2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

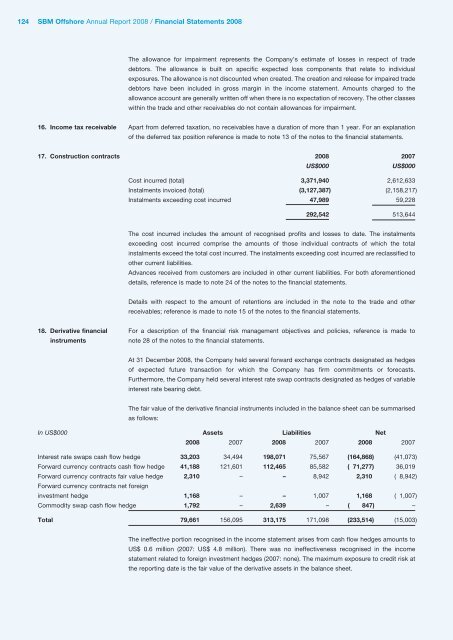

124 <strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong>The allowance for impairment represents the Company’s estimate of losses in respect of tradedebtors. The allowance is built on specific expected loss components that relate to individualexposures. The allowance is not discounted when created. The creation and release for impaired tradedebtors have been included in gross margin in the income statement. Amounts charged to theallowance account are generally written off when there is no expectation of recovery. The other classeswithin the trade and other receivables do not contain allowances for impairment.16. Income tax receivable Apart from deferred taxation, no receivables have a duration of more than 1 year. For an explanationof the deferred tax position reference is made to note 13 of the notes to the financial statements.17. Construction contracts <strong>2008</strong> 2007US$000US$000Cost incurred (total) 3,371,940 2,612,633Instalments invoiced (total) (3,127,387) (2,158,217)Instalments exceeding cost incurred 47,989 59,228292,542 513,644The cost incurred includes the amount of recognised profits and losses to date. The instalmentsexceeding cost incurred comprise the amounts of those individual contracts of which the totalinstalments exceed the total cost incurred. The instalments exceeding cost incurred are reclassified toother current liabilities.Advances received from customers are included in other current liabilities. For both aforementioneddetails, reference is made to note 24 of the notes to the financial statements.Details with respect to the amount of retentions are included in the note to the trade and otherreceivables; reference is made to note 15 of the notes to the financial statements.18. Derivative financial For a description of the financial risk management objectives and policies, reference is made toinstrumentsnote 28 of the notes to the financial statements.At 31 December <strong>2008</strong>, the Company held several forward exchange contracts designated as hedgesof expected future transaction for which the Company has firm commitments or forecasts.Furthermore, the Company held several interest rate swap contracts designated as hedges of variableinterest rate bearing debt.The fair value of the derivative financial instruments included in the balance sheet can be summarisedas follows:In US$000 Assets Liabilities Net<strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007Interest rate swaps cash flow hedge 33,203 34,494 198,071 75,567 (164,868) (41,073)Forward currency contracts cash flow hedge 41,188 121,601 112,465 85,582 ( 71,277) 36,019Forward currency contracts fair value hedge 2,310 – – 8,942 2,310 ( 8,942)Forward currency contracts net foreigninvestment hedge 1,168 – – 1,007 1,168 ( 1,007)Commodity swap cash flow hedge 1,792 – 2,639 – ( 847) –Total 79,661 156,095 313,175 171,098 (233,514) (15,003)The ineffective portion recognised in the income statement arises from cash flow hedges amounts toUS$ 0.6 million (2007: US$ 4.8 million). There was no ineffectiveness recognised in the incomestatement related to foreign investment hedges (2007: none). The maximum exposure to credit risk atthe reporting date is the fair value of the derivative assets in the balance sheet.