Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

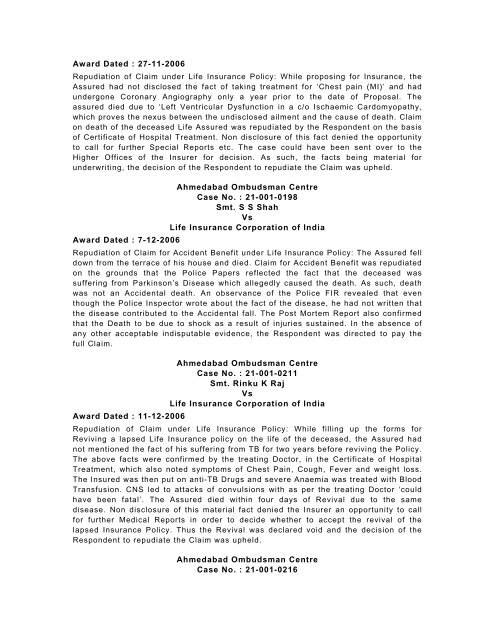

Award Dated : 27-11-2006Repudiation of <strong>Claim</strong> under Life Insurance Policy: While propos<strong>in</strong>g for Insurance, theAssured had not disclosed the fact of tak<strong>in</strong>g treatment for ‘Chest pa<strong>in</strong> (MI)’ and hadundergone Coronary Angiography only a year prior to the date of Proposal. Theassured died due to ‘Left Ventricular Dysfunction <strong>in</strong> a c/o Ischaemic Cardomyopathy,which proves the nexus between the undisclosed ailment and the cause of death. <strong>Claim</strong>on death of the deceased Life Assured was repudiated by the Respondent on the basisof Certificate of Hospital Treatment. Non disclosure of this fact denied the opportunityto call for further Special Reports etc. The case <strong>co</strong>uld have been sent over to theHigher Offices of the Insurer for decision. As such, the facts be<strong>in</strong>g material forunderwrit<strong>in</strong>g, the decision of the Respondent to repudiate the <strong>Claim</strong> was upheld.Ahmedabad Ombudsman CentreCase No. : 21-001-0198Smt. S S ShahVsLife Insurance Corporation of IndiaAward Dated : 7-12-2006Repudiation of <strong>Claim</strong> for Accident Benefit under Life Insurance Policy: The Assured felldown from the terrace of his house and died. <strong>Claim</strong> for Accident Benefit was repudiatedon the grounds that the Police Papers reflected the fact that the deceased wassuffer<strong>in</strong>g from Park<strong>in</strong>son’s Disease which allegedly caused the death. As such, deathwas not an Accidental death. An observance of the Police FIR revealed that eventhough the Police Inspector wrote about the fact of the disease, he had not written thatthe disease <strong>co</strong>ntributed to the Accidental fall. The Post Mortem Report also <strong>co</strong>nfirmedthat the <strong>Death</strong> to be due to shock as a result of <strong>in</strong>juries susta<strong>in</strong>ed. In the absence ofany other acceptable <strong>in</strong>disputable evidence, the Respondent was directed to pay thefull <strong>Claim</strong>.Ahmedabad Ombudsman CentreCase No. : 21-001-0211Smt. R<strong>in</strong>ku K RajVsLife Insurance Corporation of IndiaAward Dated : 11-12-2006Repudiation of <strong>Claim</strong> under Life Insurance Policy: While fill<strong>in</strong>g up the forms forReviv<strong>in</strong>g a lapsed Life Insurance policy on the life of the deceased, the Assured hadnot mentioned the fact of his suffer<strong>in</strong>g from TB for two years before reviv<strong>in</strong>g the Policy.The above facts were <strong>co</strong>nfirmed by the treat<strong>in</strong>g Doctor, <strong>in</strong> the Certificate of HospitalTreatment, which also noted symptoms of Chest Pa<strong>in</strong>, Cough, Fever and weight loss.The Insured was then put on anti-TB Drugs and severe Anaemia was treated with BloodTransfusion. CNS led to attacks of <strong>co</strong>nvulsions with as per the treat<strong>in</strong>g Doctor ‘<strong>co</strong>uldhave been fatal’. The Assured died with<strong>in</strong> four days of Revival due to the samedisease. Non disclosure of this material fact denied the Insurer an opportunity to callfor further Medical Reports <strong>in</strong> order to decide whether to accept the revival of thelapsed Insurance Policy. Thus the Revival was declared void and the decision of theRespondent to repudiate the <strong>Claim</strong> was upheld.Ahmedabad Ombudsman CentreCase No. : 21-001-0216