Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

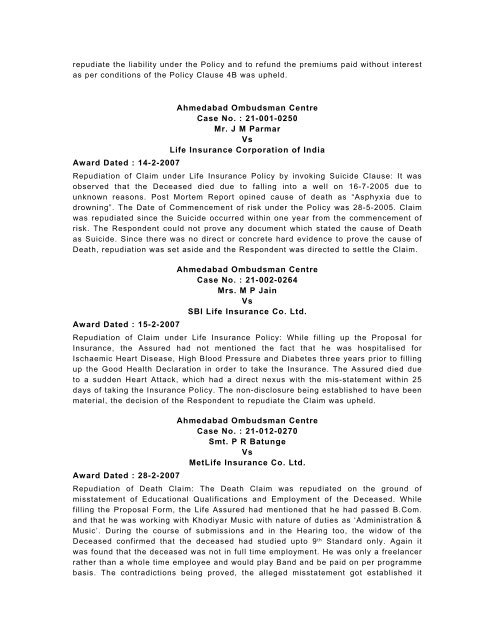

epudiate the liability under the Policy and to refund the premiums paid without <strong>in</strong>terestas per <strong>co</strong>nditions of the Policy Clause 4B was upheld.Ahmedabad Ombudsman CentreCase No. : 21-001-0250Mr. J M ParmarVsLife Insurance Corporation of IndiaAward Dated : 14-2-2007Repudiation of <strong>Claim</strong> under Life Insurance Policy by <strong>in</strong>vok<strong>in</strong>g Suicide Clause: It wasobserved that the Deceased died due to fall<strong>in</strong>g <strong>in</strong>to a well on 16-7-2005 due tounknown reasons. Post Mortem Report op<strong>in</strong>ed cause of death as “Asphyxia due todrown<strong>in</strong>g”. The Date of Commencement of risk under the Policy was 28-5-2005. <strong>Claim</strong>was repudiated s<strong>in</strong>ce the Suicide occurred with<strong>in</strong> one year from the <strong>co</strong>mmencement ofrisk. The Respondent <strong>co</strong>uld not prove any document which stated the cause of <strong>Death</strong>as Suicide. S<strong>in</strong>ce there was no direct or <strong>co</strong>ncrete hard evidence to prove the cause of<strong>Death</strong>, repudiation was set aside and the Respondent was directed to settle the <strong>Claim</strong>.Ahmedabad Ombudsman CentreCase No. : 21-002-0264Mrs. M P Ja<strong>in</strong>VsSBI Life Insurance Co. Ltd.Award Dated : 15-2-2007Repudiation of <strong>Claim</strong> under Life Insurance Policy: While fill<strong>in</strong>g up the Proposal forInsurance, the Assured had not mentioned the fact that he was hospitalised forIschaemic Heart Disease, High Blood Pressure and Diabetes three years prior to fill<strong>in</strong>gup the Good Health Declaration <strong>in</strong> order to take the Insurance. The Assured died dueto a sudden Heart Attack, which had a direct nexus with the mis-statement with<strong>in</strong> 25days of tak<strong>in</strong>g the Insurance Policy. The non-disclosure be<strong>in</strong>g established to have beenmaterial, the decision of the Respondent to repudiate the <strong>Claim</strong> was upheld.Ahmedabad Ombudsman CentreCase No. : 21-012-0270Smt. P R BatungeVsMetLife Insurance Co. Ltd.Award Dated : 28-2-2007Repudiation of <strong>Death</strong> <strong>Claim</strong>: The <strong>Death</strong> <strong>Claim</strong> was repudiated on the ground ofmisstatement of Educational Qualifications and Employment of the Deceased. Whilefill<strong>in</strong>g the Proposal Form, the Life Assured had mentioned that he had passed B.Com.and that he was work<strong>in</strong>g with Khodiyar Music with nature of duties as ‘Adm<strong>in</strong>istration &Music’. Dur<strong>in</strong>g the <strong>co</strong>urse of submissions and <strong>in</strong> the Hear<strong>in</strong>g too, the widow of theDeceased <strong>co</strong>nfirmed that the deceased had studied upto 9 th Standard only. Aga<strong>in</strong> itwas found that the deceased was not <strong>in</strong> full time employment. He was only a freelancerrather than a whole time employee and would play Band and be paid on per programmebasis. The <strong>co</strong>ntradictions be<strong>in</strong>g proved, the alleged misstatement got established it