Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

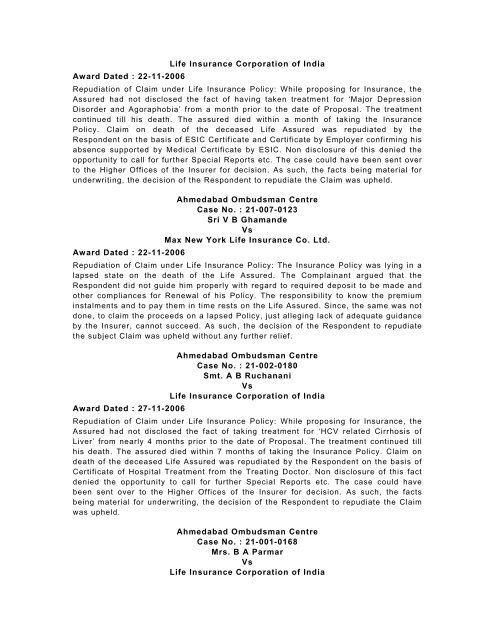

Life Insurance Corporation of IndiaAward Dated : 22-11-2006Repudiation of <strong>Claim</strong> under Life Insurance Policy: While propos<strong>in</strong>g for Insurance, theAssured had not disclosed the fact of hav<strong>in</strong>g taken treatment for ‘Major DepressionDisorder and Agoraphobia’ from a month prior to the date of Proposal. The treatment<strong>co</strong>nt<strong>in</strong>ued till his death. The assured died with<strong>in</strong> a month of tak<strong>in</strong>g the InsurancePolicy. <strong>Claim</strong> on death of the deceased Life Assured was repudiated by theRespondent on the basis of ESIC Certificate and Certificate by Employer <strong>co</strong>nfirm<strong>in</strong>g hisabsence supported by Medical Certificate by ESIC. Non disclosure of this denied theopportunity to call for further Special Reports etc. The case <strong>co</strong>uld have been sent overto the Higher Offices of the Insurer for decision. As such, the facts be<strong>in</strong>g material forunderwrit<strong>in</strong>g, the decision of the Respondent to repudiate the <strong>Claim</strong> was upheld.Ahmedabad Ombudsman CentreCase No. : 21-007-0123Sri V B GhamandeVsMax New York Life Insurance Co. Ltd.Award Dated : 22-11-2006Repudiation of <strong>Claim</strong> under Life Insurance Policy: The Insurance Policy was ly<strong>in</strong>g <strong>in</strong> alapsed state on the death of the Life Assured. The Compla<strong>in</strong>ant argued that theRespondent did not guide him properly with regard to required deposit to be made andother <strong>co</strong>mpliances for Renewal of his Policy. The responsibility to know the premium<strong>in</strong>stalments and to pay them <strong>in</strong> time rests on the Life Assured. S<strong>in</strong>ce, the same was notdone, to claim the proceeds on a lapsed Policy, just alleg<strong>in</strong>g lack of adequate guidanceby the Insurer, cannot succeed. As such, the decision of the Respondent to repudiatethe subject <strong>Claim</strong> was upheld without any further relief.Ahmedabad Ombudsman CentreCase No. : 21-002-0180Smt. A B RuchananiVsLife Insurance Corporation of IndiaAward Dated : 27-11-2006Repudiation of <strong>Claim</strong> under Life Insurance Policy: While propos<strong>in</strong>g for Insurance, theAssured had not disclosed the fact of tak<strong>in</strong>g treatment for ‘HCV related Cirrhosis ofLiver’ from nearly 4 months prior to the date of Proposal. The treatment <strong>co</strong>nt<strong>in</strong>ued tillhis death. The assured died with<strong>in</strong> 7 months of tak<strong>in</strong>g the Insurance Policy. <strong>Claim</strong> ondeath of the deceased Life Assured was repudiated by the Respondent on the basis ofCertificate of Hospital Treatment from the Treat<strong>in</strong>g Doctor. Non disclosure of this factdenied the opportunity to call for further Special Reports etc. The case <strong>co</strong>uld havebeen sent over to the Higher Offices of the Insurer for decision. As such, the factsbe<strong>in</strong>g material for underwrit<strong>in</strong>g, the decision of the Respondent to repudiate the <strong>Claim</strong>was upheld.Ahmedabad Ombudsman CentreCase No. : 21-001-0168Mrs. B A ParmarVsLife Insurance Corporation of India