- Page 1:

RaiManagementJournalAn Initiative o

- Page 4 and 5:

From the Editor’s DeskIt gives me

- Page 6 and 7:

Training Delivery and Methodology i

- Page 8 and 9:

The work force ofan organizationbec

- Page 10 and 11:

Choice of trainingand delivery meth

- Page 12 and 13:

Research studies ofmemory following

- Page 14 and 15:

Table -3: Perception of employees r

- Page 16:

Table -5: Perception of employees r

- Page 19 and 20:

Table -8: Perception of employees r

- Page 21 and 22:

Reference• Bhatia, S.K (1989).

- Page 23 and 24:

celebrity. Keeping these two things

- Page 25 and 26:

Figure IIFigure IIIDecember 2010 Vo

- Page 27 and 28:

• The Pepsi Campaign after theInd

- Page 29 and 30:

Table showing PERCENTAGE OF FAMILIA

- Page 31 and 32:

NAMETable showing PERCENTAGE OF Q-S

- Page 33 and 34:

and Irfan Pathan have beenranked at

- Page 35 and 36:

REFERENCESBOOKS -• Cloe, E. Kenne

- Page 37 and 38:

sations moving forward?In order to

- Page 39 and 40:

When studying the essentials of ano

- Page 41 and 42:

The effectiveness of the currentmot

- Page 43 and 44:

Fig.3: Ranking of Motivational Fact

- Page 46 and 47:

It seems clear thatIndian organisat

- Page 48 and 49:

• Kumar, N. (2001) Soft Ware Indu

- Page 51 and 52:

table 1. On an average, restaurants

- Page 53 and 54:

is also a major factor which effect

- Page 55 and 56:

careful analysis of the market ands

- Page 57 and 58:

Table 5: Size of the restaurants in

- Page 59 and 60:

Table 12: Strategy for promoting re

- Page 62 and 63:

...there will be atextile boom inIn

- Page 64 and 65: apparel industry, be it export ordo

- Page 67 and 68: It is clear from table 5 that solep

- Page 69 and 70: Table 8: Ranking of various problem

- Page 71 and 72: It is evident from table 10 that th

- Page 73 and 74: Table 12 shows that the respondents

- Page 75 and 76: to more than 100 countries worldwid

- Page 77 and 78: An Empirical Study on Indian Health

- Page 79 and 80: Table-1: Gross Premium from Busines

- Page 81 and 82: On August 15, 2007, the PrimeMinist

- Page 83 and 84: data collected from the respondents

- Page 85 and 86: Profile, purpose and investingpract

- Page 87 and 88: The Percentage Rank Analysis isappl

- Page 89 and 90: Based on the Average PercentageAnal

- Page 91 and 92: OBJECTIVE-3:To study the factors th

- Page 93 and 94: FUTURE CHANGEEXPECTEDAt present whe

- Page 95 and 96: Random walks in stock market prices

- Page 97 and 98: eported forsome indices.Kok and Lee

- Page 99 and 100: SAMPLEFrom the list of Oil and Gas

- Page 101 and 102: • Barnes, P. (1986) Thin trading

- Page 103 and 104: Thus, this paper has incorporateddi

- Page 105 and 106: hypotheses of the information conte

- Page 107 and 108: The present study addresses itsobje

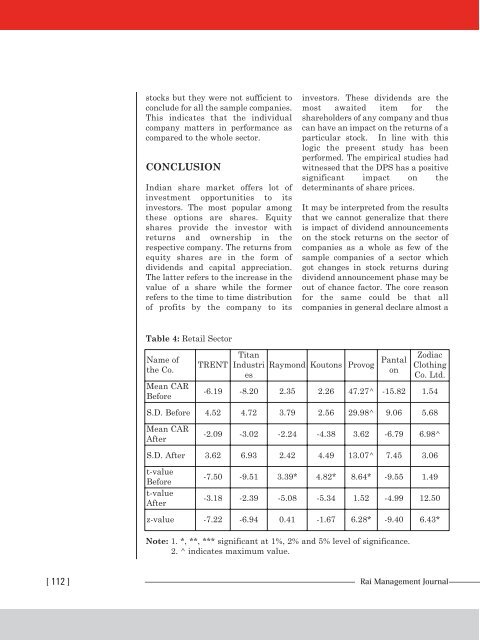

- Page 109 and 110: Deviations are similarly compared i

- Page 111 and 112: The remaining banks did not show an

- Page 113: at this time the Telecom sector had

- Page 118 and 119: Organized retail canbe defined as a

- Page 120 and 121: In the midst of the unorganised ret

- Page 122 and 123: convenience are some of majorattrib

- Page 124 and 125: STATISTICAL ANALYSESThe 475 usable

- Page 126 and 127: The Table 4 gives the 6 extracted f

- Page 128 and 129: The most significant factor thatdet

- Page 130 and 131: • Mulhern, F., and Leone, R., 199

- Page 132 and 133: carefully/exactly identified group

- Page 134 and 135: interaction effects. Variations in

- Page 136 and 137: eduction, indicating that the decli

- Page 138 and 139: Rs.10000 to Rs.20000 prefer maligai

- Page 140 and 141: Table 6: Reason for purchasing at a

- Page 142 and 143: Table 9: Monthly income and frequen

- Page 144 and 145: Once “time spent” by the users

- Page 146 and 147: Out of 200 respondents 111responden

- Page 148 and 149: etail stores are facing.VII. PREFER

- Page 150 and 151: From table 22 it can be inferred th

- Page 152 and 153: Role of Relationship in Pharmaceuti

- Page 154 and 155: Wholesaler, animportantmiddleman fo

- Page 156 and 157: ... a medicalrepresentative needsto

- Page 158 and 159: ole in selling the products. And74(

- Page 160 and 161: On the Basis ofQualificationOut of

- Page 162 and 163: Figure 7Figure 8[ 160 ] Rai Managem

- Page 164 and 165:

Empirical Study On PerformanceMeasu

- Page 166 and 167:

these non- productive assets wasalm

- Page 168 and 169:

Tools for Analysis:First of all the

- Page 170 and 171:

... the commonstrength of theplasti

- Page 172 and 173:

adversely. Thus the common problems

- Page 174 and 175:

• Nimbalkar .B. Chairman & Managi

- Page 176 and 177:

Customersatisfaction and theservice

- Page 178 and 179:

The tourismindustry of Indiahas exp

- Page 180 and 181:

The hotel industryof India is one o

- Page 182 and 183:

Reichheld and sche(2000) embracedth

- Page 184 and 185:

Customersatisfaction is verycrucial

- Page 186 and 187:

2010 and 2020 respectively whichcal

- Page 188 and 189:

• Zineldin, m. (1999), ``explorin

- Page 190:

RNI NO.: DELENG/2004/12383Printed a