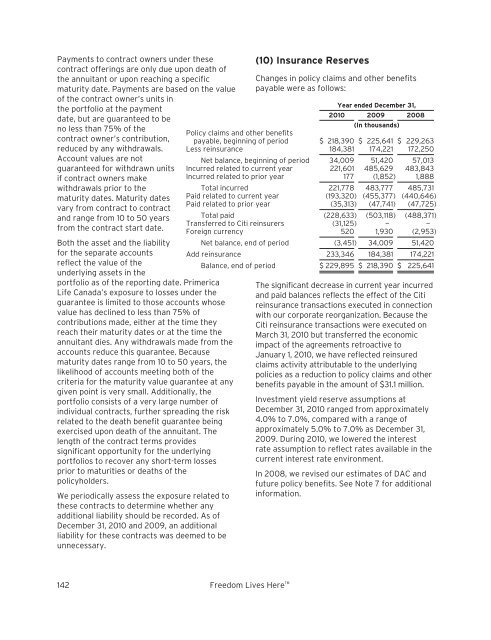

Payments to contract owners under thesecontract offerings are only due upon death ofthe annuitant or upon reaching a specificmaturity date. Payments are based on the valueof the contract owner’s units inthe portfolio at the paymentdate, but are guaranteed to beno less than 75% of thecontract owner’s contribution,reduced by any withdrawals.Account values are notguaranteed for withdrawn unitsif contract owners makewithdrawals prior to thematurity dates. Maturity datesvary from contract to contractand range from 10 to 50 yearsfrom the contract start date.Both the asset and the liabilityfor the separate accountsreflect the value of theunderlying assets in theportfolio as of the reporting date. <strong>Primerica</strong>Life Canada’s exposure to losses under theguarantee is limited to those accounts whosevalue has declined to less than 75% ofcontributions made, either at the time theyreach their maturity dates or at the time theannuitant dies. Any withdrawals made from theaccounts reduce this guarantee. Becausematurity dates range from 10 to 50 years, thelikelihood of accounts meeting both of thecriteria for the maturity value guarantee at anygiven point is very small. Additionally, theportfolio consists of a very large number ofindividual contracts, further spreading the riskrelated to the death benefit guarantee beingexercised upon death of the annuitant. Thelength of the contract terms providessignificant opportunity for the underlyingportfolios to recover any short-term lossesprior to maturities or deaths of thepolicyholders.We periodically assess the exposure related tothese contracts to determine whether anyadditional liability should be recorded. As ofDecember 31, <strong>2010</strong> and 2009, an additionalliability for these contracts was deemed to beunnecessary.(10) Insurance ReservesChanges in policy claims and other benefitspayable were as follows:Year ended December 31,<strong>2010</strong> 2009 2008(In thousands)Policy claims and other benefitspayable, beginning of period $ 218,390 $ 225,641 $ 229,263Less reinsurance 184,381 174,221 172,250Net balance, beginning of period 34,009 51,420 57,013Incurred related to current year 221,601 485,629 483,843Incurred related to prior year 177 (1,852) 1,888Total incurred 221,778 483,777 485,731Paid related to current year (193,320) (455,377) (440,646)Paid related to prior year (35,313) (47,741) (47,725)Total paid (228,633) (503,118) (488,371)Transferred to Citi reinsurers (31,125) — —Foreign currency 520 1,930 (2,953)Net balance, end of period (3,451) 34,009 51,420Add reinsurance 233,346 184,381 174,221Balance, end of period $ 229,895 $ 218,390 $ 225,641The significant decrease in current year incurredand paid balances reflects the effect of the Citireinsurance transactions executed in connectionwith our corporate reorganization. Because theCiti reinsurance transactions were executed onMarch 31, <strong>2010</strong> but transferred the economicimpact of the agreements retroactive toJanuary 1, <strong>2010</strong>, we have reflected reinsuredclaims activity attributable to the underlyingpolicies as a reduction to policy claims and otherbenefits payable in the amount of $31.1 million.Investment yield reserve assumptions atDecember 31, <strong>2010</strong> ranged from approximately4.0% to 7.0%, compared with a range ofapproximately 5.0% to 7.0% as December 31,2009. During <strong>2010</strong>, we lowered the interestrate assumption to reflect rates available in thecurrent interest rate environment.In 2008, we revised our estimates of DAC andfuture policy benefits. See Note 7 for additionalinformation.142 Freedom Lives Here

