Akademiska Hus Annual Report

Akademiska Hus Annual Report

Akademiska Hus Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

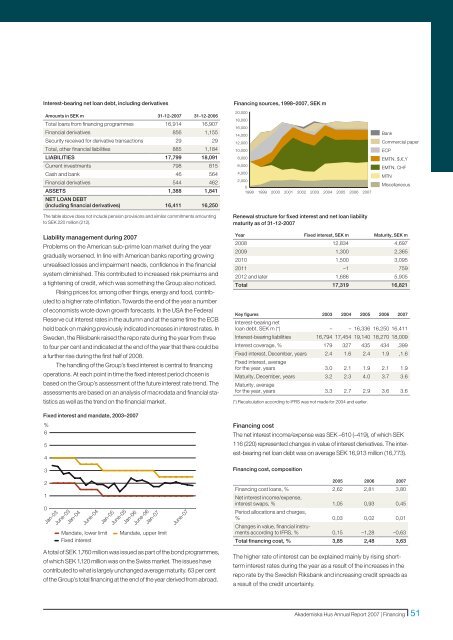

Interest-bearing net loan debt, including derivativesAmounts in SEK m 31-12-2007 31-12-2006Total loans from financing programmes 16,914 16,907Financial derivatives 856 1,155Security received for derivative transactions 29 29Total, other financial liabilities 885 1,184LIABILITIES 17,799 18,091Current investments 798 815Cash and bank 46 564Financial derivatives 544 462ASSETS 1,388 1,841NET LOAN DEBT(including financial derivatives) 16,411 16,250The table above does not include pension provisions and similar commitments amountingto SEK 220 million (212).Financing sources, 1998–2007, SEK m20,00018,00016,00014,00012,00010,0008,0006,0004,0002,00001998 1999 2000 2001 2002 2003 2004 2005 2006 2007Renewal structure for fixed interest and net loan liabilitymaturity as of 31-12-2007BankCommercial paperECPEMTN, $,€,YEMTN, CHFMTNMiscellaneousLiability management during 2007Problems on the American sub-prime loan market during the yeargradually worsened. In line with American banks reporting growingunrealised losses and impairment needs, confidence in the financialsystem diminished. This contributed to increased risk premiums anda tightening of credit, which was something the Group also noticed.Rising prices for, among other things, energy and food, contributedto a higher rate of inflation. Towards the end of the year a numberof economists wrote down growth forecasts. In the USA the FederalReserve cut interest rates in the autumn and at the same time the ECBheld back on making previously indicated increases in interest rates. InSweden, the Riksbank raised the repo rate during the year from threeto four per cent and indicated at the end of the year that there could bea further rise during the first half of 2008.The handling of the Group’s fixed interest is central to financingoperations. At each point in time the fixed interest period chosen isbased on the Group’s assessment of the future interest rate trend. Theassessments are based on an analysis of macrodata and financial statisticsas well as the trend on the financial market.Fixed interest and mandate, 2003–2007%6543210Jan-03June-03Jan-04June-04Mandate, lower limitFixed interestJan-05June-05Jan-06June-06Jan-07Mandate, upper limitJune-07A total of SEK 1,760 million was issued as part of the bond programmes,of which SEK 1,120 million was on the Swiss market. The issues havecontributed to what is largely unchanged average maturity. 63 per centof the Group’s total financing at the end of the year derived from abroad.Year Fixed interest, SEK m Maturity, SEK m2008 12,834 4,6972009 1,300 2,3652010 1,500 3,0952011 –1 7592012 and later 1,686 5,905Total 17,319 16,821Key figures 2003 2004 2005 2006 2007Interest-bearing netloan debt, SEK m (*) – – 16,336 16,250 16,411Interest-bearing liabilities 16,794 17,454 19,140 18,270 18,009Interest coverage, % 179 327 435 434 ,399Fixed interest, December, years 2.4 1.6 2.4 1.9 ,1.6Fixed interest, averagefor the year, years 3.0 2.1 1.9 2.1 1.9Maturity, December, years 3.2 2.3 4.0 3.7 3.6Maturity, averagefor the year, years 3.3 2.7 2.9 3.6 3.6(*) Recalculation according to IFRS was not made for 2004 and earlier.Financing costThe net interest income/expense was SEK –610 (–419), of which SEK116 (220) represented changes in value of interest derivatives. The interest-bearingnet loan debt was on average SEK 16,913 million (16,773).Financing cost, composition2005 2006 2007Financing cost loans, % 2,62 2,81 3,80Net interest income/expense,interest swaps, % 1,05 0,93 0,45Period allocations and charges,% 0,03 0,02 0,01Changes in value, financial instrumentsaccording to IFRS, % 0,15 –1,28 –0,63Total financing cost, % 3,85 2,48 3,63The higher rate of interest can be explained mainly by rising shortterminterest rates during the year as a result of the increases in therepo rate by the Swedish Riksbank and increasing credit spreads asa result of the credit uncertainty.<strong>Akademiska</strong> <strong>Hus</strong> <strong>Annual</strong> <strong>Report</strong> 2007 | Financing 51