Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

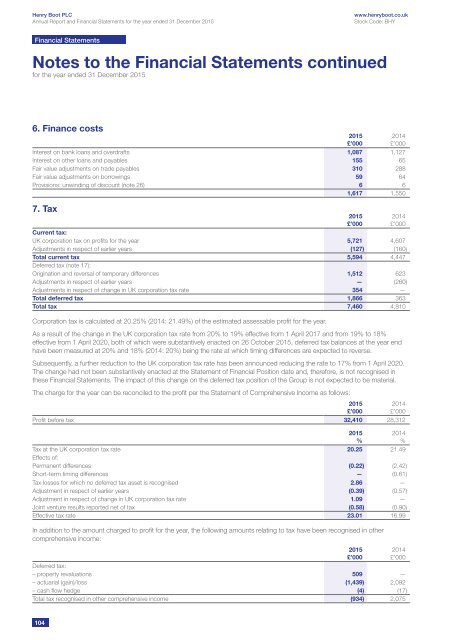

6. Finance costs<br />

Interest on bank loans and overdrafts 1,087 1,127<br />

Interest on other loans and payables 155 65<br />

Fair value adjustments on trade payables 310 288<br />

Fair value adjustments on borrowings 59 64<br />

Provisions: unwinding of discount (note 26) 6 6<br />

1,617 1,550<br />

7. Tax<br />

Current tax:<br />

UK corporation tax on profits for the year 5,721 4,607<br />

Adjustments in respect of earlier years (127) (160)<br />

Total current tax 5,594 4,447<br />

Deferred tax (note 17):<br />

Origination and reversal of temporary differences 1,512 623<br />

Adjustments in respect of earlier years — (260)<br />

Adjustments in respect of change in UK corporation tax rate 354 —<br />

Total deferred tax 1,866 363<br />

Total tax 7,460 4,810<br />

Corporation tax is calculated at 20.25% (2014: 21.49%) of the estimated assessable profit for the year.<br />

As a result of the change in the UK corporation tax rate from 20% to 19% effective from 1 April 2017 and from 19% to 18%<br />

effective from 1 April 2020, both of which were substantively enacted on 26 October 2015, deferred tax balances at the year end<br />

have been measured at 20% and 18% (2014: 20%) being the rate at which timing differences are expected to reverse.<br />

Subsequently, a further reduction to the UK corporation tax rate has been announced reducing the rate to 17% from 1 April 2020.<br />

The change had not been substantively enacted at the Statement of Financial Position date and, therefore, is not recognised in<br />

these Financial Statements. The impact of this change on the deferred tax position of the Group is not expected to be material.<br />

The charge for the year can be reconciled to the profit per the Statement of Comprehensive Income as follows:<br />

Profit before tax 32,410 28,312<br />

Tax at the UK corporation tax rate 20.25 21.49<br />

Effects of:<br />

Permanent differences (0.22) (2.42)<br />

Short-term timing differences — (0.61)<br />

Tax losses for which no deferred tax asset is recognised 2.86 —<br />

Adjustment in respect of earlier years (0.39) (0.57)<br />

Adjustment in respect of change in UK corporation tax rate 1.09 —<br />

Joint venture results reported net of tax (0.58) (0.90)<br />

Effective tax rate 23.01 16.99<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

2015<br />

£’000<br />

In addition to the amount charged to profit for the year, the following amounts relating to tax have been recognised in other<br />

comprehensive income:<br />

2015<br />

£’000<br />

Deferred tax:<br />

– property revaluations 509 —<br />

– actuarial (gain)/loss (1,439) 2,092<br />

– cash flow hedge (4) (17)<br />

Total tax recognised in other comprehensive income (934) 2,075<br />

2015<br />

%<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

%<br />

2014<br />

£’000<br />

104