(11) Note PayableIn April <strong>2010</strong>, we issued to Citi a $300.0 millionnote as part of our corporate reorganization inwhich Citi transferred to us the businesses thatcomprise our operations. Prior to the issuanceof the Citi note, we had no outstanding debt.The Citi note bears interest at an annual rate of5.5%, payable semi-annually in arrears onJanuary 15 and July 15, and matures March 31,2015. Citi may participate out, assign or sell allor any portion of the note at any time.We have the option to redeem the Citi note inwhole or in part at a redemption price equal to100% of the principal amount to be redeemedplus accrued and unpaid interest to the date ofredemption. In the event of a change in control,the holder of the Citi note has the right torequire us to repurchase it at a price equal to101% of the outstanding principal amount plusaccrued and unpaid interest.The Citi note also requires us to use ourcommercially reasonable efforts to arrange andconsummate an offering of investment-gradedebt securities, trust preferred securities,surplus notes, hybrid securities or convertibledebt that generates sufficient net cashproceeds (after deducting fees and expenses)to repay the note in full at certain mutuallyagreeable dates, based oncertain conditions.We were in compliance with allof the covenants of the Citinote at December 31, <strong>2010</strong>. Noevents of default or defaultsoccurred during <strong>2010</strong>.(12) Income TaxesIn conjunction with the Offering and the privatesale, we made elections under Section338(h)(10) of the Internal Revenue Code, whichresulted in changes to our deferred taxbalances and reduced stockholders’ equity by$172.5 million.During the first quarter of <strong>2010</strong>, our federalincome tax return was included as part of Citi’sconsolidated federal income tax return. OnMarch 30, <strong>2010</strong>, in anticipation of our corporatereorganization, we entered into a taxseparation agreement with Citi. In accordancewith the tax separation agreement, Citi will beresponsible for and shall indemnify and hold theCompany harmless from and against anyconsolidated, combined, affiliated, unitary orsimilar federal, state or local income tax liabilitywith respect to the Company for any taxableperiod ending on or before April 7, <strong>2010</strong>, theclosing date of the Offering.Deferred income taxes are recognized for thefuture tax consequences of temporarydifferences between the financial statementcarrying amounts and the tax bases of assetsand liabilities. The main components ofdeferred income tax assets and liabilities wereas follows:December 31,<strong>2010</strong> 2009(In thousands)Deferred tax assets:Policy benefit reserves and unpaid policyclaims $ 132,006 $ 5,775Intangibles and tax goodwill 37,719 —Deferred compensation — employee benefits — 45,548Other 9,542 32,230Total deferred tax assets 179,267 83,553Deferred tax liabilities:Deferred policy acquisition costs (247,344) (727,373)Investments (17,469) (35,513)Unremitted earnings on foreign subsidiaries — (68,481)Other (7,456) (51,913)Total deferred tax liabilities (272,269) (883,280)Net deferred tax liabilities $ (93,002) $ (799,727)<strong>Primerica</strong> <strong>2010</strong> <strong>Annual</strong> <strong>Report</strong> 143

- Page 1 and 2:

Freedom Lives Here 2010 Annual Repo

- Page 3 and 4:

A Main Street Company for Main Stre

- Page 5 and 6:

North America’s vastmiddle-income

- Page 7 and 8:

More than 50 percent of U.S. househ

- Page 9 and 10:

We are PrimericaPrimerica is a Main

- Page 11 and 12:

Primerica helps familiescreate a fi

- Page 13 and 14:

René Turner wasalways told growing

- Page 15 and 16:

We teach people how money works.We

- Page 19 and 20:

UNITED STATESSECURITIES AND EXCHANG

- Page 21 and 22:

CAUTIONARY STATEMENT CONCERNING FOR

- Page 23 and 24:

PART IITEM 1.BUSINESSOverviewPrimer

- Page 25 and 26:

them reduce and ultimately pay off

- Page 27 and 28:

With the support of our home office

- Page 29 and 30:

ecognized with the sales representa

- Page 31 and 32:

force. We also profile successful s

- Page 33 and 34:

• bonuses and other compensation,

- Page 35 and 36:

originators (and in some states as

- Page 37 and 38:

We organize and manage our business

- Page 39 and 40:

premiums that are less per person p

- Page 41 and 42:

insurance policies that we underwri

- Page 43 and 44:

assistance, has developed a series

- Page 45 and 46:

SEC, FINRA and with respect to 529

- Page 47 and 48:

they sell insurance policies. Our C

- Page 49 and 50:

preceding 12 months, exceed this st

- Page 51 and 52:

interest rate risk and business ris

- Page 53 and 54:

operational support to its subsidia

- Page 55 and 56:

Privacy of Consumer Information. U.

