2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

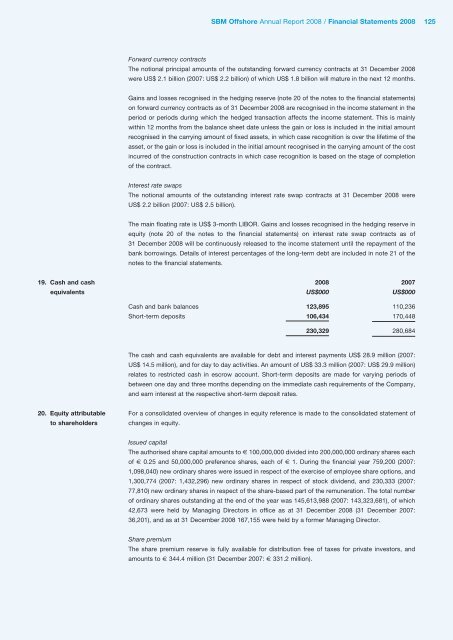

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong> 125Forward currency contractsThe notional principal amounts of the outstanding forward currency contracts at 31 December <strong>2008</strong>were US$ 2.1 billion (2007: US$ 2.2 billion) of which US$ 1.8 billion will mature in the next 12 months.Gains and losses recognised in the hedging reserve (note 20 of the notes to the financial statements)on forward currency contracts as of 31 December <strong>2008</strong> are recognised in the income statement in theperiod or periods during which the hedged transaction affects the income statement. This is mainlywithin 12 months from the balance sheet date unless the gain or loss is included in the initial amountrecognised in the carrying amount of fixed assets, in which case recognition is over the lifetime of theasset, or the gain or loss is included in the initial amount recognised in the carrying amount of the costincurred of the construction contracts in which case recognition is based on the stage of completionof the contract.Interest rate swapsThe notional amounts of the outstanding interest rate swap contracts at 31 December <strong>2008</strong> wereUS$ 2.2 billion (2007: US$ 2.5 billion).The main floating rate is US$ 3-month LIBOR. Gains and losses recognised in the hedging reserve inequity (note 20 of the notes to the financial statements) on interest rate swap contracts as of31 December <strong>2008</strong> will be continuously released to the income statement until the repayment of thebank borrowings. Details of interest percentages of the long-term debt are included in note 21 of thenotes to the financial statements.19. Cash and cash <strong>2008</strong> 2007equivalents US$000 US$000Cash and bank balances 123,895 110,236Short-term deposits 106,434 170,448230,329 280,684The cash and cash equivalents are available for debt and interest payments US$ 28.9 million (2007:US$ 14.5 million), and for day to day activities. An amount of US$ 33.3 million (2007: US$ 29.9 million)relates to restricted cash in escrow account. Short-term deposits are made for varying periods ofbetween one day and three months depending on the immediate cash requirements of the Company,and earn interest at the respective short-term deposit rates.20. Equity attributable For a consolidated overview of changes in equity reference is made to the consolidated statement ofto shareholders changes in equity.Issued capitalThe authorised share capital amounts to € 100,000,000 divided into 200,000,000 ordinary shares eachof € 0.25 and 50,000,000 preference shares, each of € 1. During the financial year 759,200 (2007:1,098,040) new ordinary shares were issued in respect of the exercise of employee share options, and1,300,774 (2007: 1,432,296) new ordinary shares in respect of stock dividend, and 230,333 (2007:77,810) new ordinary shares in respect of the share-based part of the remuneration. The total numberof ordinary shares outstanding at the end of the year was 145,613,988 (2007: 143,323,681), of which42,673 were held by Managing Directors in office as at 31 December <strong>2008</strong> (31 December 2007:36,201), and as at 31 December <strong>2008</strong> 167,155 were held by a former Managing Director.Share premiumThe share premium reserve is fully available for distribution free of taxes for private investors, andamounts to € 344.4 million (31 December 2007: € 331.2 million).