Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

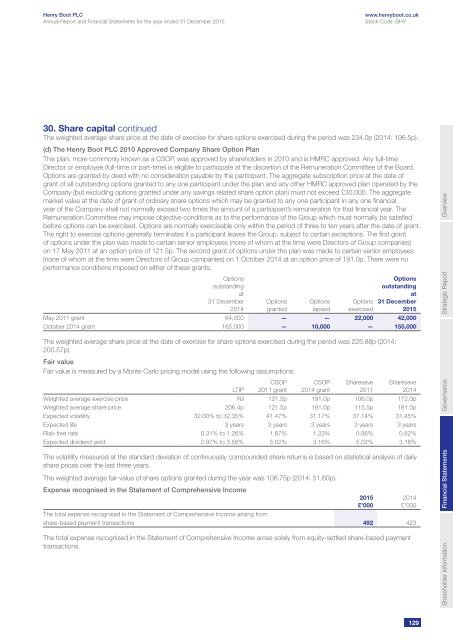

30. Share capital continued<br />

The weighted average share price at the date of exercise for share options exercised during the period was 234.0p (2014: 196.5p).<br />

(d) The Henry Boot PLC 2010 Approved Company Share Option Plan<br />

This plan, more commonly known as a CSOP, was approved by shareholders in 2010 and is HMRC approved. Any full-time<br />

Director or employee (full-time or part-time) is eligible to participate at the discretion of the Remuneration Committee of the Board.<br />

Options are granted by deed with no consideration payable by the participant. The aggregate subscription price at the date of<br />

grant of all outstanding options granted to any one participant under the plan and any other HMRC approved plan operated by the<br />

Company (but excluding options granted under any savings related share option plan) must not exceed £30,000. The aggregate<br />

market value at the date of grant of ordinary share options which may be granted to any one participant in any one financial<br />

year of the Company shall not normally exceed two times the amount of a participant’s remuneration for that financial year. The<br />

Remuneration Committee may impose objective conditions as to the performance of the Group which must normally be satisfied<br />

before options can be exercised. Options are normally exercisable only within the period of three to ten years after the date of grant.<br />

The right to exercise options generally terminates if a participant leaves the Group, subject to certain exceptions. The first grant<br />

of options under the plan was made to certain senior employees (none of whom at the time were Directors of Group companies)<br />

on 17 May 2011 at an option price of 121.5p. The second grant of options under the plan was made to certain senior employees<br />

(none of whom at the time were Directors of Group companies) on 1 October 2014 at an option price of 191.0p. There were no<br />

performance conditions imposed on either of these grants.<br />

Options<br />

outstanding<br />

at<br />

31 December<br />

2014<br />

Options<br />

granted<br />

Options<br />

lapsed<br />

Options<br />

exercised<br />

Options<br />

outstanding<br />

at<br />

31 December<br />

2015<br />

May 2011 grant 64,000 — — 22,000 42,000<br />

October 2014 grant 165,000 — 10,000 — 155,000<br />

The weighted average share price at the date of exercise for share options exercised during the period was 225.88p (2014:<br />

200.57p).<br />

Fair value<br />

Fair value is measured by a Monte Carlo pricing model using the following assumptions:<br />

LTIP<br />

CSOP<br />

2011 grant<br />

CSOP<br />

2014 grant<br />

Sharesave<br />

2011<br />

Sharesave<br />

2014<br />

Weighted average exercise price Nil 121.5p 191.0p 106.0p 172.0p<br />

Weighted average share price 206.4p 121.5p 191.0p 115.5p 181.0p<br />

Expected volatility 32.00% to 32.35% 41.47% 31.17% 37.14% 31.45%<br />

Expected life 3 years 3 years 3 years 3 years 3 years<br />

Risk-free rate 0.31% to 1.26% 1.67% 1.23% 0.86% 0.82%<br />

Expected dividend yield 2.97% to 3.56% 5.02% 3.16% 5.02% 3.16%<br />

The volatility measured at the standard deviation of continuously compounded share returns is based on statistical analysis of daily<br />

share prices over the last three years.<br />

The weighted average fair value of share options granted during the year was 106.75p (2014: 51.60p).<br />

Expense recognised in the Statement of Comprehensive Income<br />

The total expense recognised in the Statement of Comprehensive Income arising from<br />

share-based payment transactions 492 423<br />

The total expense recognised in the Statement of Comprehensive Income arose solely from equity-settled share-based payment<br />

transactions.<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

Shareholder Information Financial Statements<br />

Governance<br />

Strategic Report<br />

Overview<br />

129