Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

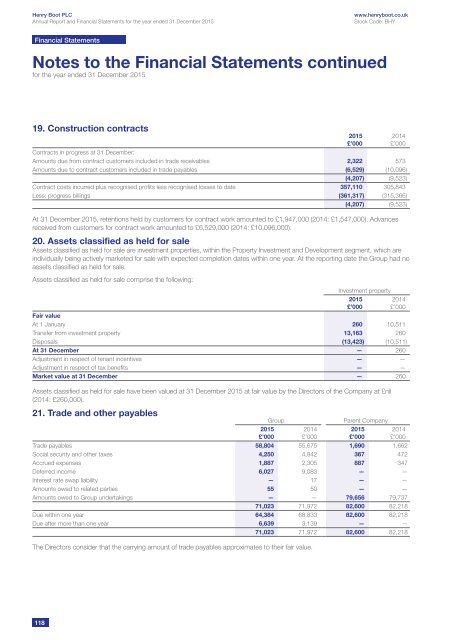

19. Construction contracts<br />

Contracts in progress at 31 December:<br />

Amounts due from contract customers included in trade receivables 2,322 573<br />

Amounts due to contract customers included in trade payables (6,529) (10,096)<br />

(4,207) (9,523)<br />

Contract costs incurred plus recognised profits less recognised losses to date 357,110 305,843<br />

Less: progress billings (361,317) (315,366)<br />

(4,207) (9,523)<br />

At 31 December 2015, retentions held by customers for contract work amounted to £1,947,000 (2014: £1,547,000). Advances<br />

received from customers for contract work amounted to £6,529,000 (2014: £10,096,000).<br />

20. Assets classified as held for sale<br />

Assets classified as held for sale are investment properties, within the Property Investment and Development segment, which are<br />

individually being actively marketed for sale with expected completion dates within one year. At the reporting date the Group had no<br />

assets classified as held for sale.<br />

Assets classified as held for sale comprise the following:<br />

2015<br />

£’000<br />

Investment property<br />

Fair value<br />

At 1 January 260 10,511<br />

Transfer from investment property 13,163 260<br />

Disposals (13,423) (10,511)<br />

At 31 December — 260<br />

Adjustment in respect of tenant incentives — —<br />

Adjustment in respect of tax benefits — —<br />

Market value at 31 December — 260<br />

2015<br />

£’000<br />

Assets classified as held for sale have been valued at 31 December 2015 at fair value by the Directors of the Company at £nil<br />

(2014: £260,000).<br />

21. Trade and other payables<br />

Group<br />

2015<br />

£’000<br />

Parent Company<br />

Trade payables 58,804 55,675 1,690 1,662<br />

Social security and other taxes 4,250 4,842 367 472<br />

Accrued expenses 1,887 2,305 887 347<br />

Deferred income 6,027 9,083 — —<br />

Interest rate swap liability — 17 — —<br />

Amounts owed to related parties 55 50 — —<br />

Amounts owed to Group undertakings — — 79,656 79,737<br />

71,023 71,972 82,600 82,218<br />

Due within one year 64,384 68,833 82,600 82,218<br />

Due after more than one year 6,639 3,139 — —<br />

71,023 71,972 82,600 82,218<br />

The Directors consider that the carrying amount of trade payables approximates to their fair value.<br />

2014<br />

£’000<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

118