Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

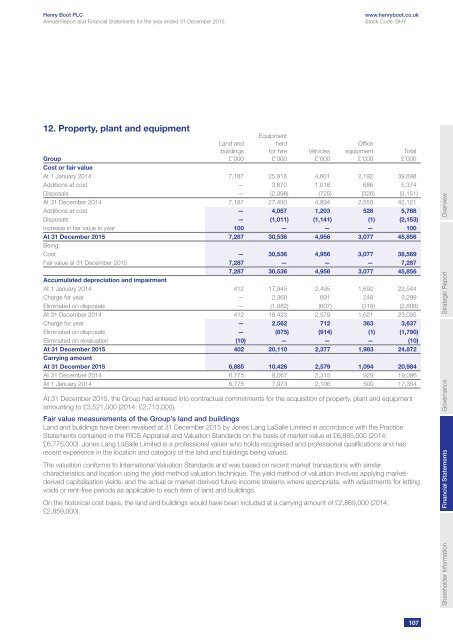

12. Property, plant and equipment<br />

Group<br />

Land and<br />

buildings<br />

£’000<br />

Equipment<br />

held<br />

for hire<br />

£’000<br />

Vehicles<br />

£’000<br />

Office<br />

equipment<br />

£’000<br />

Cost or fair value<br />

At 1 January 2014 7,187 25,918 4,601 2,192 39,898<br />

Additions at cost — 3,670 1,018 686 5,374<br />

Disposals — (2,098) (725) (328) (3,151)<br />

At 31 December 2014 7,187 27,490 4,894 2,550 42,121<br />

Additions at cost — 4,057 1,203 528 5,788<br />

Disposals — (1,011) (1,141) (1) (2,153)<br />

Increase in fair value in year 100 — — — 100<br />

At 31 December 2015 7,287 30,536 4,956 3,077 45,856<br />

Being:<br />

Cost — 30,536 4,956 3,077 38,569<br />

Fair value at 31 December 2015 7,287 — — — 7,287<br />

7,287 30,536 4,956 3,077 45,856<br />

Accumulated depreciation and impairment<br />

At 1 January 2014 412 17,945 2,495 1,692 22,544<br />

Charge for year — 2,360 691 248 3,299<br />

Eliminated on disposals — (1,882) (607) (319) (2,808)<br />

At 31 December 2014 412 18,423 2,579 1,621 23,035<br />

Charge for year — 2,562 712 363 3,637<br />

Eliminated on disposals — (875) (914) (1) (1,790)<br />

Eliminated on revaluation (10) — — — (10)<br />

At 31 December 2015 402 20,110 2,377 1,983 24,872<br />

Carrying amount<br />

At 31 December 2015 6,885 10,426 2,579 1,094 20,984<br />

At 31 December 2014 6,775 9,067 2,315 929 19,086<br />

At 1 January 2014 6,775 7,973 2,106 500 17,354<br />

At 31 December 2015, the Group had entered into contractual commitments for the acquisition of property, plant and equipment<br />

amounting to £3,521,000 (2014: £2,713,000).<br />

Fair value measurements of the Group’s land and buildings<br />

Land and buildings have been revalued at 31 December 2015 by Jones Lang LaSalle Limited in accordance with the Practice<br />

Statements contained in the RICS Appraisal and Valuation Standards on the basis of market value at £6,885,000 (2014:<br />

£6,775,000). Jones Lang LaSalle Limited is a professional valuer who holds recognised and professional qualifications and has<br />

recent experience in the location and category of the land and buildings being valued.<br />

The valuation conforms to International Valuation Standards and was based on recent market transactions with similar<br />

characteristics and location using the yield method valuation technique. The yield method of valuation involves applying marketderived<br />

capitalisation yields, and the actual or market-derived future income streams where appropriate, with adjustments for letting<br />

voids or rent-free periods as applicable to each item of land and buildings.<br />

On the historical cost basis, the land and buildings would have been included at a carrying amount of £2,869,000 (2014:<br />

£2,859,000).<br />

Total<br />

£’000<br />

Shareholder Information Financial Statements<br />

Governance<br />

Strategic Report<br />

Overview<br />

107