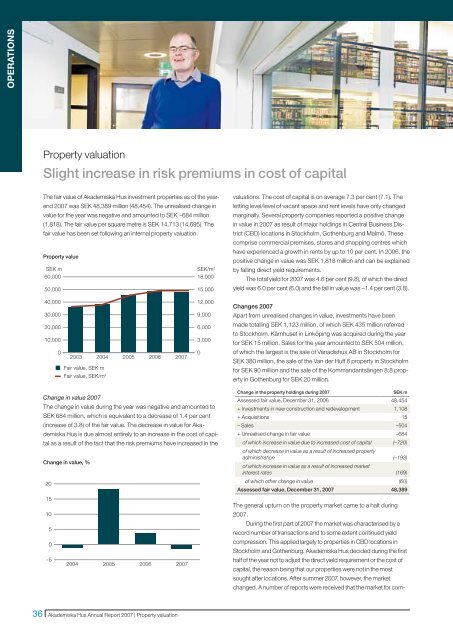

OPERATIONSProperty valuationSlight increase in risk premiums in cost of capitalThe fair value of <strong>Akademiska</strong> <strong>Hus</strong> investment properties as of the yearend2007 was SEK 48,389 million (48,454). The unrealised change invalue for the year was negative and amounted to SEK –684 million(1,818). The fair value per square metre is SEK 14,713 (14,695). Thefair value has been set following an internal property valuation.Property valueSEK m SEK/m 260,00018,00050,00015,000valuations. The cost of capital is on average 7.3 per cent (7.1). Theletting level/level of vacant space and rent levels have only changedmarginally. Several property companies reported a positive changein value in 2007 as result of major holdings in Central Business District(CBD) locations in Stockholm, Gothenburg and Malmö. Thesecomprise commercial premises, stores and shopping centres whichhave experienced a growth in rents by up to 10 per cent. In 2006, thepositive change in value was SEK 1,818 million and can be explainedby falling direct yield requirements.The total yield for 2007 was 4.6 per cent (9.8), of which the directyield was 6.0 per cent (6.0) and the fall in value was –1.4 per cent (3.8).40,00012,000Changes 200730,0009,000Apart from unrealised changes in value, investments have been20,00010,0006,0003,000made totalling SEK 1,123 million, of which SEK 435 million referredto Stockholm. Kärnhuset in Linköping was acquired during the yearfor SEK 15 million. Sales for the year amounted to SEK 504 million,02003 2004Fair value, SEK mFair value, SEK/m 22005200620070of which the largest is the sale of Vanadishus AB in Stockholm forSEK 380 million, the sale of the Van der Huff 8 property in Stockholmfor SEK 90 million and the sale of the Kommandantsängen 8:8 propertyin Gothenburg for SEK 20 million.Change in value 2007The change in value during the year was negative and amounted toSEK 684 million, which is equivalent to a decrease of 1.4 per cent(increase of 3.8) of the fair value. The decrease in value for <strong>Akademiska</strong><strong>Hus</strong> is due almost entirely to an increase in the cost of capitalas a result of the fact that the risk premiums have increased in theChange in value, %20Change in the property holdings during 2007SEK mAssessed fair value, December 31, 2006 48,454+ Investments in new construction and redevelopment 1,108+ Acquisitions 15– Sales –504+ Unrealised change in fair value –684of which increase in value due to increased cost of capital (–720)of which decrease in value as a result of increased propertyadministration (–193)of which increase in value as a result of increased marketinterest rates (169)of which other change in value (60)Assessed fair value, December 31, 2007 48,38915The general upturn on the property market came to a halt during102007.5During the first part of 2007 the market was characterised by arecord number of transactions and to some extent continued yield0compression. This applied largely to properties in CBD locations inStockholm and Gothenburg. <strong>Akademiska</strong> <strong>Hus</strong> decided during the first–52004200520062007half of the year not to adjust the direct yield requirement or the cost ofcapital, the reason being that our properties were not in the mostsought after locations. After summer 2007, however, the marketchanged. A number of reports were received that the market for com-36 <strong>Akademiska</strong> <strong>Hus</strong> <strong>Annual</strong> <strong>Report</strong> 2007 | Property valuation

