Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

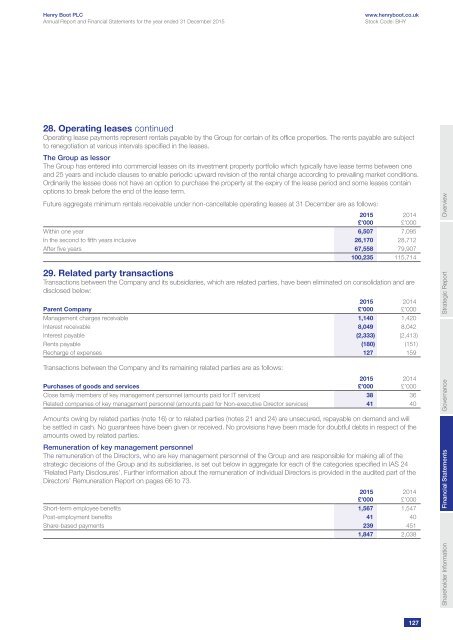

28. Operating leases continued<br />

Operating lease payments represent rentals payable by the Group for certain of its office properties. The rents payable are subject<br />

to renegotiation at various intervals specified in the leases.<br />

The Group as lessor<br />

The Group has entered into commercial leases on its investment property portfolio which typically have lease terms between one<br />

and 25 years and include clauses to enable periodic upward revision of the rental charge according to prevailing market conditions.<br />

Ordinarily the lessee does not have an option to purchase the property at the expiry of the lease period and some leases contain<br />

options to break before the end of the lease term.<br />

Future aggregate minimum rentals receivable under non-cancellable operating leases at 31 December are as follows:<br />

Within one year 6,507 7,095<br />

In the second to fifth years inclusive 26,170 28,712<br />

After five years 67,558 79,907<br />

100,235 115,714<br />

29. Related party transactions<br />

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are<br />

disclosed below:<br />

Parent Company<br />

Management charges receivable 1,140 1,420<br />

Interest receivable 8,049 8,042<br />

Interest payable (2,333) (2,413)<br />

Rents payable (180) (151)<br />

Recharge of expenses 127 159<br />

Transactions between the Company and its remaining related parties are as follows:<br />

Purchases of goods and services<br />

Close family members of key management personnel (amounts paid for IT services) 38 36<br />

Related companies of key management personnel (amounts paid for Non-executive Director services) 41 40<br />

Amounts owing by related parties (note 16) or to related parties (notes 21 and 24) are unsecured, repayable on demand and will<br />

be settled in cash. No guarantees have been given or received. No provisions have been made for doubtful debts in respect of the<br />

amounts owed by related parties.<br />

Remuneration of key management personnel<br />

The remuneration of the Directors, who are key management personnel of the Group and are responsible for making all of the<br />

strategic decisions of the Group and its subsidiaries, is set out below in aggregate for each of the categories specified in IAS 24<br />

‘Related Party Disclosures’. Further information about the remuneration of individual Directors is provided in the audited part of the<br />

Directors’ Remuneration Report on pages 66 to 73.<br />

Short-term employee benefits 1,567 1,547<br />

Post-employment benefits 41 40<br />

Share-based payments 239 451<br />

1,847 2,038<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

Shareholder Information Financial Statements<br />

Governance<br />

Strategic Report<br />

Overview<br />

127