Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

31. Reserves continued<br />

Property revaluation reserve<br />

The property revaluation reserve represents the unrealised surpluses arising on revaluation of the Group occupied land and<br />

buildings and is not available for distribution until realised on disposal.<br />

Retained earnings<br />

Retained earnings represent the accumulated profits and losses of the Group.<br />

Capital redemption reserve<br />

The capital redemption reserve represents the purchase and cancellation by the Company of its own shares and comprises the<br />

aggregate nominal value of all the ordinary shares repurchased and cancelled.<br />

Share premium reserve<br />

The share premium reserve represents the difference between the sums received from the issue of shares and their nominal value<br />

net of share issue expenses. This reserve is not distributable.<br />

Capital reserve<br />

The capital reserve represents realised profits arising on the disposal of investments and is available for distribution.<br />

Hedging reserve<br />

The hedging reserve represents the cumulative effective portion of gains or losses arising on changes in fair value of the hedging<br />

instrument entered by the Group for the purposes of cash flow hedging. The hedge is 100% effective and as such cumulative gains<br />

or losses arising on changes in the fair value of the hedging instrument that are recognised and accumulated in the hedging reserve<br />

will not subsequently be reclassified to profit or loss.<br />

Investment revaluation reserve<br />

The investment revaluation reserve represents enhancements to the original cost of shares in subsidiary companies where the<br />

Directors have considered it appropriate to reflect in the valuation increases of a permanent nature in the underlying net asset<br />

values of subsidiary companies. Such enhancements were £1,135,000 in 1989 and are not distributable.<br />

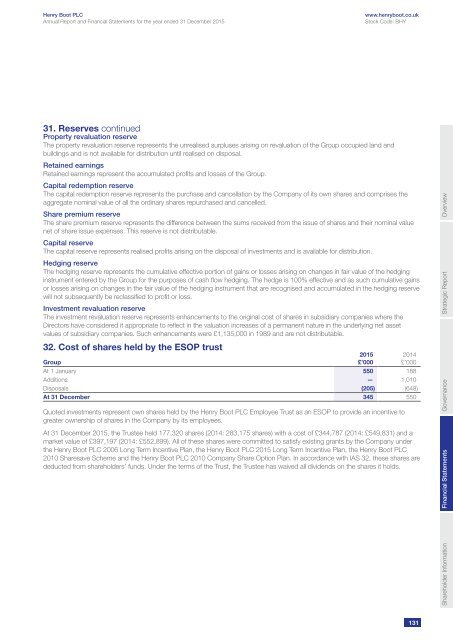

32. Cost of shares held by the ESOP trust<br />

Group<br />

At 1 January 550 188<br />

Additions — 1,010<br />

Disposals (205) (648)<br />

At 31 December 345 550<br />

2015<br />

£’000<br />

Quoted investments represent own shares held by the Henry Boot PLC Employee Trust as an ESOP to provide an incentive to<br />

greater ownership of shares in the Company by its employees.<br />

At 31 December 2015, the Trustee held 177,320 shares (2014: 283,175 shares) with a cost of £344,787 (2014: £549,831) and a<br />

market value of £397,197 (2014: £552,899). All of these shares were committed to satisfy existing grants by the Company under<br />

the Henry Boot PLC 2006 Long Term Incentive Plan, the Henry Boot PLC 2015 Long Term Incentive Plan, the Henry Boot PLC<br />

2010 Sharesave Scheme and the Henry Boot PLC 2010 Company Share Option Plan. In accordance with IAS 32, these shares are<br />

deducted from shareholders’ funds. Under the terms of the Trust, the Trustee has waived all dividends on the shares it holds.<br />

2014<br />

£’000<br />

Shareholder Information Financial Statements<br />

Governance<br />

Strategic Report<br />

Overview<br />

131