2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

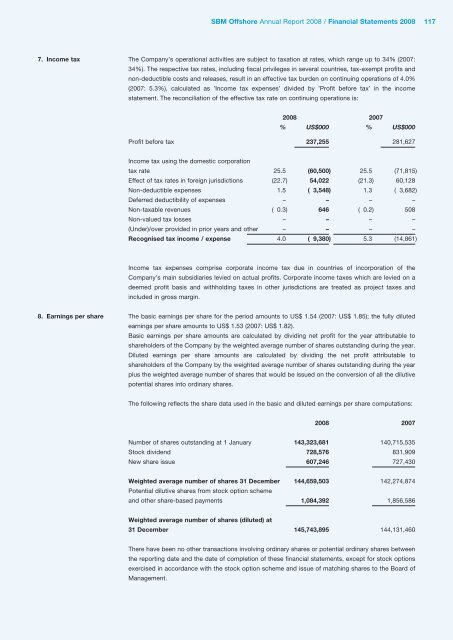

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong> 1177. Income tax The Company’s operational activities are subject to taxation at rates, which range up to 34% (2007:34%). The respective tax rates, including fiscal privileges in several countries, tax-exempt profits andnon-deductible costs and releases, result in an effective tax burden on continuing operations of 4.0%(2007: 5.3%), calculated as ’Income tax expenses’ divided by ’Profit before tax’ in the incomestatement. The reconciliation of the effective tax rate on continuing operations is:<strong>2008</strong> 2007% US$000 % US$000Profit before tax 237,255 281,627Income tax using the domestic corporationtax rate 25.5 (60,500) 25.5 (71,815)Effect of tax rates in foreign jurisdictions (22.7) 54,022 (21.3) 60,128Non-deductible expenses 1.5 ( 3,548) 1.3 ( 3,682)Deferred deductibility of expenses – – – –Non-taxable revenues ( 0.3) 646 ( 0.2) 508Non-valued tax losses – – – –(Under)/over provided in prior years and other – – – –Recognised tax income / expense 4.0 ( 9,380) 5.3 (14,861)Income tax expenses comprise corporate income tax due in countries of incorporation of theCompany’s main subsidiaries levied on actual profits. Corporate income taxes which are levied on adeemed profit basis and withholding taxes in other jurisdictions are treated as project taxes andincluded in gross margin.8. Earnings per share The basic earnings per share for the period amounts to US$ 1.54 (2007: US$ 1.85); the fully dilutedearnings per share amounts to US$ 1.53 (2007: US$ 1.82).Basic earnings per share amounts are calculated by dividing net profit for the year attributable toshareholders of the Company by the weighted average number of shares outstanding during the year.Diluted earnings per share amounts are calculated by dividing the net profit attributable toshareholders of the Company by the weighted average number of shares outstanding during the yearplus the weighted average number of shares that would be issued on the conversion of all the dilutivepotential shares into ordinary shares.The following reflects the share data used in the basic and diluted earnings per share computations:<strong>2008</strong> 2007Number of shares outstanding at 1 January 143,323,681 140,715,535Stock dividend 728,576 831,909New share issue 607,246 727,430Weighted average number of shares 31 December 144,659,503 142,274,874Potential dilutive shares from stock option schemeand other share-based payments 1,084,392 1,856,586Weighted average number of shares (diluted) at31 December 145,743,895 144,131,460There have been no other transactions involving ordinary shares or potential ordinary shares betweenthe reporting date and the date of completion of these financial statements, except for stock optionsexercised in accordance with the stock option scheme and issue of matching shares to the Board ofManagement.