Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Governance<br />

Directors’ Remuneration Report continued<br />

Vesting between the 25% threshold and the maximum award will<br />

be on a pro rata basis. The weightings for each measure have<br />

been chosen because the Committee believes that they each<br />

have equal importance in aligning the interests of shareholders<br />

and the Executive Directors. In addition to the amended<br />

performance criteria calculation, the Committee reduced the<br />

amount of the award vesting at threshold from 30% to 25% from<br />

awards in 2014 onwards. For Jamie Boot any grant of awards in<br />

2017 and 2018 will be on a pro rata basis to his retirement date<br />

of 31 December 2015 under the provisions for good leavers.<br />

Pension entitlement<br />

Jamie Boot began drawing his pension benefits from<br />

19 November 2012 and therefore no pension contributions<br />

are made on his behalf. Instead, a salary in lieu of pension<br />

contributions at a rate of 20% of salary is paid; in 2015 this<br />

payment amounted to £73,055.<br />

John Sutcliffe is a member of the Henry Boot PLC Group<br />

Stakeholder Pension Plan. Contributions are made at 20% of<br />

basic salary and contributions to the Scheme in the year were<br />

£40,821 (2014: £40,000). The annual allowance for tax relief on<br />

pension savings applicable to John Sutcliffe in 2015 was £40,821<br />

and he elected to receive a salary supplement in lieu of the<br />

employer contributions over and above this level which amounted<br />

to £9,041 (2014: £8,411).<br />

The Henry Boot PLC Group Stakeholder Pension Plan provides<br />

a lump sum death in service benefit, a refund of contributions<br />

on death in service and, on death after retirement, a pension<br />

for dependants subject to what the policyholder decides. The<br />

notional leaving work age is currently 65.<br />

Payments to past Directors<br />

There were no payments made to past Directors during the<br />

period in respect of services provided to the Company as a<br />

Director.<br />

Payments made for loss of office<br />

There were no payments made during the period in respect of<br />

loss of office to a Director.<br />

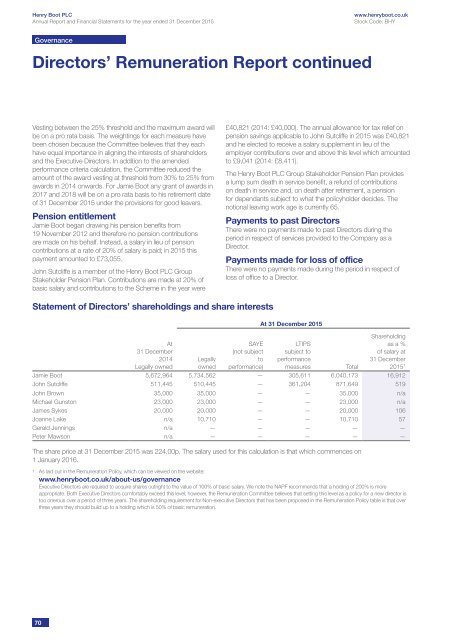

Statement of Directors’ shareholdings and share interests<br />

At<br />

31 December<br />

2014<br />

Legally owned<br />

Legally<br />

owned<br />

SAYE<br />

(not subject<br />

to<br />

performance)<br />

At 31 December 2015<br />

LTIPS<br />

subject to<br />

performance<br />

measures<br />

Total<br />

Shareholding<br />

as a %<br />

of salary at<br />

31 December<br />

2015 1<br />

Jamie Boot 5,672,964 5,734,562 — 305,611 6,040,173 16,912<br />

John Sutcliffe 511,445 510,445 — 361,204 871,649 519<br />

John Brown 35,000 35,000 — — 35,000 n/a<br />

Michael Gunston 23,000 23,000 — — 23,000 n/a<br />

James Sykes 20,000 20,000 — — 20,000 106<br />

Joanne Lake n/a 10,710 — — 10,710 57<br />

Gerald Jennings n/a — — — — —<br />

Peter Mawson n/a — — — — —<br />

The share price at 31 December 2015 was 224.00p. The salary used for this calculation is that which commences on<br />

1 January 2016.<br />

1 As laid out in the Remuneration Policy, which can be viewed on the website:<br />

www.henryboot.co.uk/about-us/governance<br />

Executive Directors are required to acquire shares outright to the value of 100% of basic salary. We note the NAPF recommends that a holding of 200% is more<br />

appropriate. Both Executive Directors comfortably exceed this level; however, the Remuneration Committee believes that setting this level as a policy for a new director is<br />

too onerous over a period of three years. The shareholding requirement for Non-executive Directors that has been proposed in the Remuneration Policy table is that over<br />

three years they should build up to a holding which is 50% of basic remuneration.<br />

70