2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

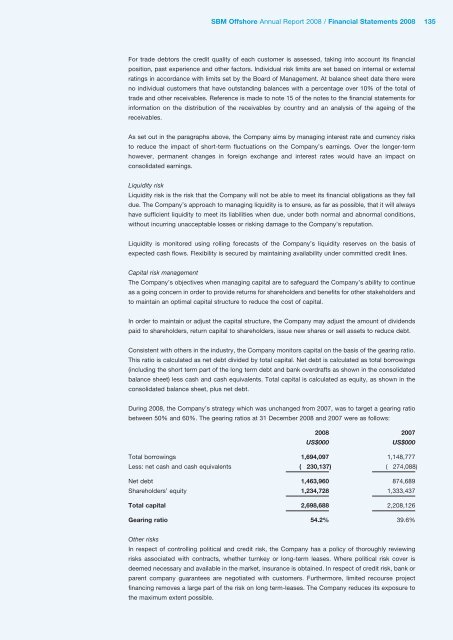

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong> 135For trade debtors the credit quality of each customer is assessed, taking into account its financialposition, past experience and other factors. Individual risk limits are set based on internal or externalratings in accordance with limits set by the Board of Management. At balance sheet date there wereno individual customers that have outstanding balances with a percentage over 10% of the total oftrade and other receivables. Reference is made to note 15 of the notes to the financial statements forinformation on the distribution of the receivables by country and an analysis of the ageing of thereceivables.As set out in the paragraphs above, the Company aims by managing interest rate and currency risksto reduce the impact of short-term fluctuations on the Company’s earnings. Over the longer-termhowever, permanent changes in foreign exchange and interest rates would have an impact onconsolidated earnings.Liquidity riskLiquidity risk is the risk that the Company will not be able to meet its financial obligations as they falldue. The Company’s approach to managing liquidity is to ensure, as far as possible, that it will alwayshave sufficient liquidity to meet its liabilities when due, under both normal and abnormal conditions,without incurring unacceptable losses or risking damage to the Company’s reputation.Liquidity is monitored using rolling forecasts of the Company’s liquidity reserves on the basis ofexpected cash flows. Flexibility is secured by maintaining availability under committed credit lines.Capital risk managementThe Company’s objectives when managing capital are to safeguard the Company’s ability to continueas a going concern in order to provide returns for shareholders and benefits for other stakeholders andto maintain an optimal capital structure to reduce the cost of capital.In order to maintain or adjust the capital structure, the Company may adjust the amount of dividendspaid to shareholders, return capital to shareholders, issue new shares or sell assets to reduce debt.Consistent with others in the industry, the Company monitors capital on the basis of the gearing ratio.This ratio is calculated as net debt divided by total capital. Net debt is calculated as total borrowings(including the short term part of the long term debt and bank overdrafts as shown in the consolidatedbalance sheet) less cash and cash equivalents. Total capital is calculated as equity, as shown in theconsolidated balance sheet, plus net debt.During <strong>2008</strong>, the Company’s strategy which was unchanged from 2007, was to target a gearing ratiobetween 50% and 60%. The gearing ratios at 31 December <strong>2008</strong> and 2007 were as follows:<strong>2008</strong> 2007US$000US$000Total borrowings 1,694,097 1,148,777Less: net cash and cash equivalents ( 230,137) ( 274,088)Net debt 1,463,960 874,689Shareholders’ equity 1,234,728 1,333,437Total capital 2,698,688 2,208,126Gearing ratio 54.2% 39.6%Other risksIn respect of controlling political and credit risk, the Company has a policy of thoroughly reviewingrisks associated with contracts, whether turnkey or long-term leases. Where political risk cover isdeemed necessary and available in the market, insurance is obtained. In respect of credit risk, bank orparent company guarantees are negotiated with customers. Furthermore, limited recourse projectfinancing removes a large part of the risk on long term-leases. The Company reduces its exposure tothe maximum extent possible.