The library and learning resources at Borås University College offer a modern library environment with areas for lively group discussions as well as quiet,individual study.Assessed fair values of investment properties, regions, SEK mRegion 31-12-2007 31-12-2006 ChangeOf which investments/acquisitionsOf which sales/disposalOf which unrealisedchange in valueNorth 4,264 4,190 74 217 –6 –137Uppsala 6,334 6,170 164 132 –8 39Stockholm 19,571 19,670 –99 435 –470 –65East 4,604 4,729 –125 151 – –276West 7,240 7,252 –12 52 –20 –43South 6,377 6,443 –66 136 – –202Total 48,389 48,454 –65 1,123 –504 –684mercial properties had peaked and stagnating prices and values arebeing reported. The number of transactions has fallen and since thesummer credit concern has meant that the risk premiums in the cost ofcapital have once again increased slightly. In the light of this, and followingconsultation with DTZ, <strong>Akademiska</strong> <strong>Hus</strong> has chosen to allow thedirect yield requirements to remain unchanged and at the same timeadjust the cost of capital upwards by 0.5 percentage points for all valuationobjects with a lease of six years or less. Customer factors, such asthe category of customer, the customer’s long-term presence and paymentcapacity have for several years been regarded by the market asbeing increasingly important in the valuations. <strong>Akademiska</strong> <strong>Hus</strong> has 88per cent of its customers under state control and with long leases.For a number of years the significance of customer factors hasincreased, which must be regarded as being very strong for <strong>Akademiska</strong><strong>Hus</strong>, and means that the direct yield requirement canremain on the same level as 2006.The direct yield requirement per town and location is shown in thegraph on page 39. The direct yield requirement for <strong>Akademiska</strong> <strong>Hus</strong>includes the specific residual value risk in the <strong>Akademiska</strong> <strong>Hus</strong> propertyholdings. Laboratory premises make up 34 per cent of the holdingsand there is a relatively higher risk in the rental flow in the longterm. This higher risk justifies the relatively speaking slightly higherdirect yield requirement (for an explanation of the valuation location,see the Town and location section). The upward adjustment of the costof capital has had a negative impact on profit of SEK 720 million.External valuationA selection of the properties is valued each year by external valuationcompanies as a benchmark to quality-assure the internal valuationmodel. In addition, certain development properties with income andcosts which are difficult to estimate are valued externally. Apart fromdeveloped properties, expansion reserves were also valued externallyduring 2007. The external valuations were made by DTZ, whose valuersare authorised by the Swedish Society of Real Estate Economics.Of the 100 objects in <strong>Akademiska</strong> <strong>Hus</strong> which had been valuedthe highest, 10 objects were valued externally. In terms of value, theexternal valuations account for approximately 10 per cent of the totalvalue. The deviation in value for the externally valued objects comparedwith the internal valuation is on the object level with a margin oferror of +/– 10 per cent. The external valuations carried out confirmedthe reliability of the <strong>Akademiska</strong> <strong>Hus</strong> internal valuation model.The external valuations made of the <strong>Akademiska</strong> <strong>Hus</strong> expansionreserves give slightly lower values. At the end of 2007, theseaccounted for only 2.0 per cent of the total assessed fair value.Internal valuationSEK 46,349 million (96 per cent) of the assessed fair value has beenset using the internal cash flow valuation.Assessed fair value, investment properties SEK m ShareInternal valuation model 46,349 96%Expansion reserves 981 2%Other valuation 1,059 2%Assessed fair value, investment properties,December 31, 2007 48,389 100%Valuation using the cash flow methodThe value of an asset comprises the current value of the future cashflows which the asset is expected to generate.Within <strong>Akademiska</strong> <strong>Hus</strong> the property valuation is based oneach individual valuation object’s expected cash flow during thecoming ten years with an estimated residual value for year 11. Thevaluation objects have been valued individually without taking intoaccount portfolio effects. The cash flow comprises each valuationobject’s income and expenses, i.e. the net operating profit. The calcu-<strong>Akademiska</strong> <strong>Hus</strong> <strong>Annual</strong> <strong>Report</strong> 2007 | Property valuation 37

