<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong> 13127. Commitments and Under the terms of financing arrangements and as security for credit facilities made available to severalcontingenciessubsidiaries, property of these Group companies has been mortgaged and movable assets and currentassets have been given in lien to the Group’s bankers.At 31 December <strong>2008</strong>, outstanding bank guarantees amounted to US$ 455 million (31 December 2007:US$ 467 million).Certain investment commitments have been entered into principally in respect of the BC-10 FPSO, theThunder Hawk semisubmersible, the Yme MOPUstor, the Cachalote FPSO and EnCana MOPU. Atyear-end the remaining contractual commitments for acquisition of property, plant and equipment andinvestment in leases amounted to US$ 380.3 million (2007: US$ 486.1 million).Certain legal disputes with customers or subcontractors exist. Management is of the opinion thatamounts provided for these disputes are adequate.The obligations in respect of operating lease, rental and leasehold obligations, are as follows:In US$000 <strong>2008</strong> 2007< 1 year 1-5 years > 5 years TotalOperating lease 2,980 5,317 – 8,297 5,195Rental and leasehold 13,462 26,215 5 39,682 49,44116,442 31,532 5 47,979 54,63628. Financial risk This note presents information about the Company’s exposure to risk resulting from its use of financialmanagementinstruments, the Company’s objectives, policies and processes for measuring and managing risk, andthe Company’s management of capital. Further qualitative disclosures are included throughout theseconsolidated financial statements.The Company’s activities expose it to a variety of financial risks, market risk (including currency risk,fair value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk. TheCompany’s overall risk management programme focuses on the unpredictability of financial marketsand seeks to minimise potential adverse effects on the Company’s financial performance. TheCompany uses derivative financial instruments to hedge certain risk exposures. The Company buysand sells derivatives in the ordinary course of business, and also incurs financial liabilities, in order tomanage market risks. All such transactions are carried out within the guidelines set by the Board ofManagement. Generally the Company seeks to apply hedge accounting in order to manage volatilityin the profit and loss account. The purpose is to manage the interest rate and currency risk arising fromthe Company’s operations and its sources of finance. Derivatives are only used to hedge closelycorrelated underlying business transactions.The Company’s principal financial instruments, other than derivatives, comprise trade debtors andcreditors, bank loans and overdraft, cash and cash equivalents (including short term deposits) andfinancial guarantees. The main purpose of these financial instruments is to finance the Company’soperations and/or result directly from the operations.Risk management is carried out by a central treasury department under policies approved by theBoard of Management and the Supervisory Board. Treasury identifies, evaluates and hedges financialrisks in close co-operation with the subsidiaries and the CFO. The Board provides written principlesfor overall risk management, as well as written policies covering specific areas, such as foreignexchange risk, interest rate risk, credit risk, use of derivative financial instruments and non-derivativefinancial instruments, and investment of excess liquidity. It is, and has been throughout the year underreview, the Company’s policy that no trading in financial instruments shall be undertaken. The mainrisks arising from the Company’s financial instruments are market risk, liquidity risk and credit risks.

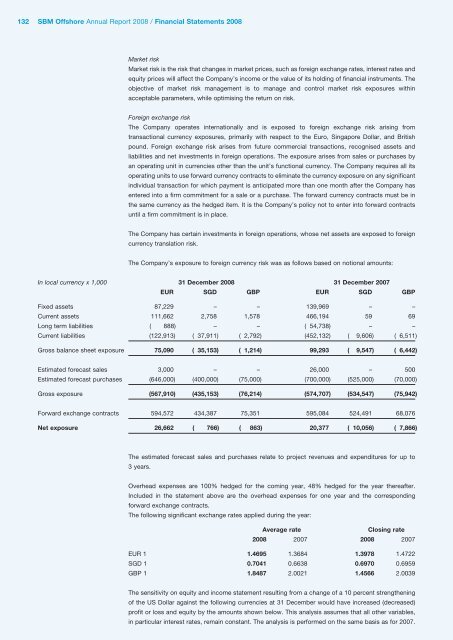

132 <strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong>Market riskMarket risk is the risk that changes in market prices, such as foreign exchange rates, interest rates andequity prices will affect the Company’s income or the value of its holding of financial instruments. Theobjective of market risk management is to manage and control market risk exposures withinacceptable parameters, while optimising the return on risk.Foreign exchange riskThe Company operates internationally and is exposed to foreign exchange risk arising fromtransactional currency exposures, primarily with respect to the Euro, Singapore Dollar, and Britishpound. Foreign exchange risk arises from future commercial transactions, recognised assets andliabilities and net investments in foreign operations. The exposure arises from sales or purchases byan operating unit in currencies other than the unit’s functional currency. The Company requires all itsoperating units to use forward currency contracts to eliminate the currency exposure on any significantindividual transaction for which payment is anticipated more than one month after the Company hasentered into a firm commitment for a sale or a purchase. The forward currency contracts must be inthe same currency as the hedged item. It is the Company’s policy not to enter into forward contractsuntil a firm commitment is in place.The Company has certain investments in foreign operations, whose net assets are exposed to foreigncurrency translation risk.The Company’s exposure to foreign currency risk was as follows based on notional amounts:In local currency x 1,000 31 December <strong>2008</strong> 31 December 2007EUR SGD GBP EUR SGD GBPFixed assets 87,229 – – 139,969 – –Current assets 111,662 2,758 1,578 466,194 59 69Long term liabilities ( 888) – – ( 54,738) – –Current liabilities (122,913) ( 37,911) ( 2,792) (452,132) ( 9,606) ( 6,511)Gross balance sheet exposure 75,090 ( 35,153) ( 1,214) 99,293 ( 9,547) ( 6,442)Estimated forecast sales 3,000 – – 26,000 – 500Estimated forecast purchases (646,000) (400,000) (75,000) (700,000) (525,000) (70,000)Gross exposure (567,910) (435,153) (76,214) (574,707) (534,547) (75,942)Forward exchange contracts 594,572 434,387 75,351 595,084 524,491 68,076Net exposure 26,662 ( 766) ( 863) 20,377 ( 10,056) ( 7,866)The estimated forecast sales and purchases relate to project revenues and expenditures for up to3 years.Overhead expenses are 100% hedged for the coming year, 48% hedged for the year thereafter.Included in the statement above are the overhead expenses for one year and the correspondingforward exchange contracts.The following significant exchange rates applied during the year:Average rateClosing rate<strong>2008</strong> 2007 <strong>2008</strong> 2007EUR 1 1.4695 1.3684 1.3978 1.4722SGD 1 0.7041 0.6638 0.6970 0.6959GBP 1 1.8487 2.0021 1.4566 2.0039The sensitivity on equity and income statement resulting from a change of a 10 percent strengtheningof the US Dollar against the following currencies at 31 December would have increased (decreased)profit or loss and equity by the amounts shown below. This analysis assumes that all other variables,in particular interest rates, remain constant. The analysis is performed on the same basis as for 2007.