- Page 57 and 58:

media. This negative commentary can

- Page 59 and 60:

with such laws and regulations, inc

- Page 61 and 62:

and disrupt the economy. Although w

- Page 63 and 64:

Our financial strength and credit r

- Page 65 and 66:

There are certain risks and uncerta

- Page 67 and 68:

26). The update revises the definit

- Page 69 and 70:

conduct standards prescribed by FIN

- Page 71 and 72:

licensing requirements have caused,

- Page 73 and 74:

Terrorist Financing Act and its acc

- Page 75 and 76:

educing dividends or other amounts

- Page 77 and 78:

housed at our Duluth and Roswell, G

- Page 79 and 80:

• for dates as of or periods endi

- Page 81 and 82:

to and subject to the limitations o

- Page 83 and 84:

Field Audit Department from 1993 to

- Page 85 and 86:

Securities Authorized for Issuanceu

- Page 87 and 88:

ITEM 6.SELECTED FINANCIAL DATA.The

- Page 89 and 90:

pursuant to which we issued to a wh

- Page 91 and 92:

ecruiting boost we experienced in t

- Page 93 and 94:

• Mortality. We use historical ex

- Page 95 and 96:

• sales of a higher proportion of

- Page 97 and 98:

on quality rating, average life and

- Page 99 and 100:

Deferred Policy Acquisition Costs(D

- Page 101 and 102:

life insurance processing responsib

- Page 103 and 104:

einsurance agreements impacted the

- Page 105 and 106:

Notes to the Pro Forma Statement of

- Page 107 and 108:

Term Life Insurance Segment ProForm

- Page 109 and 110:

Investments and Savings ProductsSeg

- Page 111 and 112: We believe that the pro forma resul

- Page 113 and 114: ecognized in 2008. Excluding the ef

- Page 115 and 116: amortize the higher DAC balance res

- Page 117 and 118: Corporate and Other DistributedProd

- Page 119 and 120: The composition of our invested ass

- Page 121 and 122: LIQUIDITY AND CAPITALRESOURCESDivid

- Page 123 and 124: surplus notes, hybrid securities or

- Page 125 and 126: ITEM 7A. QUANTITATIVE ANDQUALITATIV

- Page 127 and 128: AssetsPRIMERICA, INC. AND SUBSIDIAR

- Page 129 and 130: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 131 and 132: PRIMERICA, INC. AND SUBSIDIARIESCon

- Page 133 and 134: which we are able to reinvest at ou

- Page 135 and 136: with reinsured policies. Ceded poli

- Page 137 and 138: indemnify and hold the Company harm

- Page 139 and 140: New Accounting PrinciplesScope Exce

- Page 141 and 142: immediately contributed back to us

- Page 143 and 144: The Investment and Savings Products

- Page 145 and 146: (4) InvestmentsOn March 31, 2010, w

- Page 147 and 148: The following tables summarize, for

- Page 149 and 150: The net effect on stockholders’ e

- Page 151 and 152: The amortized cost and fair value o

- Page 153 and 154: The roll-forward of credit-related

- Page 155 and 156: having similar tenors (e.g., sector

- Page 157 and 158: (5) Financial InstrumentsThe carryi

- Page 159 and 160: Due from reinsurers includes ceded

- Page 161: (8) Intangible Assets and GoodwillT

- Page 165 and 166: Income tax expense (benefit) attrib

- Page 167 and 168: above, plus an additional 7,098 com

- Page 169 and 170: Non-Employee Share-BasedTransaction

- Page 171 and 172: We had arrangements with Citi in re

- Page 173 and 174: Contingent LiabilitiesThe Company i

- Page 175 and 176: ITEM 9. CHANGES IN ANDDISAGREEMENTS

- Page 177 and 178: Members of Our Board of DirectorsTh

- Page 179 and 180: finance, and risk and asset managem

- Page 181 and 182: PART IVITEM 15. EXHIBITS AND FINANC

- Page 183 and 184: 10.4 Long-Term Services Agreement d

- Page 185 and 186: 10.29 Employment Agreement, dated a

- Page 187 and 188: Schedule ISummary of Investments

- Page 189 and 190: Schedule IICondensed Financial Info

- Page 191 and 192: Schedule IICondensed Financial Info

- Page 193 and 194: 101% of the outstanding principal a

- Page 195 and 196: GrossamountSchedule IVReinsurancePR

- Page 197 and 198: Annual MeetingThe annual meeting of