<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong> 133In US$000 Profit or loss Equity10 percent 10 percent 10 percent 10 percentincrease decrease increase decrease31 December <strong>2008</strong>EUR (273) 273 (12,190) 12,190SGD ( 67) 67 ( 1,119) 1,119GBP ( 55) 55 ( 2,108) 2,10831 December 2007 *EUR (420) 420 ( 5,631) 5,631SGD 7 ( 7) ( 1,825) 1,825GBP ( 84) 84 ( 600) 600* The 2007 equity impact is restated for comparison purposes.Interest rate riskThe Company’s exposure to risk for changes in market interest rates relates primarily to theCompany’s long-term debt obligations with a floating interest rate. In respect of controlling interestrate risk, the floating interest rates of long-term loans are hedged by fixed rate swaps for the entirematurity period. The revolving credit facility is intended for fluctuating needs of construction financingof facilities and bears interest at floating rates, which is also swapped for fixed rates when exposureis significant.At the reporting date the interest rate profile of the Company’s interest-bearing financial instrumentswas:<strong>2008</strong> 2007US$000US$000Fixed rate instrumentsFinancial assets 351,553 20,747Financial liabilities ( 27,025) ( 7,209)324,528 13,538Variable rate instrumentsFinancial assets 127,035 77,538Financial liabilities (1,578,145) (1,141,568)Financial liabilities (future) ( 759,097) (1,461,500)(2,210,207) (2,525,530)<strong>2008</strong> 2007US$000US$000Variable rate instruments (2,210,207) (2,525,530)Less: IRS contracts 2,225,353 2,537,012Exposure 15,146 11,482At 31 December <strong>2008</strong>, it is estimated that a general increase of 100 basis points in interest rates woulddecrease the Company’s profit before tax for the year by approximately US$ (0.1) million (2007:decrease of US$ 0.4 million) since 103.2% (2007: 98.7%) of the operating debt is hedged by fixedinterest rate swaps.The sensitivity on equity and income statement resulting from a change of 100 basis points in interestrates at the reporting date would have increased (decreased) equity and profit or loss by the amountsshown below. This analysis assumes that all other variables, in particular foreign currency rates, remainconstant. The analysis is performed on the same basis as for 2007.

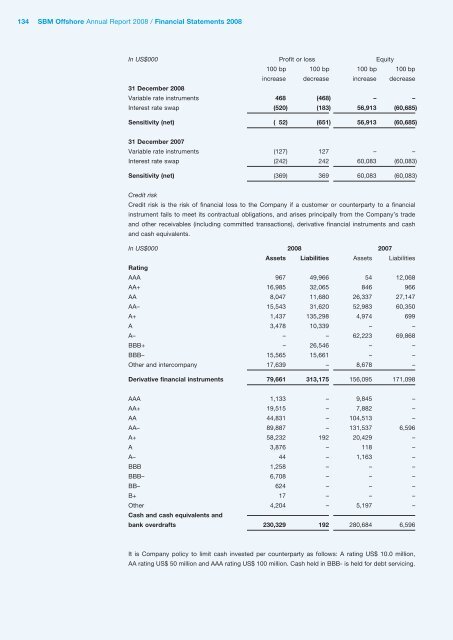

134<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / Financial Statements <strong>2008</strong>In US$000 Profit or loss Equity100 bp 100 bp 100 bp 100 bpincrease decrease increase decrease31 December <strong>2008</strong>Variable rate instruments 468 (468) – –Interest rate swap (520) (183) 56,913 (60,685)Sensitivity (net) ( 52) (651) 56,913 (60,685)31 December 2007Variable rate instruments (127) 127 – –Interest rate swap (242) 242 60,083 (60,083)Sensitivity (net) (369) 369 60,083 (60,083)Credit riskCredit risk is the risk of financial loss to the Company if a customer or counterparty to a financialinstrument fails to meet its contractual obligations, and arises principally from the Company’s tradeand other receivables (including committed transactions), derivative financial instruments and cashand cash equivalents.In US$000 <strong>2008</strong> 2007Assets Liabilities Assets LiabilitiesRatingAAA 967 49,966 54 12,068AA+ 16,985 32,065 846 966AA 8,047 11,680 26,337 27,147AA– 15,543 31,620 52,983 60,350A+ 1,437 135,298 4,974 699A 3,478 10,339 – –A– – – 62,223 69,868BBB+ – 26,546 – –BBB– 15,565 15,661 – –Other and intercompany 17,639 – 8,678 –Derivative financial instruments 79,661 313,175 156,095 171,098AAA 1,133 – 9,845 –AA+ 19,515 – 7,882 –AA 44,831 – 104,513 –AA– 89,887 – 131,537 6,596A+ 58,232 192 20,429 –A 3,876 – 118 –A– 44 – 1,163 –BBB 1,258 – – –BBB– 6,708 – – –BB– 624 – – –B+ 17 – – –Other 4,204 – 5,197 –Cash and cash equivalents andbank overdrafts 230,329 192 280,684 6,596It is Company policy to limit cash invested per counterparty as follows: A rating US$ 10.0 million,AA rating US$ 50 million and AAA rating US$ 100 million. Cash held in BBB- is held for debt servicing.