestricted stock activity during <strong>2010</strong>.Weighted-averagemeasurement-date fairvalue per shareShares(Shares in thousands)Unvested non-employee restricted stockand RSUs, December 31, 2009 — —Granted in <strong>2010</strong> 2,615 $ 13.27RSUs vested in <strong>2010</strong> (2,427) $12.80Unvested non-employee restricted stockand RSUs, December 31, <strong>2010</strong> 188 $19.37All of our non-employee share-basedtransactions relate to the grant of RSUs tomembers of our sales force, which are subject toshort-term vesting provisions, all vesting withinapproximately three months of the initial grant.However, they are subject to long-term salesrestrictions lifting over three years. Because thesale restrictions extend up to three yearsbeyond the vesting period, the awards aresubject to a liquidity discount reflecting the riskassociated with the post-vesting restrictions. Toquantify this discount for each award, we useda series of Black-Scholes models with one-, twoandthree-year tenors to estimate put optioncosts less a nominal transaction cost as amethodology for quantifying the cost ofeliminating the downside risk associated withthe sale restrictions. The most significantassumptions in the Black-Scholes models werethe volatility assumptions. Because our stockand the options on our stock have had a verylimited active trading history, we derivedvolatility assumptions by analyzing other publicinsurance companies’ historical and impliedvolatilities over terms comparable to the salerestriction terms. Our volatility assumptionsranged from 36 to 52. We also utilized dividendassumptions ranging from zero dividends to$0.01 per quarter and risk-free rates less than2%.On April 1, <strong>2010</strong>, we granted 1,865,000 RSUs tocertain of our sales force leaders. These RSUsvested immediately but were subject to salesrestrictions that expire annually over thesubsequent three years from the vesting date.The IPO price of our shares was $15.00. Werecognized a discounted fair value of theseawards of $12.00 per RSU, reflecting theliquidity discount described above. Werecognized total expense of approximately$22.4 million, partiallyoffset by a tax benefitof approximately $7.8million, for theseIPO-relatednon-employee awards.Between April 1, <strong>2010</strong>and December 31, <strong>2010</strong>we granted additionalequity awards in theform of 750,000 RSUsvesting between July 1, <strong>2010</strong> and January 1, 2011to certain sales force leaders. The awards weremeasured based on the market price of ourshares on the respective vesting dates, lessliquidity discounts ranging from 20% to 28%as described above. The measurement date fairvalues of these awards ranged from $15.44 to$19.37. These awards varied with and primarilyrelated to life insurance policy acquisitions. Assuch, we deferred the full $12.3 million cost andrecognized a corresponding increase in DACwhich will be amortized over the life of theunderlying policies. The resulting ongoing DACamortization expense will be partially offset bya concurrent tax benefit totaling approximately$4.0 million over the same periods.As of December 31, <strong>2010</strong>, all non-employeeequity awards were fully vested with theexception of 187,500 shares that reached theirfinal vesting on January 1, 2011. As such, anyrelated compensation cost not recognized inour financial statements through December 31,<strong>2010</strong> is immaterial. Shares awarded underperformance-based, non-employee grants wereearned by certain of our sales force leadersbased on performance criteria varying with andprimarily relating to acquiring life insurancepolicies, and therefore increasing our DAC.These amounts are then amortized over theterms of the underlying policies acquired.Citi Share-Based TransactionsWe participated in various share-basedcompensation benefit plans sponsored by Citi<strong>Primerica</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong> 149

- Page 1 and 2:

Freedom Lives Here 2010 Annual Repo

- Page 3 and 4:

A Main Street Company for Main Stre

- Page 5 and 6:

North America’s vastmiddle-income

- Page 7 and 8:

More than 50 percent of U.S. househ

- Page 9 and 10:

We are PrimericaPrimerica is a Main

- Page 11 and 12:

Primerica helps familiescreate a fi

- Page 13 and 14:

René Turner wasalways told growing

- Page 15 and 16:

We teach people how money works.We

- Page 19 and 20:

UNITED STATESSECURITIES AND EXCHANG

- Page 21 and 22:

CAUTIONARY STATEMENT CONCERNING FOR

- Page 23 and 24:

PART IITEM 1.BUSINESSOverviewPrimer

- Page 25 and 26:

them reduce and ultimately pay off

- Page 27 and 28:

With the support of our home office

- Page 29 and 30:

ecognized with the sales representa

- Page 31 and 32:

force. We also profile successful s

- Page 33 and 34:

• bonuses and other compensation,

- Page 35 and 36:

originators (and in some states as

- Page 37 and 38:

We organize and manage our business

- Page 39 and 40:

premiums that are less per person p

- Page 41 and 42:

insurance policies that we underwri

- Page 43 and 44:

assistance, has developed a series

- Page 45 and 46:

SEC, FINRA and with respect to 529

- Page 47 and 48:

they sell insurance policies. Our C

- Page 49 and 50:

preceding 12 months, exceed this st

- Page 51 and 52:

interest rate risk and business ris

- Page 53 and 54:

operational support to its subsidia

- Page 55 and 56:

Privacy of Consumer Information. U.

