Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

Death Claim - Gbic.co.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

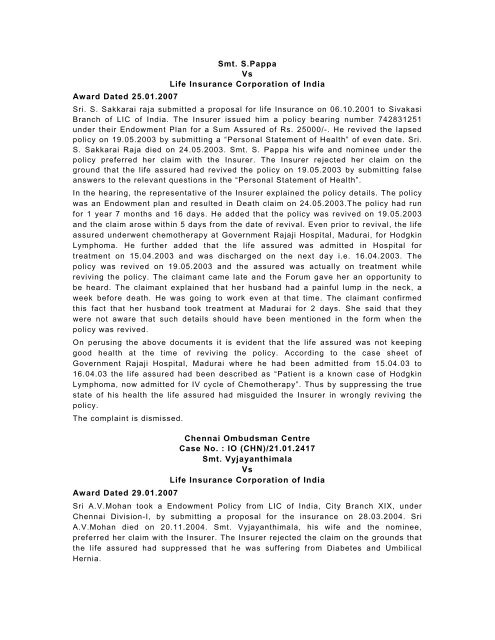

Smt. S.PappaVsLife Insurance Corporation of IndiaAward Dated 25.01.2007Sri. S. Sakkarai raja submitted a proposal for life Insurance on 06.10.2001 to SivakasiBranch of LIC of India. The Insurer issued him a policy bear<strong>in</strong>g number 742831251under their Endowment Plan for a Sum Assured of Rs. 25000/-. He revived the lapsedpolicy on 19.05.2003 by submitt<strong>in</strong>g a “Personal Statement of Health” of even date. Sri.S. Sakkarai Raja died on 24.05.2003. Smt. S. Pappa his wife and nom<strong>in</strong>ee under thepolicy preferred her claim with the Insurer. The Insurer rejected her claim on theground that the life assured had revived the policy on 19.05.2003 by submitt<strong>in</strong>g falseanswers to the relevant questions <strong>in</strong> the “Personal Statement of Health”.In the hear<strong>in</strong>g, the representative of the Insurer expla<strong>in</strong>ed the policy details. The policywas an Endowment plan and resulted <strong>in</strong> <strong>Death</strong> claim on 24.05.2003.The policy had runfor 1 year 7 months and 16 days. He added that the policy was revived on 19.05.2003and the claim arose with<strong>in</strong> 5 days from the date of revival. Even prior to revival, the lifeassured underwent chemotherapy at Government Rajaji Hospital, Madurai, for Hodgk<strong>in</strong>Lymphoma. He further added that the life assured was admitted <strong>in</strong> Hospital fortreatment on 15.04.2003 and was discharged on the next day i.e. 16.04.2003. Thepolicy was revived on 19.05.2003 and the assured was actually on treatment whilereviv<strong>in</strong>g the policy. The claimant came late and the Forum gave her an opportunity tobe heard. The claimant expla<strong>in</strong>ed that her husband had a pa<strong>in</strong>ful lump <strong>in</strong> the neck, aweek before death. He was go<strong>in</strong>g to work even at that time. The claimant <strong>co</strong>nfirmedthis fact that her husband took treatment at Madurai for 2 days. She said that theywere not aware that such details should have been mentioned <strong>in</strong> the form when thepolicy was revived.On perus<strong>in</strong>g the above documents it is evident that the life assured was not keep<strong>in</strong>ggood health at the time of reviv<strong>in</strong>g the policy. Ac<strong>co</strong>rd<strong>in</strong>g to the case sheet ofGovernment Rajaji Hospital, Madurai where he had been admitted from 15.04.03 to16.04.03 the life assured had been described as “Patient is a known case of Hodgk<strong>in</strong>Lymphoma, now admitted for IV cycle of Chemotherapy”. Thus by suppress<strong>in</strong>g the truestate of his health the life assured had misguided the Insurer <strong>in</strong> wrongly reviv<strong>in</strong>g thepolicy.The <strong>co</strong>mpla<strong>in</strong>t is dismissed.Chennai Ombudsman CentreCase No. : IO (CHN)/21.01.2417Smt. VyjayanthimalaVsLife Insurance Corporation of IndiaAward Dated 29.01.2007Sri A.V.Mohan took a Endowment Policy from LIC of India, City Branch XIX, underChennai Division-I, by submitt<strong>in</strong>g a proposal for the <strong>in</strong>surance on 28.03.2004. SriA.V.Mohan died on 20.11.2004. Smt. Vyjayanthimala, his wife and the nom<strong>in</strong>ee,preferred her claim with the Insurer. The Insurer rejected the claim on the grounds thatthe life assured had suppressed that he was suffer<strong>in</strong>g from Diabetes and UmbilicalHernia.