2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

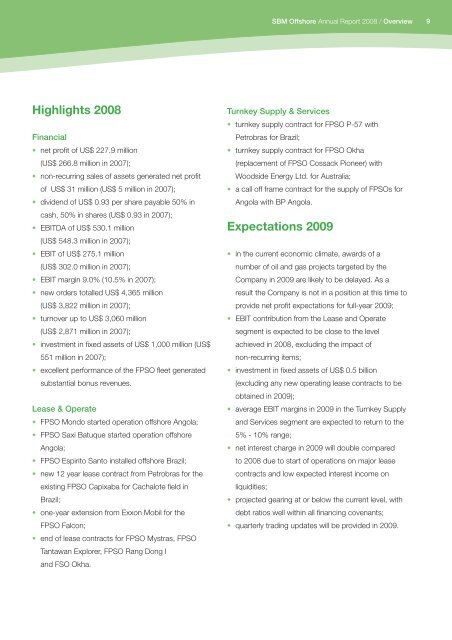

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Overview9Highlights <strong>2008</strong>Financial• net profit of US$ 227.9 million(US$ 266.8 million in 2007);• non-recurring sales of assets generated net profitof US$ 31 million (US$ 5 million in 2007);• dividend of US$ 0.93 per share payable 50% incash, 50% in shares (US$ 0.93 in 2007);• EBITDA of US$ 530.1 million(US$ 548.3 million in 2007);• EBIT of US$ 275.1 million(US$ 302.0 million in 2007);• EBIT margin 9.0% (10.5% in 2007);• new orders totalled US$ 4,365 million(US$ 3,822 million in 2007);• turnover up to US$ 3,060 million(US$ 2,871 million in 2007);• investment in fixed assets of US$ 1,000 million (US$551 million in 2007);• excellent performance of the FPSO fleet generatedsubstantial bonus revenues.Lease & Operate• FPSO Mondo started operation offshore Angola;• FPSO Saxi Batuque started operation offshoreAngola;• FPSO Espirito Santo installed offshore Brazil;• new 12 year lease contract from Petrobras for theexisting FPSO Capixaba for Cachalote field inBrazil;• one-year extension from Exxon Mobil for theFPSO Falcon;• end of lease contracts for FPSO Mystras, FPSOTantawan Explorer, FPSO Rang Dong Iand FSO Okha.Turnkey Supply & Services• turnkey supply contract for FPSO P-57 withPetrobras for Brazil;• turnkey supply contract for FPSO Okha(replacement of FPSO Cossack Pioneer) withWoodside Energy Ltd. for Australia;• a call off frame contract for the supply of FPSOs forAngola with BP Angola.Expectations 2009• in the current economic climate, awards of anumber of oil and gas projects targeted by theCompany in 2009 are likely to be delayed. As aresult the Company is not in a position at this time toprovide net profit expectations for full-year 2009;• EBIT contribution from the Lease and Operatesegment is expected to be close to the levelachieved in <strong>2008</strong>, excluding the impact ofnon-recurring items;• investment in fixed assets of US$ 0.5 billion(excluding any new operating lease contracts to beobtained in 2009);• average EBIT margins in 2009 in the Turnkey Supplyand Services segment are expected to return to the5% - 10% range;• net interest charge in 2009 will double comparedto <strong>2008</strong> due to start of operations on major leasecontracts and low expected interest income onliquidities;• projected gearing at or below the current level, withdebt ratios well within all financing covenants;• quarterly trading updates will be provided in 2009.