Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

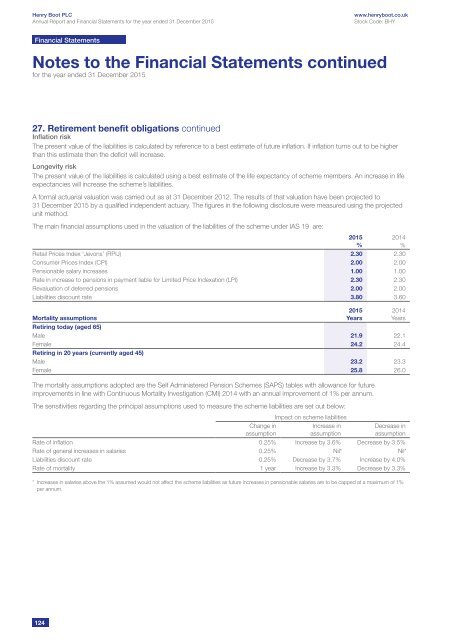

27. Retirement benefit obligations continued<br />

Inflation risk<br />

The present value of the liabilities is calculated by reference to a best estimate of future inflation. If inflation turns out to be higher<br />

than this estimate then the deficit will increase.<br />

Longevity risk<br />

The present value of the liabilities is calculated using a best estimate of the life expectancy of scheme members. An increase in life<br />

expectancies will increase the scheme’s liabilities.<br />

A formal actuarial valuation was carried out as at 31 December 2012. The results of that valuation have been projected to<br />

31 December 2015 by a qualified independent actuary. The figures in the following disclosure were measured using the projected<br />

unit method.<br />

The main financial assumptions used in the valuation of the liabilities of the scheme under IAS 19 are:<br />

Retail Prices Index ‘Jevons’ (RPIJ) 2.30 2.30<br />

Consumer Prices Index (CPI) 2.00 2.00<br />

Pensionable salary increases 1.00 1.00<br />

Rate in increase to pensions in payment liable for Limited Price Indexation (LPI) 2.30 2.30<br />

Revaluation of deferred pensions 2.00 2.00<br />

Liabilities discount rate 3.80 3.60<br />

Mortality assumptions<br />

2015<br />

%<br />

2015<br />

Years<br />

Retiring today (aged 65)<br />

Male 21.9 22.1<br />

Female 24.2 24.4<br />

Retiring in 20 years (currently aged 45)<br />

Male 23.2 23.3<br />

Female 25.8 26.0<br />

The mortality assumptions adopted are the Self Administered Pension Schemes (SAPS) tables with allowance for future<br />

improvements in line with Continuous Mortality Investigation (CMI) 2014 with an annual improvement of 1% per annum.<br />

The sensitivities regarding the principal assumptions used to measure the scheme liabilities are set out below:<br />

Impact on scheme liabilities<br />

Change in<br />

assumption<br />

Increase in<br />

assumption<br />

2014<br />

%<br />

2014<br />

Years<br />

Decrease in<br />

assumption<br />

Rate of inflation 0.25% Increase by 3.6% Decrease by 3.5%<br />

Rate of general increases in salaries 0.25% Nil* Nil*<br />

Liabilities discount rate 0.25% Decrease by 3.7% Increase by 4.0%<br />

Rate of mortality 1 year Increase by 3.3% Decrease by 3.3%<br />

* Increases in salaries above the 1% assumed would not affect the scheme liabilities as future increases in pensionable salaries are to be capped at a maximum of 1%<br />

per annum.<br />

124