Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

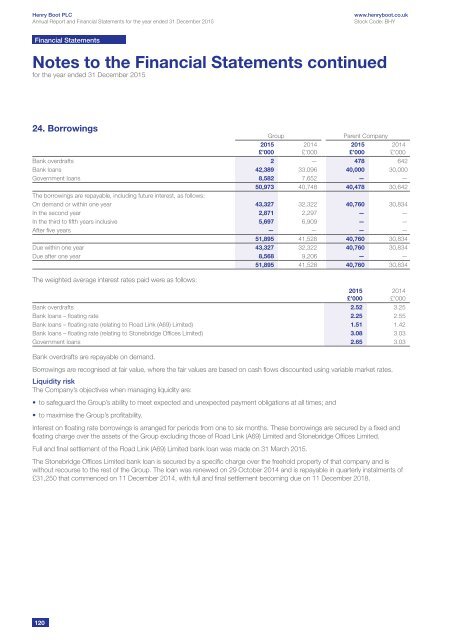

24. Borrowings<br />

Group<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

Parent Company<br />

Bank overdrafts 2 — 478 642<br />

Bank loans 42,389 33,096 40,000 30,000<br />

Government loans 8,582 7,652 — —<br />

50,973 40,748 40,478 30,642<br />

The borrowings are repayable, including future interest, as follows:<br />

On demand or within one year 43,327 32,322 40,760 30,834<br />

In the second year 2,871 2,297 — —<br />

In the third to fifth years inclusive 5,697 6,909 — —<br />

After five years — — — —<br />

51,895 41,528 40,760 30,834<br />

Due within one year 43,327 32,322 40,760 30,834<br />

Due after one year 8,568 9,206 — —<br />

51,895 41,528 40,760 30,834<br />

The weighted average interest rates paid were as follows:<br />

Bank overdrafts 2.52 3.25<br />

Bank loans – floating rate 2.25 2.55<br />

Bank loans – floating rate (relating to Road Link (A69) Limited) 1.51 1.42<br />

Bank loans – floating rate (relating to Stonebridge Offices Limited) 3.08 3.03<br />

Government loans 2.65 3.03<br />

Bank overdrafts are repayable on demand.<br />

Borrowings are recognised at fair value, where the fair values are based on cash flows discounted using variable market rates.<br />

Liquidity risk<br />

The Company’s objectives when managing liquidity are:<br />

• to safeguard the Group’s ability to meet expected and unexpected payment obligations at all times; and<br />

• to maximise the Group’s profitability.<br />

Interest on floating rate borrowings is arranged for periods from one to six months. These borrowings are secured by a fixed and<br />

floating charge over the assets of the Group excluding those of Road Link (A69) Limited and Stonebridge Offices Limited.<br />

Full and final settlement of the Road Link (A69) Limited bank loan was made on 31 March 2015.<br />

The Stonebridge Offices Limited bank loan is secured by a specific charge over the freehold property of that company and is<br />

without recourse to the rest of the Group. The loan was renewed on 29 October 2014 and is repayable in quarterly instalments of<br />

£31,250 that commenced on 11 December 2014, with full and final settlement becoming due on 11 December 2018.<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

120