2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

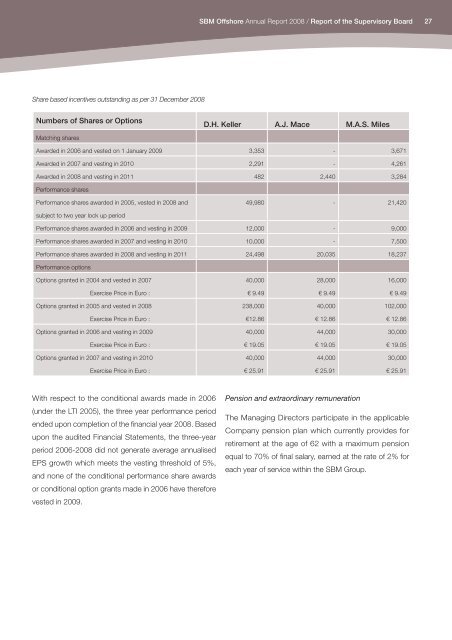

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / <strong>Report</strong> of the Supervisory Board27Share based incentives outstanding as per 31 December <strong>2008</strong>Numbers of Shares or OptionsD.H. Keller A.J. Mace M.A.S. MilesMatching sharesAwarded in 2006 and vested on 1 January 2009 3,353 - 3,671Awarded in 2007 and vesting in 2010 2,291 - 4,261Awarded in <strong>2008</strong> and vesting in 2011 482 2,440 3,284Performance sharesPerformance shares awarded in 2005, vested in <strong>2008</strong> and49,980 - 21,420subject to two year lock up periodPerformance shares awarded in 2006 and vesting in 2009 12,000 - 9,000Performance shares awarded in 2007 and vesting in 2010 10,000 - 7,500Performance shares awarded in <strong>2008</strong> and vesting in 2011 24,498 20,035 18,237Performance optionsOptions granted in 2004 and vested in 200740,00028,00016,000Exercise Price in Euro :€ 9.49€ 9.49€ 9.49Options granted in 2005 and vested in <strong>2008</strong>238,00040,000102,000Exercise Price in Euro :€12.86€ 12.86€ 12.86Options granted in 2006 and vesting in 200940,00044,00030,000Exercise Price in Euro :€ 19.05€ 19.05€ 19.05Options granted in 2007 and vesting in 201040,00044,00030,000Exercise Price in Euro :€ 25.91€ 25.91€ 25.91With respect to the conditional awards made in 2006(under the LTI 2005), the three year performance periodended upon completion of the financial year <strong>2008</strong>. Basedupon the audited Financial Statements, the three-yearperiod 2006-<strong>2008</strong> did not generate average annualisedEPS growth which meets the vesting threshold of 5%,and none of the conditional performance share awardsor conditional option grants made in 2006 have thereforevested in 2009.Pension and extraordinary remunerationThe Managing Directors participate in the applicableCompany pension plan which currently provides forretirement at the age of 62 with a maximum pensionequal to 70% of final salary, earned at the rate of 2% foreach year of service within the <strong>SBM</strong> Group.