2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

2008 Annual Report - SBM Offshore

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

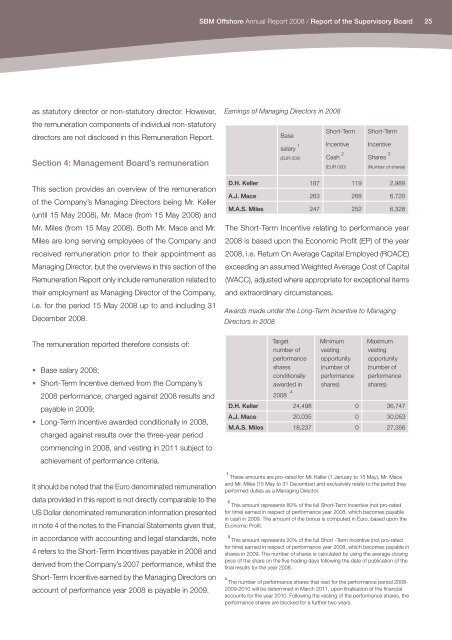

<strong>SBM</strong> <strong>Offshore</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> / <strong>Report</strong> of the Supervisory Board25as statutory director or non-statutory director. However,the remuneration components of individual non-statutorydirectors are not disclosed in this Remuneration <strong>Report</strong>.Section 4: Management Board’s remunerationEarnings of Managing Directors in <strong>2008</strong>Short-TermBasesalary 1 Incentive(EUR 000) Cash 2(EUR 000)Short-TermIncentiveShares 3(Number of shares)This section provides an overview of the remunerationof the Company’s Managing Directors being Mr. Keller(until 15 May <strong>2008</strong>), Mr. Mace (from 15 May <strong>2008</strong>) andMr. Miles (from 15 May <strong>2008</strong>). Both Mr. Mace and Mr.Miles are long serving employees of the Company andreceived remuneration prior to their appointment asManaging Director, but the overviews in this section of theRemuneration <strong>Report</strong> only include remuneration related totheir employment as Managing Director of the Company,i.e. for the period 15 May <strong>2008</strong> up to and including 31December <strong>2008</strong>.The remuneration reported therefore consists of:• Base salary <strong>2008</strong>;• Short-Term Incentive derived from the Company’s<strong>2008</strong> performance, charged against <strong>2008</strong> results andpayable in 2009;• Long-Term Incentive awarded conditionally in <strong>2008</strong>,charged against results over the three-year periodcommencing in <strong>2008</strong>, and vesting in 2011 subject toachievement of performance criteria.It should be noted that the Euro denominated remunerationdata provided in this report is not directly comparable to theUS Dollar denominated remuneration information presentedin note 4 of the notes to the Financial Statements given that,in accordance with accounting and legal standards, note4 refers to the Short-Term Incentives payable in <strong>2008</strong> andderived from the Company’s 2007 performance, whilst theShort-Term Incentive earned by the Managing Directors onaccount of performance year <strong>2008</strong> is payable in 2009.D.H. Keller 187 119 2,989A.J. Mace 263 268 6,720M.A.S. Miles 247 252 6,328The Short-Term Incentive relating to performance year<strong>2008</strong> is based upon the Economic Profit (EP) of the year<strong>2008</strong>, i.e. Return On Average Capital Employed (ROACE)exceeding an assumed Weighted Average Cost of Capital(WACC), adjusted where appropriate for exceptional itemsand extraordinary circumstances.Awards made under the Long-Term Incentive to ManagingDirectors in <strong>2008</strong>MinimumTargetMaximum<strong>2008</strong> 4number ofperformancesharesconditionallyawarded investingopportunity(number ofperformanceshares)vestingopportunity(number ofperformanceshares)D.H. Keller 24,498 0 36,747A.J. Mace 20,035 0 30,053M.A.S. Miles 18,237 0 27,3561 These amounts are pro-rated for Mr. Keller (1 January to 15 May), Mr. Maceand Mr. Miles (15 May to 31 December) and exclusively relate to the period theyperformed duties as a Managing Director.2 This amount represents 80% of the full Short-Term Incentive (not pro-ratedfor time) earned in respect of performance year <strong>2008</strong>, which becomes payablein cash in 2009. The amount of the bonus is computed in Euro, based upon theEconomic Profit.3 This amount represents 20% of the full Short -Term Incentive (not pro-ratedfor time) earned in respect of performance year <strong>2008</strong>, which becomes payable inshares in 2009. The number of shares is calculated by using the average closingprice of the share on the five trading days following the date of publication of thefinal results for the year <strong>2008</strong>4 The number of performance shares that vest for the performance period <strong>2008</strong>-2009-2010 will be determined in March 2011, upon finalisation of the financialaccounts for the year 2010. Following the vesting of the performance shares, theperformance shares are blocked for a further two years.