Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

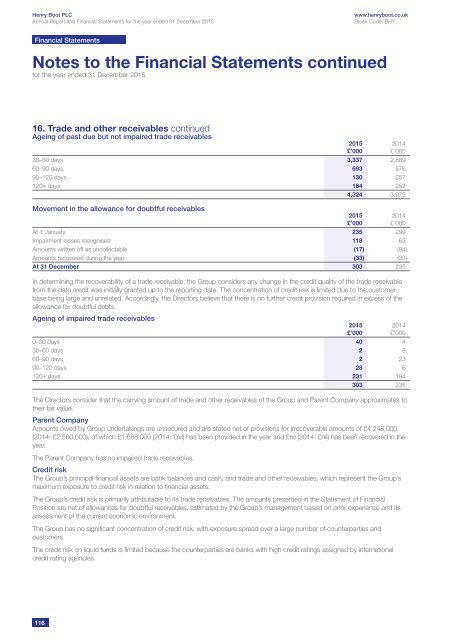

16. Trade and other receivables continued<br />

Ageing of past due but not impaired trade receivables<br />

30–60 days 3,337 2,889<br />

60–90 days 693 576<br />

90–120 days 130 257<br />

120+ days 164 253<br />

4,324 3,975<br />

Movement in the allowance for doubtful receivables<br />

At 1 January 235 299<br />

Impairment losses recognised 118 63<br />

Amounts written off as uncollectable (17) (94)<br />

Amounts recovered during the year (33) (33)<br />

At 31 December 303 235<br />

In determining the recoverability of a trade receivable, the Group considers any change in the credit quality of the trade receivable<br />

from the date credit was initially granted up to the reporting date. The concentration of credit risk is limited due to the customer<br />

base being large and unrelated. Accordingly, the Directors believe that there is no further credit provision required in excess of the<br />

allowance for doubtful debts.<br />

Ageing of impaired trade receivables<br />

0–30 days 40 4<br />

30–60 days 2 8<br />

60–90 days 2 23<br />

90–120 days 28 6<br />

120+ days 231 194<br />

303 235<br />

The Directors consider that the carrying amount of trade and other receivables of the Group and Parent Company approximates to<br />

their fair value.<br />

Parent Company<br />

Amounts owed by Group undertakings are unsecured and are stated net of provisions for irrecoverable amounts of £4,248,000<br />

(2014: £2,560,000), of which £1,688,000 (2014: £nil) has been provided in the year and £nil (2014: £nil) has been recovered in the<br />

year.<br />

The Parent Company has no impaired trade receivables.<br />

Credit risk<br />

The Group’s principal financial assets are bank balances and cash, and trade and other receivables, which represent the Group’s<br />

maximum exposure to credit risk in relation to financial assets.<br />

The Group’s credit risk is primarily attributable to its trade receivables. The amounts presented in the Statement of Financial<br />

Position are net of allowances for doubtful receivables, estimated by the Group’s management based on prior experience and its<br />

assessment of the current economic environment.<br />

The Group has no significant concentration of credit risk, with exposure spread over a large number of counterparties and<br />

customers.<br />

The credit risk on liquid funds is limited because the counterparties are banks with high credit ratings assigned by international<br />

credit rating agencies.<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

116