2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

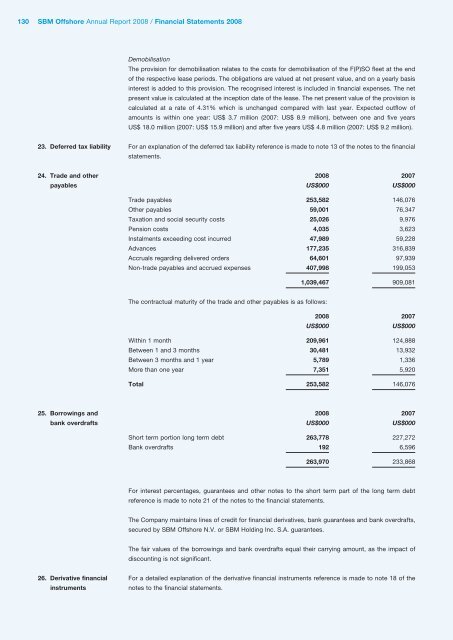

130<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong>DemobilisationThe provision for demobilisation relates to the costs for demobilisation of the F(P)SO fleet at the endof the respective lease periods. The obligations are valued at net present value, and on a yearly basisinterest is added to this provision. The recognised interest is included in financial expenses. The netpresent value is calculated at the inception date of the lease. The net present value of the provision iscalculated at a rate of 4.31% which is unchanged compared with last year. Expected outflow ofamounts is within one year: US$ 3.7 million (2007: US$ 8.9 million), between one and five yearsUS$ 18.0 million (2007: US$ 15.9 million) and after five years US$ 4.8 million (2007: US$ 9.2 million).23. Deferred tax liability For an explanation of the deferred tax liability reference is made to note 13 of the notes to the financialstatements.24. Trade and other <strong>2008</strong> 2007payables US$000 US$000Trade payables 253,582 146,076Other payables 59,001 76,347Taxation and social security costs 25,026 9,976Pension costs 4,035 3,623Instalments exceeding cost incurred 47,989 59,228Advances 177,235 316,839Accruals regarding delivered orders 64,601 97,939Non-trade payables and accrued expenses 407,998 199,0531,039,467 909,081The contractual maturity of the trade and other payables is as follows:<strong>2008</strong> 2007US$000US$000Within 1 month 209,961 124,888Between 1 and 3 months 30,481 13,932Between 3 months and 1 year 5,789 1,336More than one year 7,351 5,920Total 253,582 146,07625. Borrowings and <strong>2008</strong> 2007bank overdrafts US$000 US$000Short term portion long term debt 263,778 227,272Bank overdrafts 192 6,596263,970 233,868For interest percentages, guarantees and other notes to the short term part of the long term debtreference is made to note 21 of the notes to the financial statements.The Company maintains lines of credit for financial derivatives, bank guarantees and bank overdrafts,secured by <strong>SBM</strong> <strong>Offshore</strong> N.V. or <strong>SBM</strong> Holding Inc. S.A. guarantees.The fair values of the borrowings and bank overdrafts equal their carrying amount, as the impact ofdiscounting is not significant.26. Derivative financial For a detailed explanation of the derivative financial instruments reference is made to note 18 of theinstrumentsnotes to the financial statements.