Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

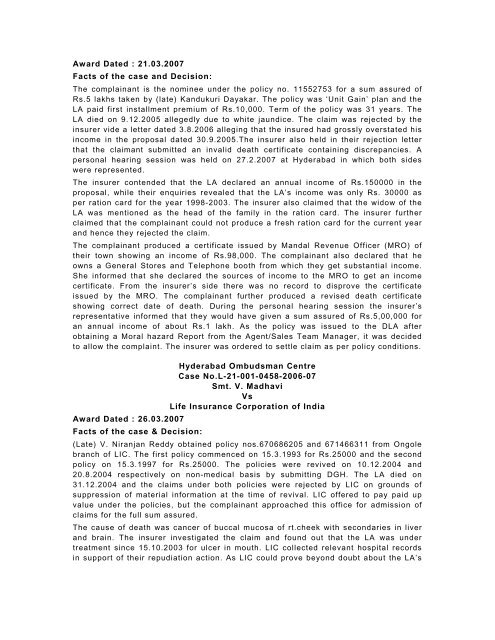

Award Dated : 21.03.2007Facts of the case and Decision:The <strong>co</strong>mpla<strong>in</strong>ant is the nom<strong>in</strong>ee under the policy no. 11552753 for a sum assured ofRs.5 lakhs taken by (late) Kandukuri Dayakar. The policy was ‘Unit Ga<strong>in</strong>’ plan and theLA paid first <strong>in</strong>stallment premium of Rs.10,000. Term of the policy was 31 years. TheLA died on 9.12.2005 allegedly due to white jaundice. The claim was rejected by the<strong>in</strong>surer vide a letter dated 3.8.2006 alleg<strong>in</strong>g that the <strong>in</strong>sured had grossly overstated his<strong>in</strong><strong>co</strong>me <strong>in</strong> the proposal dated 30.9.2005.The <strong>in</strong>surer also held <strong>in</strong> their rejection letterthat the claimant submitted an <strong>in</strong>valid death certificate <strong>co</strong>nta<strong>in</strong><strong>in</strong>g discrepancies. Apersonal hear<strong>in</strong>g session was held on 27.2.2007 at Hyderabad <strong>in</strong> which both sideswere represented.The <strong>in</strong>surer <strong>co</strong>ntended that the LA declared an annual <strong>in</strong><strong>co</strong>me of Rs.150000 <strong>in</strong> theproposal, while their enquiries revealed that the LA’s <strong>in</strong><strong>co</strong>me was only Rs. 30000 asper ration card for the year 1998-2003. The <strong>in</strong>surer also claimed that the widow of theLA was mentioned as the head of the family <strong>in</strong> the ration card. The <strong>in</strong>surer furtherclaimed that the <strong>co</strong>mpla<strong>in</strong>ant <strong>co</strong>uld not produce a fresh ration card for the current yearand hence they rejected the claim.The <strong>co</strong>mpla<strong>in</strong>ant produced a certificate issued by Mandal Revenue Officer (MRO) oftheir town show<strong>in</strong>g an <strong>in</strong><strong>co</strong>me of Rs.98,000. The <strong>co</strong>mpla<strong>in</strong>ant also declared that heowns a General Stores and Telephone booth from which they get substantial <strong>in</strong><strong>co</strong>me.She <strong>in</strong>formed that she declared the sources of <strong>in</strong><strong>co</strong>me to the MRO to get an <strong>in</strong><strong>co</strong>mecertificate. From the <strong>in</strong>surer’s side there was no re<strong>co</strong>rd to disprove the certificateissued by the MRO. The <strong>co</strong>mpla<strong>in</strong>ant further produced a revised death certificateshow<strong>in</strong>g <strong>co</strong>rrect date of death. Dur<strong>in</strong>g the personal hear<strong>in</strong>g session the <strong>in</strong>surer’srepresentative <strong>in</strong>formed that they would have given a sum assured of Rs.5,00,000 foran annual <strong>in</strong><strong>co</strong>me of about Rs.1 lakh. As the policy was issued to the DLA afterobta<strong>in</strong><strong>in</strong>g a Moral hazard Report from the Agent/Sales Team Manager, it was decidedto allow the <strong>co</strong>mpla<strong>in</strong>t. The <strong>in</strong>surer was ordered to settle claim as per policy <strong>co</strong>nditions.Hyderabad Ombudsman CentreCase No.L-21-001-0458-2006-07Smt. V. MadhaviVsLife Insurance Corporation of IndiaAward Dated : 26.03.2007Facts of the case & Decision:(Late) V. Niranjan Reddy obta<strong>in</strong>ed policy nos.670686205 and 671466311 from Ongolebranch of LIC. The first policy <strong>co</strong>mmenced on 15.3.1993 for Rs.25000 and the se<strong>co</strong>ndpolicy on 15.3.1997 for Rs.25000. The policies were revived on 10.12.2004 and20.8.2004 respectively on non-medical basis by submitt<strong>in</strong>g DGH. The LA died on31.12.2004 and the claims under both policies were rejected by LIC on grounds ofsuppression of material <strong>in</strong>formation at the time of revival. LIC offered to pay paid upvalue under the policies, but the <strong>co</strong>mpla<strong>in</strong>ant approached this office for admission ofclaims for the full sum assured.The cause of death was cancer of buccal mu<strong>co</strong>sa of rt.cheek with se<strong>co</strong>ndaries <strong>in</strong> liverand bra<strong>in</strong>. The <strong>in</strong>surer <strong>in</strong>vestigated the claim and found out that the LA was undertreatment s<strong>in</strong>ce 15.10.2003 for ulcer <strong>in</strong> mouth. LIC <strong>co</strong>llected relevant hospital re<strong>co</strong>rds<strong>in</strong> support of their repudiation action. As LIC <strong>co</strong>uld prove beyond doubt about the LA’s