Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements<br />

for the year ended 31 December 2015<br />

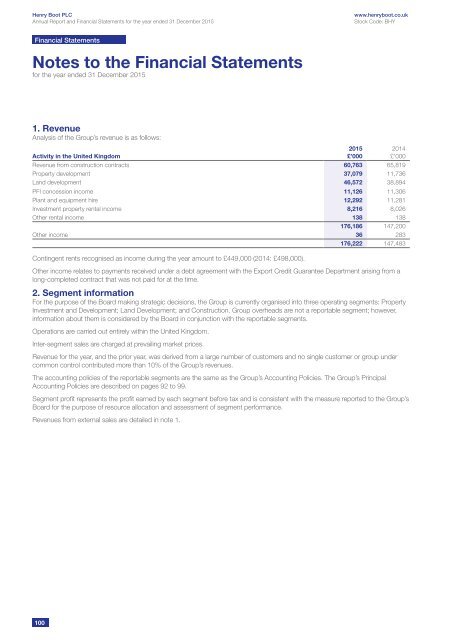

1. Revenue<br />

Analysis of the Group’s revenue is as follows:<br />

Activity in the United Kingdom<br />

Revenue from construction contracts 60,763 65,819<br />

Property development 37,079 11,736<br />

Land development 46,572 38,894<br />

PFI concession income 11,126 11,306<br />

Plant and equipment hire 12,292 11,281<br />

Investment property rental income 8,216 8,026<br />

Other rental income 138 138<br />

176,186 147,200<br />

Other income 36 283<br />

176,222 147,483<br />

Contingent rents recognised as income during the year amount to £449,000 (2014: £498,000).<br />

Other income relates to payments received under a debt agreement with the Export Credit Guarantee Department arising from a<br />

long-completed contract that was not paid for at the time.<br />

2. Segment information<br />

For the purpose of the Board making strategic decisions, the Group is currently organised into three operating segments: Property<br />

Investment and Development; Land Development; and Construction. Group overheads are not a reportable segment; however,<br />

information about them is considered by the Board in conjunction with the reportable segments.<br />

Operations are carried out entirely within the United Kingdom.<br />

Inter-segment sales are charged at prevailing market prices.<br />

Revenue for the year, and the prior year, was derived from a large number of customers and no single customer or group under<br />

common control contributed more than 10% of the Group’s revenues.<br />

The accounting policies of the reportable segments are the same as the Group’s Accounting Policies. The Group’s Principal<br />

Accounting Policies are described on pages 92 to 99.<br />

Segment profit represents the profit earned by each segment before tax and is consistent with the measure reported to the Group’s<br />

Board for the purpose of resource allocation and assessment of segment performance.<br />

Revenues from external sales are detailed in note 1.<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

100