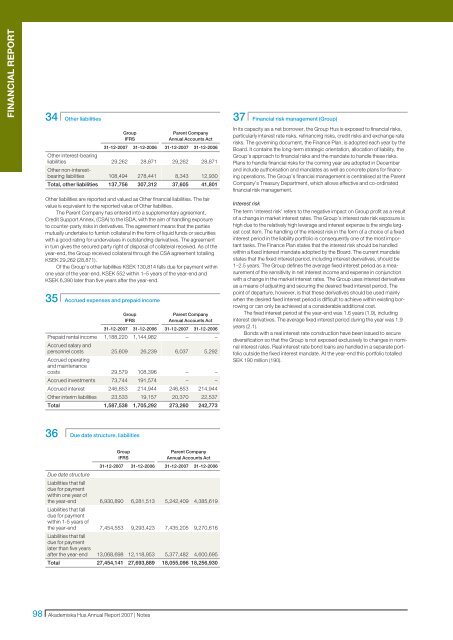

Financial <strong>Report</strong>34 Other liabilitiesGroupIFRSParent Company<strong>Annual</strong> Accounts Act31-12-2007 31-12-2006 31-12-2007 31-12-2006Other interest-bearingliabilities 29,262 28,871 29,262 28,871Other non-interestbearingliabilities 108,494 278,441 8,343 12,930Total, other liabilities 137,756 307,312 37,605 41,801Other liabilities are reported and valued as Other financial liabilities. The fairvalue is equivalent to the reported value of Other liabilities.The Parent Company has entered into a supplementary agreement,Credit Support Annex, (CSA) to the ISDA, with the aim of handling exposureto counter-party risks in derivatives. The agreement means that the partiesmutually undertake to furnish collateral in the form of liquid funds or securitieswith a good rating for undervalues in outstanding derivatives. The agreementin turn gives the secured party right of disposal of collateral received. As of theyear-end, the Group received collateral through the CSA agreement totallingKSEK 29,262 (28,871).Of the Group’s other liabilities KSEK 130,814 falls due for payment withinone year of the year-end, KSEK 552 within 1–5 years of the year-end andKSEK 6,390 later than five years after the year-end.35 Accrued expenses and prepaid incomeGroupIFRSParent Company<strong>Annual</strong> Accounts Act31-12-2007 31-12-2006 31-12-2007 31-12-2006Prepaid rental income 1,188,220 1,144,982 – –Accrued salary andpersonnel costs 25,609 26,239 6,037 5,292Accrued operatingand maintenancecosts 29,579 108,396 – –Accrued investments 73,744 191,574 – –Accrued interest 246,853 214,944 246,853 214,944Other interim liabilities 23,533 19,157 20,370 22,537Total 1,587,538 1,705,292 273,260 242,77337 Financial risk management (Group)In its capacity as a net borrower, the Group <strong>Hus</strong> is exposed to financial risks,particularly interest rate risks, refinancing risks, credit risks and exchange raterisks. The governing document, the Finance Plan, is adopted each year by theBoard. It contains the long-term strategic orientation, allocation of liability, theGroup’s approach to financial risks and the mandate to handle these risks.Plans to handle financial risks for the coming year are adopted in Decemberand include authorisation and mandates as well as concrete plans for financingoperations. The Group’s financial management is centralised at the ParentCompany’s Treasury Department, which allows effective and co-ordinatedfinancial risk management.Interest riskThe term ‘interest risk’ refers to the negative impact on Group profit as a resultof a change in market interest rates. The Group’s interest rate risk exposure ishigh due to the relatively high leverage and interest expense is the single largestcost item. The handling of the interest risk in the form of a choice of a fixedinterest period in the liability portfolio is consequently one of the most importanttasks. The Finance Plan states that the interest risk should be handledwithin a fixed interest mandate adopted by the Board. The current mandatestates that the fixed interest period, including interest derivatives, should be1–2.5 years. The Group defines the average fixed interest period as a measurementof the sensitivity in net interest income and expense in conjunctionwith a change in the market interest rates. The Group uses interest derivativesas a means of adjusting and securing the desired fixed interest period. Thepoint of departure, however, is that these derivatives should be used mainlywhen the desired fixed interest period is difficult to achieve within existing borrowingor can only be achieved at a considerable additional cost.The fixed interest period at the year-end was 1.6 years (1.9), includinginterest derivatives. The average fixed interest period during the year was 1.9years (2.1).Bonds with a real interest rate construction have been issued to securediversification so that the Group is not exposed exclusively to changes in nominalinterest rates. Real interest rate bond loans are handled in a separate portfoliooutside the fixed interest mandate. At the year-end this portfolio totalledSEK 190 million (190).36 Due date structure, liabilitiesDue date structureGroupIFRSParent Company<strong>Annual</strong> Accounts Act31-12-2007 31-12-2006 31-12-2007 31-12-2006Liabilities that falldue for paymentwithin one year ofthe year-end 6,930,890 6,281,513 5,242,409 4,385,619Liabilities that falldue for paymentwithin 1-5 years ofthe year-end 7,454,553 9,293,423 7,435,205 9,270,616Liabilities that falldue for paymentlater than five yearsafter the year-end 13,068,698 12,118,953 5,377,482 4,600,695Total 27,454,141 27,693,889 18,055,096 18,256,93098 <strong>Akademiska</strong> <strong>Hus</strong> <strong>Annual</strong> <strong>Report</strong> 2007 | Notes

