Answers to the European Commission on the ... - Eiopa - Europa

Answers to the European Commission on the ... - Eiopa - Europa

Answers to the European Commission on the ... - Eiopa - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Currency risk<br />

B.101 (Currency risk relates <str<strong>on</strong>g>to</str<strong>on</strong>g> b<strong>on</strong>ds, real estate and liabilities and will be<br />

c<strong>on</strong>sidered, provided a given threshold <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> basis of current values is<br />

exceeded. Due <str<strong>on</strong>g>to</str<strong>on</strong>g> difficulties in denominati<strong>on</strong>, fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r analysis is<br />

needed <str<strong>on</strong>g>to</str<strong>on</strong>g> determine whe<str<strong>on</strong>g>the</str<strong>on</strong>g>r currency risk of shares should be<br />

addressed.)<br />

B.102 Currency risk could be addressed through a scenario-based approach.<br />

For <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g>tal foreign currency positi<strong>on</strong>, and taking account of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

applicable investment policy, <str<strong>on</strong>g>the</str<strong>on</strong>g> instituti<strong>on</strong> has <str<strong>on</strong>g>to</str<strong>on</strong>g> determine <str<strong>on</strong>g>the</str<strong>on</strong>g> effect<br />

<strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> surplus of a fall in value of all o<str<strong>on</strong>g>the</str<strong>on</strong>g>r currencies against <str<strong>on</strong>g>the</str<strong>on</strong>g> euro<br />

of for example 25%.<br />

B.103 Alternatively, in a fac<str<strong>on</strong>g>to</str<strong>on</strong>g>r-based approach, risk fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rs may be derived<br />

for different currencies assuming normal distributi<strong>on</strong>s.<br />

Risk c<strong>on</strong>centrati<strong>on</strong>s<br />

B.104 C<strong>on</strong>centrati<strong>on</strong> effects could be taken in<str<strong>on</strong>g>to</str<strong>on</strong>g> account by adjusting risk<br />

fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rs or increasing volume measures. Since c<strong>on</strong>centrati<strong>on</strong> results in<br />

more 'dangerous' distributi<strong>on</strong>s, adjusted risk fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rs might be based <strong>on</strong><br />

higher moments (e.g. skewness). For <str<strong>on</strong>g>the</str<strong>on</strong>g> sake of simplicity of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

standard formula, however, <str<strong>on</strong>g>the</str<strong>on</strong>g> choice of increasing volume measures<br />

appears more practicable. For example, a certain percentage of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

amount of b<strong>on</strong>ds of a single issuer which exceeds a given limit might<br />

be added <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> corresp<strong>on</strong>ding volume measure.<br />

Credit risk<br />

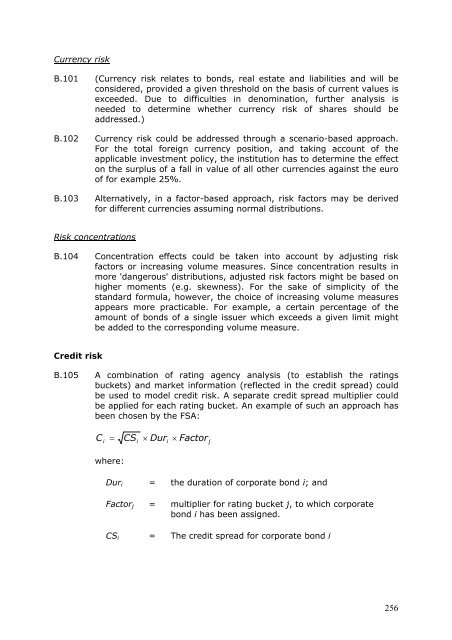

B.105 A combinati<strong>on</strong> of rating agency analysis (<str<strong>on</strong>g>to</str<strong>on</strong>g> establish <str<strong>on</strong>g>the</str<strong>on</strong>g> ratings<br />

buckets) and market informati<strong>on</strong> (reflected in <str<strong>on</strong>g>the</str<strong>on</strong>g> credit spread) could<br />

be used <str<strong>on</strong>g>to</str<strong>on</strong>g> model credit risk. A separate credit spread multiplier could<br />

be applied for each rating bucket. An example of such an approach has<br />

been chosen by <str<strong>on</strong>g>the</str<strong>on</strong>g> FSA:<br />

C = CS × Dur × Fac<str<strong>on</strong>g>to</str<strong>on</strong>g>r<br />

i<br />

where:<br />

i<br />

i<br />

j<br />

Duri = <str<strong>on</strong>g>the</str<strong>on</strong>g> durati<strong>on</strong> of corporate b<strong>on</strong>d i; and<br />

Fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rj = multiplier for rating bucket j, <str<strong>on</strong>g>to</str<strong>on</strong>g> which corporate<br />

b<strong>on</strong>d i has been assigned.<br />

CSi = The credit spread for corporate b<strong>on</strong>d i<br />

256