- Page 6 and 7: Review of the yearAkademiska Hus 20

- Page 8 and 9: Statement by the PresidentIncreased

- Page 10 and 11: Business concept, visions and objec

- Page 12 and 13: MARKETRental and property marketGoo

- Page 14 and 15: MARKETAkademiska Hus marketHigher e

- Page 16 and 17: MARKETResearch Bill 2008In internat

- Page 18 and 19: MARKETCompetitorsLocal players the

- Page 20 and 21: MARKETProperty specification, North

- Page 23 and 24: 1613 6 24 2912171142962122932464751

- Page 25 and 26: EASTERN REGION (ÖST)Major efforts

- Page 27 and 28: ((KYRKBYNE6E20GOTHENBURGSA-FÄRJEST

- Page 29 and 30: LLUNDPLANTAGELYCKANHELGONAGÅRDEN3S

- Page 31 and 32: At the Ingvar Kamprad Design Centre

- Page 33 and 34: could benefit from proximity to the

- Page 35 and 36: of energy system and form of energy

- Page 37 and 38: difficult to influence. In the Ultu

- Page 42: OPERATIONSlation of the rental paym

- Page 45 and 46: Operating costsOperating costs, a s

- Page 47 and 48: Maintenance costsStable maintenance

- Page 49 and 50: Comments on the Five-year summary1.

- Page 51 and 52: Regions and GroupKey figuresKey fig

- Page 53 and 54: Average rentable floor space, regio

- Page 55 and 56: Interest-bearing net loan debt, inc

- Page 57 and 58: Construction projectsNew constructi

- Page 59 and 60: By drawing up good documents for co

- Page 61 and 62: Akademiska Hus - a partner in the d

- Page 63 and 64: SustainabilityAkademiska Hus’s am

- Page 65 and 66: Akademiska Hus is working to ensure

- Page 67 and 68: EmployeesInvestment in employee dev

- Page 69 and 70: Group level, on the regional level

- Page 71 and 72: Group corporate governance reportTh

- Page 73 and 74: Remuneration and other terms and co

- Page 75 and 76: Board and auditorsBOARDEva-Britt Gu

- Page 77 and 78: Financial Report 73-10473Swedish Na

- Page 79 and 80: Income StatementsGroupIFRSParent Co

- Page 81 and 82: Balance SheetsGroupIFRSParent Compa

- Page 83 and 84: Cash Flow StatementsGroupIFRSParent

- Page 85 and 86: Note 3, cont’d .comprises rental

- Page 87 and 88: Note 3, cont’d .fair value. Chang

- Page 89 and 90:

6 Categorised operating costsFuncti

- Page 91 and 92:

Note 13, cont’d .Payments to the

- Page 93 and 94:

Note 17, cont’d.17 TaxesThe follo

- Page 95 and 96:

Cost of capital and direct yield re

- Page 97 and 98:

Note 24, cont’d.The table below s

- Page 99 and 100:

Note 32, cont’d.Borrowing can be

- Page 101 and 102:

Note 33, cont’d.The retirement pe

- Page 103 and 104:

Note 37, cont’d.Due date structur

- Page 105 and 106:

39 Pledged assetsGroupIFRSParent Co

- Page 107 and 108:

Audit ReportTo the annual meeting o

- Page 109 and 110:

AddressesGROUP HEAD OFFICEAkademisk