Note 37, cont’d.Due date structure for fixed interest periods and liability capital tie-up, SEK mCapital tie-up,loansFixed interestperiod, loansFixed interestperiod, derivativesFixed interestperiod, total2008:1 1,987 2,577 9,555 12,1322008:2 1,546 1,546 –2,522 –9762008:3 – – –500 –5002008:4 1,164 2,081 97 2,1782009 2,365 2,365 –1,065 1,3002010 3,095 3,095 –1,595 1,5002011 759 759 –760 –12012 711 711 14 7252013 – – 1,261 1,2612014 1,426 1,426 –1,426 –2015 and later 3,768 2,261 –2,561 –300Total 16,821 16,821 498 17,319The above table shows nominal amounts. The nominal amounts have been recalculated at the year-end rate. As all loans that are raised in foreign currency areswapped to Swedish kronor the exchange rate effect is neutralised. Positive value = the Group pays interest, negative value = the Group receives interest.Currency riskA currency risk is the risk that exchange rate changes will have a negativeimpact on the Group’s Income Statement and Balance Sheet. In conjunctionwith borrowing in a foreign currency, the Group is exposed to an exchangerate risk. As the Group’s operations are exclusively in Swedish kronor thepolicy is that all exchange rate risk in conjunction with financing in a foreigncurrency should be eliminated. All payment flows attributable to borrowingare exchange hedged with the aid of forward rate agreements and currencyswaps. The Group accepts exchange rate exposure for electricity trading, asthis takes place to a limited extent.Currency breakdown, loans and derivatives, SEK mOriginal currency Loans Derivatives TotalCHF 5,705 –5,705 –EUR 2,553 –2,553 –JPY 1,308 –1,308 –SEK 6,728 10,591 17,319USD 527 –527 –Total 16,821 498 17,319The table above shows nominal amounts. The nominal amounts were recalculatedusing the year-end rate.Refinancing riskThe term ‘refinancing risk’ refers to the risk that the cost is higher and thatthe financing opportunities are limited when the loans that fall due are to berenewed. The Finance Plan states that unutilised credit facilities should be inplace to a sufficient extent to guarantee good payment capacity. The aim isto limit the costs by seeking to strike a balance between short-term, mediumtermand long-term financing, and endeavouring to achieve diversificationbetween different financing arrangements and markets. Loans that fall dueshould have a spread so that a maximum of 40 per cent fall due for refinancingwithin a 12-month period.The Group has a very good credit rating, which offers a good opportunityto achieve the diversification aimed for through the public financing programmes.The Group’s liquid assets at the end of 2007 totalled SEK 844 million(1,379). At the year-end, bank facilities granted totalled SEK 4,200 million(4,200), of which SEK 2,700 million (2,700) was unconfirmed.Facilities and ratingRatingStandard & Poor’sFramework31-12-2007Utilised nom.31-12-2007Bank SEK 4,200 m –Commercial paper A1+/K1 SEK 4,000 m SEK 1,621 mECP(Euro Commercial Paper) A1+ USD 600 m USD 60 mMTN(Medium Term Note) AA SEK 8,000 m SEK 4,595 mEMTN(Euro Medium Term Note) AA/A1+ USD 1,500 m USD 869 mCredit risk and counter-party riskThe term ‘credit and counter-party risk’ refers to the risk of a loss when acounter-party does not fulfil its undertakings. The Group is exposed whensurplus liquidity is placed in financial assets and also in conjunction withtrade in derivatives. The Group applies a conservative counter-party risk. TheFinance Plan includes a limit system where permitted exposure depends onthe counter-party’s credit rating and the maturity of the involvement. The limitsare related to the Group’s risk capacity in the form of equity.As the Group is in the long term a net borrower, periods of surplus liquidityare more of a temporary nature. Investments should therefore be characterisedby good liquidity in the secondary market and be in accordance with thelimit structure.The Group’s policy is that internationally standardised netting agreements,ISDA agreements, should always be signed with a counter-party before derivativetransactions take place. As of December 31, 2007, the total counter-partyexposure in derivatives (calculated as the net claim per counter-party) stood atSEK 515 million (662). With the aim of further reducing exposure to a counterpartyrisk, the Parent Company has entered into a number of supplementaryagreements, Credit Support Annexes (CSA), to the ISDA agreements. Theagreements mean that the parties mutually undertake to furnish collateral inthe form of liquid funds or bonds for the value deficits in outstanding derivativecontracts. At the year-end, the Group had granted SEK 220 million (247) net.<strong>Akademiska</strong> <strong>Hus</strong> <strong>Annual</strong> <strong>Report</strong> 2007 | Notes 99

