Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

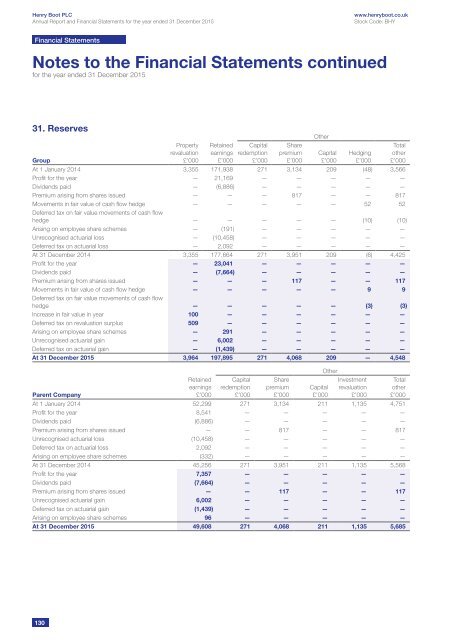

31. Reserves<br />

Group<br />

Property<br />

revaluation<br />

£’000<br />

Retained<br />

earnings<br />

£’000<br />

Capital<br />

redemption<br />

£’000<br />

Share<br />

premium<br />

£’000<br />

Other<br />

Capital<br />

£’000<br />

Hedging<br />

£’000<br />

At 1 January 2014 3,355 171,938 271 3,134 209 (48) 3,566<br />

Profit for the year — 21,169 — — — — —<br />

Dividends paid — (6,886) — — — — —<br />

Premium arising from shares issued — — — 817 — — 817<br />

Movements in fair value of cash flow hedge — — — — — 52 52<br />

Deferred tax on fair value movements of cash flow<br />

hedge — — — — — (10) (10)<br />

Arising on employee share schemes — (191) — — — — —<br />

Unrecognised actuarial loss — (10,458) — — — — —<br />

Deferred tax on actuarial loss — 2,092 — — — — —<br />

At 31 December 2014 3,355 177,664 271 3,951 209 (6) 4,425<br />

Profit for the year — 23,041 — — — — —<br />

Dividends paid — (7,664) — — — — —<br />

Premium arising from shares issued — — — 117 — — 117<br />

Movements in fair value of cash flow hedge — — — — — 9 9<br />

Deferred tax on fair value movements of cash flow<br />

hedge — — — — — (3) (3)<br />

Increase in fair value in year 100 — — — — — —<br />

Deferred tax on revaluation surplus 509 — — — — — —<br />

Arising on employee share schemes — 291 — — — — —<br />

Unrecognised actuarial gain — 6,002 — — — — —<br />

Deferred tax on actuarial gain — (1,439) — — — — —<br />

At 31 December 2015 3,964 197,895 271 4,068 209 — 4,548<br />

Parent Company<br />

Retained<br />

earnings<br />

£’000<br />

Capital<br />

redemption<br />

£’000<br />

Share<br />

premium<br />

£’000<br />

Capital<br />

£’000<br />

Other<br />

Investment<br />

revaluation<br />

£’000<br />

At 1 January 2014 52,299 271 3,134 211 1,135 4,751<br />

Profit for the year 8,541 — — — — —<br />

Dividends paid (6,886) — — — — —<br />

Premium arising from shares issued — — 817 — — 817<br />

Unrecognised actuarial loss (10,458) — — — — —<br />

Deferred tax on actuarial loss 2,092 — — — — —<br />

Arising on employee share schemes (332) — — — — —<br />

At 31 December 2014 45,256 271 3,951 211 1,135 5,568<br />

Profit for the year 7,357 — — — — —<br />

Dividends paid (7,664) — — — — —<br />

Premium arising from shares issued — — 117 — — 117<br />

Unrecognised actuarial gain 6,002 — — — — —<br />

Deferred tax on actuarial gain (1,439) — — — — —<br />

Arising on employee share schemes 96 — — — — —<br />

At 31 December 2015 49,608 271 4,068 211 1,135 5,685<br />

Total<br />

other<br />

£’000<br />

Total<br />

other<br />

£’000<br />

130