- Page 57 and 58:

media. This negative commentary can

- Page 59 and 60:

with such laws and regulations, inc

- Page 61 and 62:

and disrupt the economy. Although w

- Page 63 and 64:

Our financial strength and credit r

- Page 65 and 66:

There are certain risks and uncerta

- Page 67 and 68:

26). The update revises the definit

- Page 69 and 70:

conduct standards prescribed by FIN

- Page 71 and 72:

licensing requirements have caused,

- Page 73 and 74:

Terrorist Financing Act and its acc

- Page 75 and 76:

educing dividends or other amounts

- Page 77 and 78:

housed at our Duluth and Roswell, G

- Page 79 and 80:

• for dates as of or periods endi

- Page 81 and 82:

to and subject to the limitations o

- Page 83 and 84:

Field Audit Department from 1993 to

- Page 85 and 86:

Securities Authorized for Issuanceu

- Page 87 and 88:

ITEM 6.SELECTED FINANCIAL DATA.The

- Page 89 and 90:

pursuant to which we issued to a wh

- Page 91 and 92:

ecruiting boost we experienced in t

- Page 93 and 94:

• Mortality. We use historical ex

- Page 95 and 96:

• sales of a higher proportion of

- Page 97 and 98:

on quality rating, average life and

- Page 99 and 100:

Deferred Policy Acquisition Costs(D

- Page 101 and 102:

life insurance processing responsib

- Page 103 and 104:

einsurance agreements impacted the

- Page 105 and 106:

Notes to the Pro Forma Statement of

- Page 107 and 108:

Term Life Insurance Segment ProForm

- Page 109 and 110:

Investments and Savings ProductsSeg

- Page 111 and 112:

We believe that the pro forma resul

- Page 113 and 114:

ecognized in 2008. Excluding the ef

- Page 115 and 116:

amortize the higher DAC balance res

- Page 117 and 118: Corporate and Other DistributedProd

- Page 119 and 120: The composition of our invested ass

- Page 121 and 122: LIQUIDITY AND CAPITALRESOURCESDivid

- Page 123 and 124: surplus notes, hybrid securities or

- Page 125 and 126: ITEM 7A. QUANTITATIVE ANDQUALITATIV

- Page 127 and 128: AssetsPRIMERICA, INC. AND SUBSIDIAR

- Page 129 and 130: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 131 and 132: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 133 and 134: which we are able to reinvest at ou

- Page 135 and 136: with reinsured policies. Ceded poli

- Page 137 and 138: indemnify and hold the Company harm

- Page 139 and 140: New Accounting PrinciplesScope Exce

- Page 141 and 142: immediately contributed back to us

- Page 143 and 144: The Investment and Savings Products

- Page 145 and 146: (4) InvestmentsOn March 31, 2010, w

- Page 147 and 148: The following tables summarize, for

- Page 149 and 150: The net effect on stockholders’ e

- Page 151 and 152: The amortized cost and fair value o

- Page 153 and 154: The roll-forward of credit-related

- Page 155 and 156: having similar tenors (e.g., sector

- Page 157 and 158: (5) Financial InstrumentsThe carryi

- Page 159 and 160: Due from reinsurers includes ceded

- Page 161 and 162: (8) Intangible Assets and GoodwillT

- Page 163 and 164: (11) Note PayableIn April 2010, we

- Page 165 and 166: Income tax expense (benefit) attrib

- Page 167: above, plus an additional 7,098 com

- Page 171 and 172: We had arrangements with Citi in re

- Page 173 and 174: Contingent LiabilitiesThe Company i

- Page 175 and 176: ITEM 9. CHANGES IN ANDDISAGREEMENTS

- Page 177 and 178: Members of Our Board of DirectorsTh

- Page 179 and 180: finance, and risk and asset managem

- Page 181 and 182: PART IVITEM 15. EXHIBITS AND FINANC

- Page 183 and 184: 10.4 Long-Term Services Agreement d

- Page 185 and 186: 10.29 Employment Agreement, dated a

- Page 187 and 188: Schedule ISummary of Investments

- Page 189 and 190: Schedule IICondensed Financial Info

- Page 191 and 192: Schedule IICondensed Financial Info

- Page 193 and 194: 101% of the outstanding principal a

- Page 195 and 196: GrossamountSchedule IVReinsurancePR

- Page 197 and 198: Annual MeetingThe annual meeting of