- Page 6 and 7:

Review of the yearAkademiska Hus 20

- Page 8 and 9:

Statement by the PresidentIncreased

- Page 10 and 11:

Business concept, visions and objec

- Page 12 and 13:

MARKETRental and property marketGoo

- Page 14 and 15:

MARKETAkademiska Hus marketHigher e

- Page 16 and 17:

MARKETResearch Bill 2008In internat

- Page 18 and 19:

MARKETCompetitorsLocal players the

- Page 20 and 21:

MARKETProperty specification, North

- Page 23 and 24:

1613 6 24 2912171142962122932464751

- Page 25 and 26:

EASTERN REGION (ÖST)Major efforts

- Page 27 and 28:

((KYRKBYNE6E20GOTHENBURGSA-FÄRJEST

- Page 29 and 30:

LLUNDPLANTAGELYCKANHELGONAGÅRDEN3S

- Page 31 and 32:

At the Ingvar Kamprad Design Centre

- Page 33 and 34:

could benefit from proximity to the

- Page 35 and 36:

of energy system and form of energy

- Page 37 and 38:

difficult to influence. In the Ultu

- Page 40 and 41:

OPERATIONSProperty valuationSlight

- Page 42:

OPERATIONSlation of the rental paym

- Page 45 and 46:

Operating costsOperating costs, a s

- Page 47 and 48:

Maintenance costsStable maintenance

- Page 49 and 50:

Comments on the Five-year summary1.

- Page 51 and 52: Regions and GroupKey figuresKey fig

- Page 53 and 54: Average rentable floor space, regio

- Page 55 and 56: Interest-bearing net loan debt, inc

- Page 57 and 58: Construction projectsNew constructi

- Page 59 and 60: By drawing up good documents for co

- Page 61 and 62: Akademiska Hus - a partner in the d

- Page 63 and 64: SustainabilityAkademiska Hus’s am

- Page 65 and 66: Akademiska Hus is working to ensure

- Page 67 and 68: EmployeesInvestment in employee dev

- Page 69 and 70: Group level, on the regional level

- Page 71 and 72: Group corporate governance reportTh

- Page 73 and 74: Remuneration and other terms and co

- Page 75 and 76: Board and auditorsBOARDEva-Britt Gu

- Page 77 and 78: Financial Report 73-10473Swedish Na

- Page 79 and 80: Income StatementsGroupIFRSParent Co

- Page 81 and 82: Balance SheetsGroupIFRSParent Compa

- Page 83 and 84: Cash Flow StatementsGroupIFRSParent

- Page 85 and 86: Note 3, cont’d .comprises rental

- Page 87 and 88: Note 3, cont’d .fair value. Chang

- Page 89 and 90: 6 Categorised operating costsFuncti

- Page 91 and 92: Note 13, cont’d .Payments to the

- Page 93 and 94: Note 17, cont’d.17 TaxesThe follo

- Page 95 and 96: Cost of capital and direct yield re

- Page 97 and 98: Note 24, cont’d.The table below s

- Page 99 and 100: Note 32, cont’d.Borrowing can be

- Page 101: Note 33, cont’d.The retirement pe

- Page 105 and 106: 39 Pledged assetsGroupIFRSParent Co

- Page 107 and 108: Audit ReportTo the annual meeting o

- Page 109 and 110: AddressesGROUP HEAD OFFICEAkademisk